The first time you see “HODL” when someone is discussing cryptocurrencies, the word causes you to stop reading. You think: “Is it a misspelling?” Well, yes it is – at least it was mistyped originally. Now, rather amusingly, HODL has spawned a life of its own. It has evolved to represent a long-term trading strategy and philosophy for crypto investors.

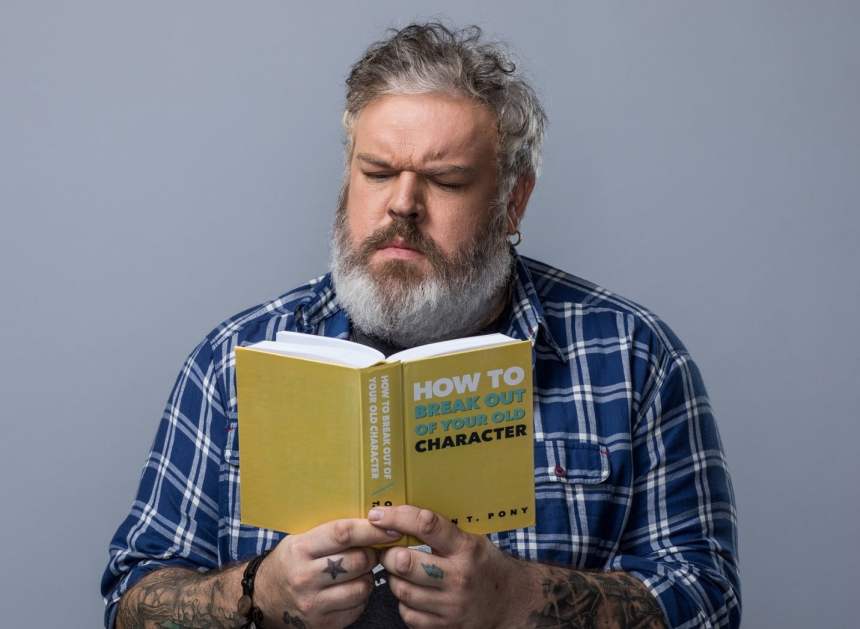

With the launch of our latest campaign – HODL, featuring Kristian Nairn – we thought it would be a good idea to explain in detail what this unusual slang term really means. Better yet, here is Kristian with the explanation:

History of HODL

HODL has become an acronym (or even backronym) for “hold on for dear life”, meaning that even when investors are in the deep red with their cryptos, they should not buckle under pressure and sell, driven by the belief that they will, ultimately, reap great rewards, once mass adoption has been achieved.

The origin of HODL can be traced back to December 18, 2013, and a legendary, whiskey-fuelled rant on Bitcoin Forum by someone calling themselves GameKyuubi.

To provide context, just before the series of poorly written posts were typed – or mistyped – the price of bitcoin had fallen almost 40 percent, from $716 to $438 in 24 hours, according to CoinDesk. The pullback was likely to have been triggered by reports of a crackdown on the original crypto in China. GameKyuubi made clear his or her intentions.

“I AM HODLING,” GameKyuubi wrote, before going on to explain a fair amount of whiskey had been consumed and the reason for “HODLING”. Almost immediately, the funny series of Bitcoin Forum posts were transformed into internet memes, with references to fighting films 300 and Braveheart being especially popular.

More than a Meme: HODL as a Strategy

The memes helped lift HODL from a mistyped “hold” to a widely adopted slang term and trading strategy used in the cryptocurrency community. Quartz heralded it as one of the most important terms in crypto culture in 2017, describing it as a determination to “stay invested in bitcoin and not to capitulate in the face of plunging prices”.

Famous Examples Where HODL Should have been Adopted

There is certainly great potential for HODLing as an investment strategy, and not buckling under pressure, as history shows us – and not just in the cryptocurrency world. One of the most notorious examples of failing to “HODL” happened in the mid-1970’s when Ronald Wayne, Apple’s third co-founder – alongside Steve Jobs and Steve Wozniak – sold his 10 percent stake in the then-start-up back to the other two co-founders for $800.

In August 2018, Apple achieved the historic milestone of reaching a market capitalisation of $1 trillion. Had Wayne adopted a HODL mentality, his Apple stake would be worth around $100 billion today.

Similarly, when another tech giant, e-commerce titan, Amazon first floated, it was worth $18. It dropped to just $1.5, leading many early investors to sell their assets. Now, however, a single stock is worth around $1,700. There are numerous other instances where a HODL philosophy would have proved the right course of action (or inaction) in other investment spheres – including real estate and especially in cryptos.

HODLing Cryptocurrency Positions

Of course, it is impossible to predict the future, but Jay Smith, one of the leading global social trading and investing platform eToro’s most recognisable traders, believes staying strong will reap the biggest rewards. Full-time trader Smith – a.k.a. jaynemesis on eToro – describes his trading style as “fundamentals, future and HODLing”.

Of the potential of cryptos, he continues: “I’ve always been a fan of automation, futurology, and transhumanism. On top of that, I am interested in politics, ideology, and economics. Cryptocurrencies are a melting pot for all of these things, experimenting with new economic models, governance models, moral and ideological models and offer massive advantages over the systems they aim to replace.”

Smith adds: “I firmly believe that cryptos will change the world, replacing stock markets, most currencies and powering everything from machine-to-machine payments and the Internet of Things through to streaming media, prediction markets, governance systems, voting systems, even potentially the internet. That being said, there is a long way to go, we are in the very early stages for most of these areas.”

About eToro

eToro is a regulated multi-asset investment platform that has been offering investors access to cryptoassets since 2014. The platform now offers 12 cryptoassets (Bitcoin, Ethereum, Bitcoin Cash, XRP, Litecoin, Ethereum Classic, Dash, Stellar, NEO, EOS, Cardano and IOTA) as well as crypto/crypto pairs and crypto/fiat pairs. eToro acts as a bridge between the old world of investing and the new, helping investors navigate and benefit from the transition of assets to the blockchain. eToro is the only place where investors can hold traditional assets such as stocks or commodities alongside ‘new’ assets such as bitcoin.

Original Article – eToro blog

eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Past performance is not an indication of future results. HODL is not investment advice. Your capital is at risk.

Disclaimer: The opinions expressed in this article do not represent the views of NewsBTC or any of its team members. NewsBTC is neither responsible nor liable for the accuracy of any of the information supplied in Sponsored Stories/Press Releases such as this one.