Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Yearn.finance’s YFI token failed to gain any momentum following yesterday’s sharp rebound following a brief dip below $10,000.

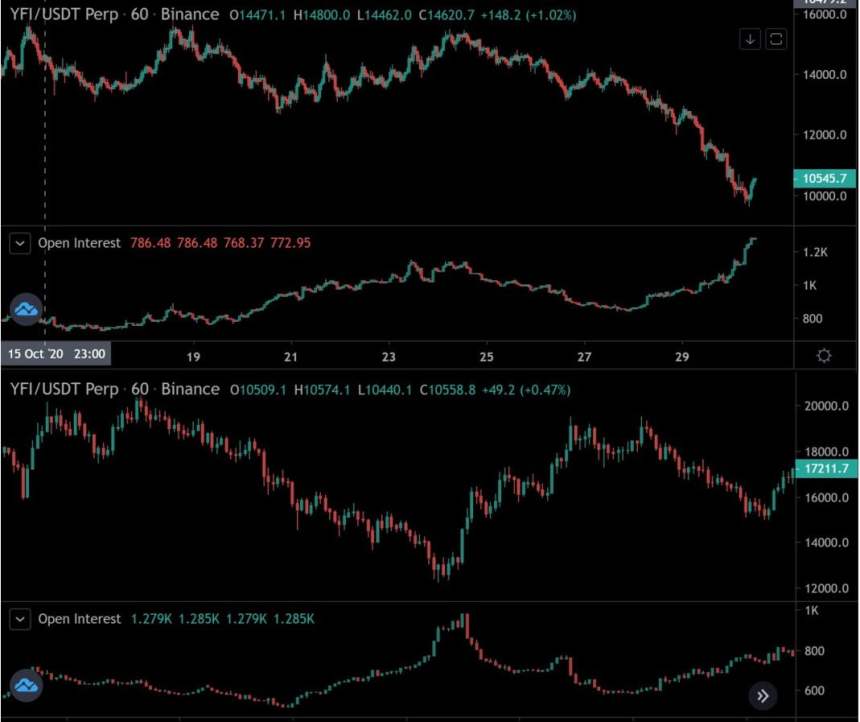

The cryptocurrency is now on the cusp of once again breaking below this level, with the immense selling pressure coming about as open interest for the token reaches an all-time high.

Although the sell-side of YFI’s order books are rather thin at the moment, a lack of any intense inflows of capital has perpetuated its recent technical weakness – which is showing few signs of slowing down any time soon.

The governance token’s price is also dipping in tandem with the implementation of a new proposal to redirect the ecosystem’s income towards YFI token buybacks, which is widely expected to boost its price.

Investors don’t seem to care too much, however, as the selling pressure placed on the token has been relentless.

Unless it traps short positions and sees a more sustainable rally in the near-term, there’s a decent chance that significantly further downside is imminent.

Yearn.finance (YFI) Struggles to Gain Momentum as Descent Continues

At the time of writing, Yearn.finance’s governance token is trading down over 6% at its current price of $10,370.

Yesterday, the crypto rallied to highs of $12,000 following a dip to lows of $9,600 set just a few days ago.

This decline marked capitulation, and the subsequent rebound made many analysts suspect that this was a short squeeze that could help mark these lows as a long-term bottom.

However, the decline seen throughout the past day signals that this selloff is not over and that further downside may be seen in the days and weeks ahead.

YFI Open Interest Hits All-Time Highs as Traders Bet on Volatility

Open interest for Yearn.finance’s YFI token is now at an all-time high, which indicates that an explosive move could be right around the corner.

Prominent investor Andrew Kang spoke about this in a recent tweet, explaining that OI is surging following the move towards $15,000 that cleared the upside liquidity.

“OI on YFI at new ATHs, surpassing first capitulation at 12k earlier this month. 12k-15k liquidity capitulated into high volume at 10ks (same as first capitulation into 12ks. Sell side orderbooks thin. What happens to shorts on a bounce up?”

Image Courtesy of Andrew Kang. Source: BTCUSD on TradingView.

Although he seems to believe that this indicates a move higher is imminent, the lack of any short squeeze during yesterday’s relief rally seems to point to immense underlying weakness amongst bulls.

Featured image from Unsplash. Charts from TradingView.