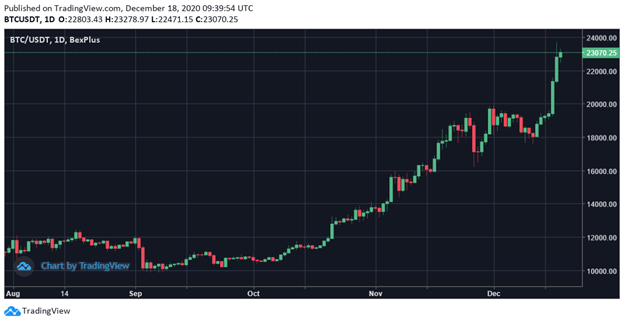

2020 has been a roller coaster ride for Bitcoin – Bitcoin once plummeted to $4K in March but gradually reached $19K, topping its highest intraday record set in December 2017. As 2021 draws closer, analysts have put forward many price predictions for the biggest cryptocurrency. Before you enter the market, let’s take a look at the major factors for its boom.

Institutional interest has been the primary price driver for Bitcoin in 2020. To name a few, Visa, Square, and Paypal will gradually support Bitcoin payment, while such Wall Street firms as Greyscale and Boston Private Wealth have added Bitcoin into their portfolios. Across the ocean, Banca Generali, one of the most prominent private banks in Italy, announced that it will provide Bitcoin custody to its customers. Wall Street firms, industry big names and even several government bodies are showing interest and confidence in the cryptocurrency.

When commenting on Banca Generali’s new move to embrace Bitcoin, CEO Gian Maria Mossa explains that “The growth of bitcoin has drawn more attention to this asset class, particularly among younger customers. Blockchain technology and digital currencies are gaining a place in global payment systems and, as an innovative bank keen to develop digital services, we want to be able to offer broader services to our clients and to be competitive in this new environment.”

Bitcoin is one of the best-performing assets amid the COVID-19 pandemic, owing to its scarcity. The total maximum supply of Bitcoin is 21 million, and the halving takes place every four years, so no Bitcoin will enter circulation by 2140. With whales accelerating their pace to buy more Bitcoin, Chainalysis estimates that there are only 3.4 million currently liquid Bitcoin for investors. Data from Glassnode shows that the number of Bitcoin wallets with a whole coin or more is at a new all-time high. Buy-in pressure is mounting and it will be more difficult for latecomers to have a share of Bitcoin.

Bitcoin could be one of the few things to benefit from the pandemic. To boost the economy, stimulus packages and bolder economic policies will add fuel to inflation. While traditional investors turn to gold to hedge against inflation, millennials favor Bitcoin and altcoins. The fall in liquidity, coming inflation and global uncertainties are some of the factors that could boost Bitcoin higher in 2021.

Where will Bitcoin be in 2021?

Some wild guesses are that Bitcoin could break $100,000 or $318,000 by the end of 2021.

It’s quite rare to see a majority of analysts sharing bullish sentiments and making wild predictions that seem too good to be true. The $100,000 target is proposed by the PlanB, the creator of Stock-to-Flow. PlanB’s prediction is based on the decreasing supply and growing demand for Bitcoin. In view of its performance after the previous halvings, Bitcoin has the potential to reach from $100,000 to $288,000 by December 2021.

The $318,000 mark is called by Citibank analyst Tom Fitzpatrick. The senior also based his theory on the past performance of Bitcoin, saying that Bitcoin could repeat its price action from 2010 to 2011, thus taking Bitcoin to $318,000.

Only time will tell us whether Bitcoin will make history again. Nevertheless, it’s always better to prepare and buckle up your seatbelt for a crazy ride.

Bexplus – go-to exchange for beginners and veterans

Bexplus is a leading crypto derivatives platform offering 100x leverage in BTC, ETH, EOS, LTC, and XRP futures contracts. No KYC, no deposit fee, traders can receive the most attentive services, including 24/7 customer support.

Highlighted Features of Bexplus Exchange

No KYC: Traders can easily register an account with email without the risks of leaking out personal information.

Trading simulator: When you successfully sign up, you can get the 10 free BTC in the trading simulator which enables you to practice trading futures contracts without losing money.

BTC wallet with up to 30% annualized interest: Even if you take a break from trading, you could still earn passive income with the Bexplus wallet. The interest is calculated daily and the revenue of the deposit will be settled monthly.

High liquidity: By utilizing an end-to-end optimized stack running on customer dedicated nodes, orders can be executed with low latency even during the huge market volatility.

Mobile support: Bexplus App is available on Google Play and App Store. The 24/7 notification helps you keep updated with the market.

100% deposit bonus: All users in Bexplus are eligible to apply for up to 10 BTC deposit bonuses at a one-time deposit. For example, if you deposit 1 BTC in your account, you will get 2 BTC credited to your account.

Image by Jose Maria Mondejar Martinez from Pixabay