Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

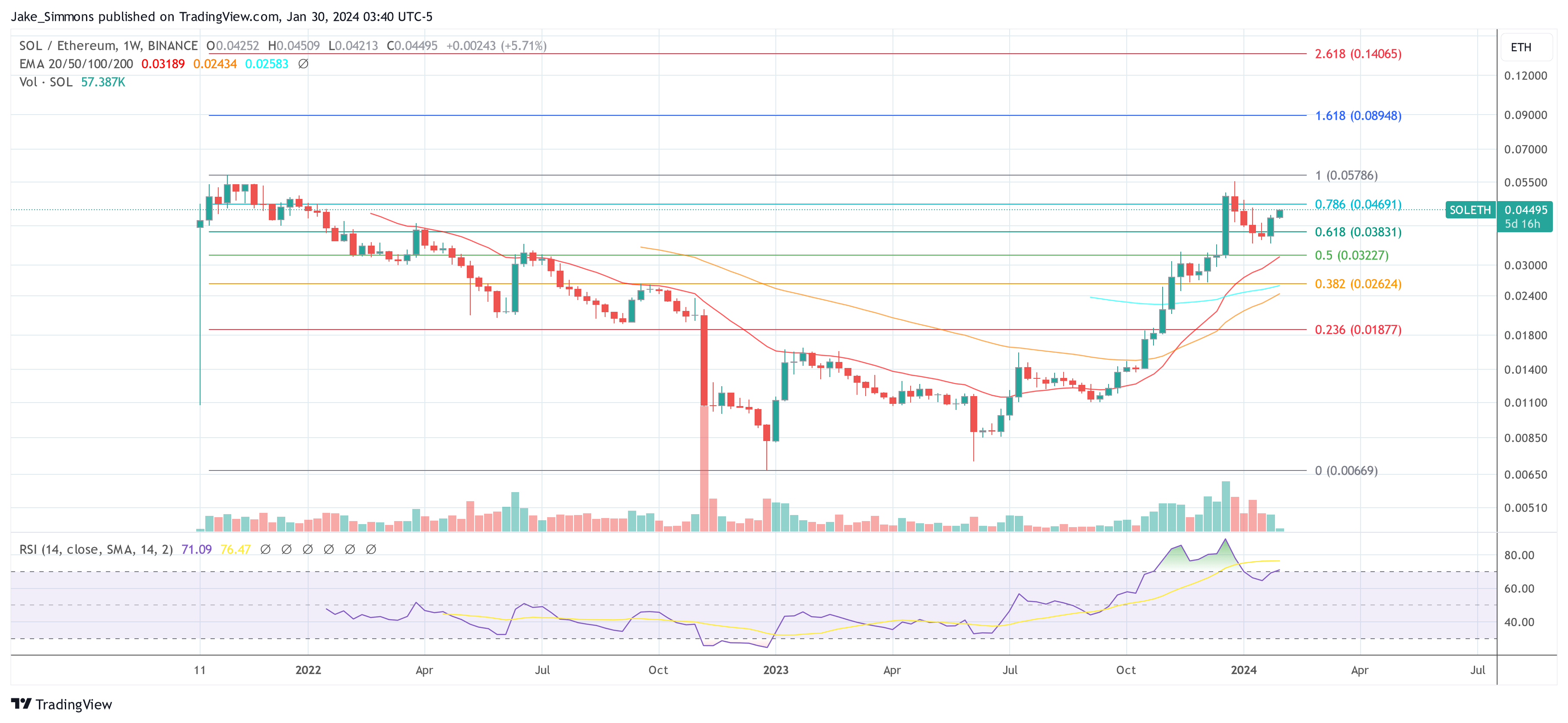

In a recent analysis, Andrew Kang, co-founder and partner of Mechanism Capital, provided a comprehensive analysis of the cryptocurrency market, focusing on the comparative strengths of Solana (SOL) over Ethereum (ETH) in the current bull cycle. Kang shared his insights via X, the platform formerly known as Twitter.

Central to Kang’s argument is the idea that in the current market, Solana presents a more favorable trading option than Ethereum. He states, “The definition of insanity is repeatedly trying to long ETHBTC when longing SOLBTC (or SOLETH) is the much better trade in a bullish environment.” This succinctly captures his perspective on the shifting dynamics between these major cryptocurrencies.

Why Solana Is The Superior Trade Than Ethereum

Kang offers a retrospective view of Ethereum’s journey, noting, “Over the first 6-7 years of ETH’s life, there was a lot of uncertainty and lack of education around ETH. There were a lot of Bitcoin holders to be converted to Ethereum holders.” He recognizes Ethereum’s early volatility and its eventual emergence as a stable trading asset.

However, he suggests that this relative stability has now become a double-edged sword: “ETH also became a ‘safe’ risk-on asset that traders could get into in size. That’s what made it a great cross to trade. But over time, people’s allocation to eth vs btc started to harden and the amount of people left to convert whittled away.”

Addressing Ethereum’s advancements in technology, Kang points out a paradox. He states, “While these [Layer 2 solutions and Modular technology] might seem like good things, it is these characteristics/innovations that weighs heavy on ETH during risk on periods where ETH previously outperformed.” He suggests that these developments, though innovative, have introduced new complexities that impact Ethereum’s performance in bull markets.

“Yes, you may have some conversion from BTC to ETH during risk on periods (much less so these days), but in this era ETH faces much more rotational pressure from those going from ETH as their base asset to these very L2s, modularity coins, SOL, those capitulating ETHBTC longs, and other shitcoins that it is supposed to benefit from,” Kang claimed.

In contrast, the crypto expert highlights Solana’s advantages, asserting, “Not only does SOL not face these same issues but it also has crossed the chasm in becoming a blue-chip Layer 1.” He emphasizes Solana’s resilience and its appeal to conservative investors who previously focused mainly on Bitcoin and Ethereum.

Kang further elucidates, “Conservative giants that previously were comfortable with BTC and ETH have SOL as an easy, safe next step. It is this transition phase of becoming a new major or base asset that you want to ride. A young fast horse, not a horse encumbered by the troubles of age, baggage and Jared Gray.”

Significantly, Kang notes a major shift in market dynamics, stating, “There was a secular shift in the collapse of ETHBTC volatility in 2023.” He posits that this shift has redefined the comparative advantage in favor of Solana. Concluding his analysis, Kang confidently asserts, “Even if that ever changes, SOLBTC will be the superior trade.”

At press time, SOL was just 30% short of a new all-time high against ETH.