Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

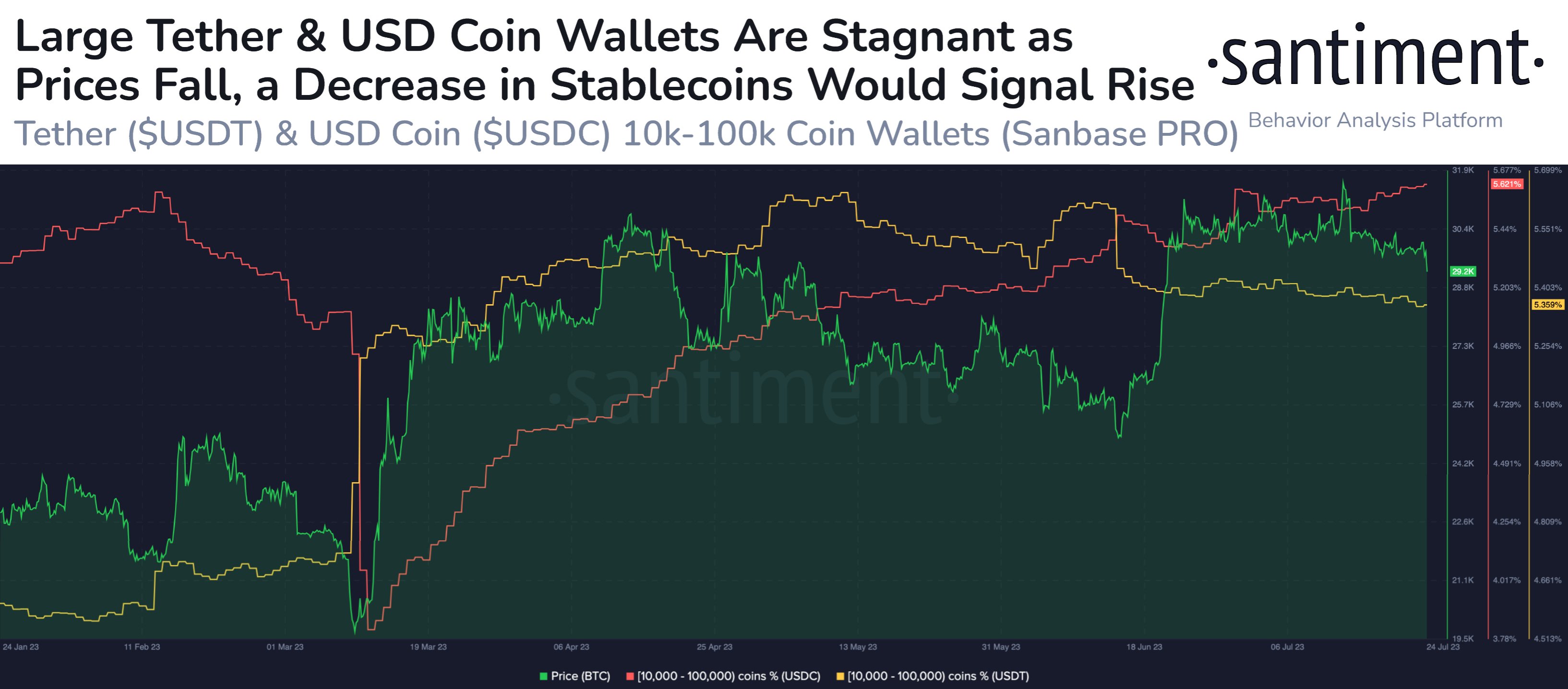

The on-chain analytics firm Santiment suggests that this indicator may be the one to watch to get hints about when Bitcoin might rebound.

Large Stablecoin Holders Have Seen Stagnant Supply Recently

According to Santiment, the movements of the dolphins and sharks of the top stablecoins like Tether (USDT) and USD Coin (USDC) may be relevant for the price of Bitcoin.

Generally, investors make use of these fiat-tied tokens whenever they want to escape the volatility associated with other assets in the market, like BTC. Such investors, however, are likely to buy back into the volatile cryptocurrencies, as holders who are truly exiting the space do so through fiat.

When these investors feel that the prices are right to jump back into the other coins, they simply exchange their stablecoins for them. Naturally, this shift can act as buying pressure for the market they are moving into, and thus, provide a bullish boost to the asset’s price.

To check whether there is any significant conversion of stables happening into Bitcoin and others right now, Santiment has looked at the data for the supply of the relatively large stablecoin investor groups.

More specifically, the combined holdings of the dolphins and sharks are of interest here. These holders generally hold between 10,000 and 100,000 BTC on their balances.

Now, here is a chart that shows how the supply of these investor cohorts has changed for USDT and USDC over the last few months:

Looks like the two metrics haven't shown much movement in recent days | Source: Santiment on Twitter

As displayed in the above graph, the dolphins and sharks of the two largest stablecoins in the sector have seen their combined supply move mostly sideways during the last few weeks.

This means that these decently-sized investors haven’t been taking part in any sort of net conversions recently, whether it be swapping Bitcoin into stables, or exchanging their stables for other assets.

Interestingly, this sideways trend has continued during the last few days, despite the plunge to the low $29,000 levels that the cryptocurrency has observed in this period.

“Currently, one of our key considerations revolves around whether this behavioral pattern will continue in the incoming 24 hours, especially in the wake of today’s fallen prices,” explains the analytics firm. “Will these users perceive this change as an opportunity to ‘buy the dip’? Or will they opt to ‘abandon ship’ amidst growing market uncertainty?”

Naturally, if the supply of these large stablecoin holders starts to slip down in the near future, it can be a sign that these investors are buying Bitcoin while its price is at a discount.

Though, on the other hand, an increase instead would obviously be a worrying signal, as it may mean that the dolphins and sharks are starting to give up on BTC for now and exiting from it.

Bitcoin Price

At the time of writing, Bitcoin is trading around $29,200, down 3% in the last week.

The value of the asset seems to have been moving sideways since the plummet | Source: BTCUSD on TradingView