Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Yearn Finance’s native token YFI showed fresh signs of recovery after crashing by up to 72 percent from its all-time high near $44,000.

The decentralized finance cryptocurrency surged by as much as 16.08 percent in the last 48 hours of trading, hitting a local high near $15,171. Its price moves remained volatile, nonetheless, as they seesawed inside a $3,000-trading range.

The Yearn Finance token is consolidating upwards inside a Bear Flag range. Source: YFIUSD on TradingView.com

The extreme rejections at local support and resistance levels suggested that YFI is – at best – consolidating. That further pointed to a short-term bias conflict, leaving the market uncertain about its next directional trend.

Divergence Spotted

Trading Tank, a Twitter-based cryptocurrency analysis channel, predicted a bullish outcome for the Yearn Finance token based on a technical outlook. It noted the YFI/USD price downtrend in conflict with its Relative Strength Index (RSI), which was rising (the RSI calculates speed and change of price movements).

Together, the two trends showed a Bullish Divergence. It technically means that bears are losing their bias in the market on a booming bull influence.

Yearn Finance's 4H chart illustrates price-RSI divergence. Source: YFIUSD on TradingView.com

“YFI looks promising with that bull div,” Trading Tank tweeted.

A pseudonymous analyst, meanwhile, envisioned YFI trading downwards inside a Falling Wedge pattern. In retrospect, traders consider the Falling Wedge structure as bullish, for it typically leads to a price breakout to the upside – a trend reversal from bearish to bullish.

The analyst noted that YFI has every possibility to log a price rebound of 41 percent. For that to happen, the token would need to keep trading lower while leaving a sequence of lower highs and lower lows behind. Once the price reaches the apex of the Wedge, it would break to the upside.

The Yearn Finance token bull setup, as presented by the Crypto Dog. Source: YFIUSD on TradingView.com

That puts YFI’s price target around $6,000 higher from the point of the breakout.

Yearn Finance’s TVL Rebounds

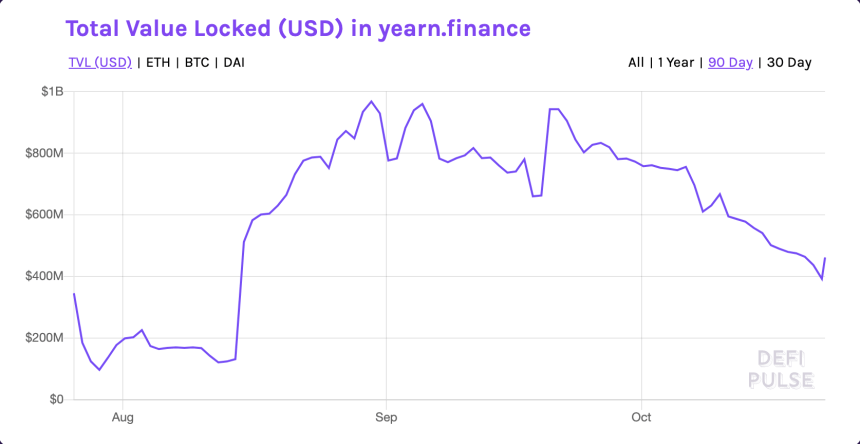

More good news is coming from the fundamental end of the YFI market. According to DeFi Pulse, a portal that tracks the total valued locked (TVL) with different DeFi projects, the Yearn Finance’s liquidity pool attracted about $80 million worth of assets in the last 24 hours.

The Yearn Finance TVL as of October 22, 2020. Source: DeFi Pulse

Locking assets with the Yearn Finance pool allows stakers to earn YFI yields in return. They use the tokens to propose and enforce changes on the yield farming aggregation protocol. They can also speculate on the value of YFI by trading it for other cryptocurrencies in the open market.

With the Yearn Finance pool adding more assets, that further hinted at an increase in adoption of the YFI tokens.