Word is, Bitcoin is the new stablecoin. Indeed it has, and behind this observation are solid metrics and research findings.

Recently, the Chicago Board Options Exchange (CBOE) released their findings demonstrating that Bitcoin volatility is lower than that of Amazon and a majority of FANG stocks. Bitcoin and similar digital assets are, or were, known to move by wide margins.

Low Volatility: CBOE and BVI Trackers

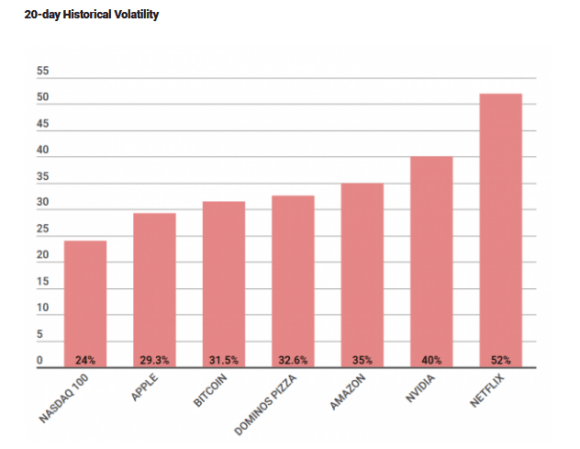

The CBOE clearly demonstrated that Bitcoin’s 20-day historical volatility had dropped to 31.5 percent and this was lower than that of Amazon (35 Percent), Netflix (52 percent), and a long list of other publicly traded stocks like Nvidia whose 20-day volatility stood at 40 percent.

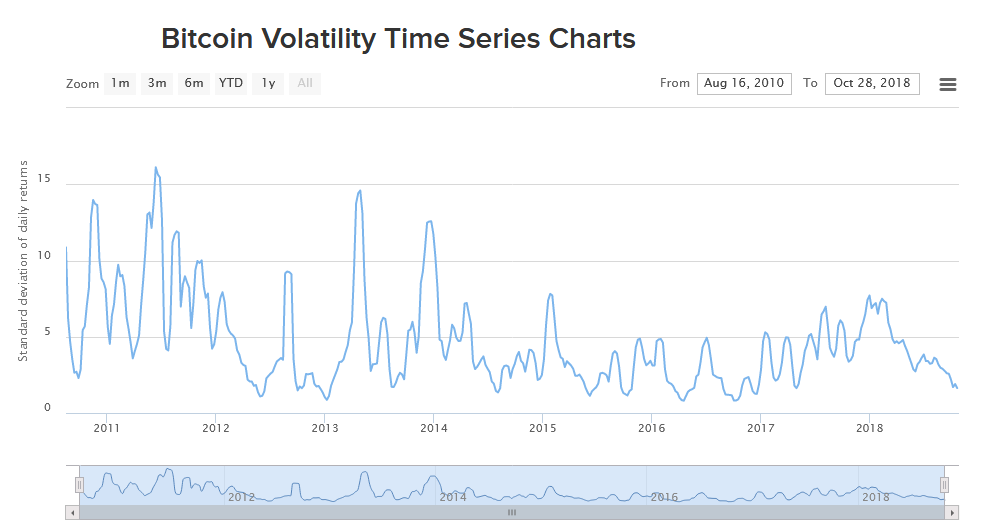

Following this is the visible drop in standard deviation. According to MarketWatch, the standard deviation of Bitcoin dropped from $4,640 or around +/-42 percent in January to $475 or +/-7.3 percent in October.

Standard deviation is a measure of dispersion of price from the mean, and the higher the dispersion, the greater the standard deviation. As such, this finding clearly demonstrated that there is a taper in volatility as standard depreciation decreased by a factor of 10.

Coincidentally, this finding meshes well with statistics drawn from the Bitcoin Volatility Index. The Bitcoin Volatility Index (BVI) measures the standard deviation of daily returns within a 30-and 60-day window and the BVI is an indicator of volatility based on Bitcoin’s historical prices.

The BVI tracks the volatility of Bitcoin prices in USD and the latest 30-day estimate puts Bitcoin’s volatility at 1.50 percent while the 60-day estimate is at 2.05 percent. By comparison, the volatility of Gold stands at 1.20 percent and the average volatility of fiat oscillates between 0.5 percent to 1.0 percent during the same time frame.

Bitcoin is not the same coin whose prices are stable. Ethereum’s weekly volatility stands at 2.69 percent according to data from BitMex.

https://twitter.com/iamjosephyoung/status/1056449643414863872

Signs of a Bottoming Market?

Could this be an indication that Bitcoin is finally bottoming out. As we can see from the technical price charts, the BTC/USD pair has been moving within a larger $3,000 price range with clear support at $6,000. This level has been retested a record six times, but despite strong bear pressure, prices do recover and surge higher.

Besides the strong support at $6,000, it is visible that whenever prices print lower, the standard deviation decreases and the last 14 days has been characterized by a tight $350 trade range inside Oct 15 high lows. This raises more questions than answers: is this tapering volatility pointers to a maturing market or has the market finally shaken off speculators?

One thing that people are ignoring in this quiet market is the fact that, as of tomorrow, Bitcoin will have held $6,000 for over a year. That’s huge. It’s proving that bitcoin is functioning as a store of value.

— Nicholas Merten (@Nicholas_Merten) October 28, 2018

Charlie Morris, multi-asset head at Atlantic House Fund Management in London weighed in on the surprising volatility around Bitcoin’s price saying:

“It simply means the market is calm and in balance. That implies that speculative interest is low. Given this bear market is now 10 months old and is getting tired, I’d be inclined to be bullish for the next major move.”

Bubble Popped

Around this time last year, in a FOMO moment, people were simply not willing to let go of a chance that could see then double or even triple their Bitcoin investment in matter of days or weeks. An opportunity which would have taken years in traditional investments.

This buying wave increased volatility, hampering adoption, and were the hallmarks of a bubble which was well-observed by Angela Walch, a law professor at St. Mary’s University in Texas. Angela is an expert studying financial and cryptocurrency stability and in an interview with Vice she said:

“Some of the hallmarks to me involve the FOMO idea—the fear of missing out and never being able to get in. People see other people making a lot of money and they just want in on it. The housing bubble is a good example of that. People thought another person would always want to buy their house from them at a higher price.”

Now that the bubble has been popped, many project that the market will recover and trend within reasonable volatility encouraging market wide adoption. In turn this will benefit coin holders who are here for the long haul.

Featured image from Shutterstock.