Uniswap (UNI) has experienced a remarkable, bullish surge in its price amidst mounting sell-pressure on cryptocurrency exchanges. Bullish crypto traders have actively placed orders to buy 1.3 million UNI tokens, driving the price to $6.43, one of the highest levels in the past four months.

CoinGecko data indicates that the token experienced a minor 0.08% slump in the past 24 hours but a notable seven-day rally of 11.4%.

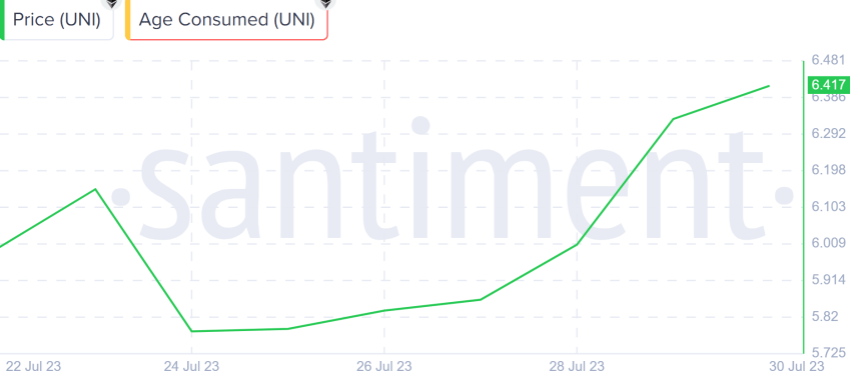

Recent data compiled by Santiment also reveals a noteworthy and sudden surge in Uniswap’s Age Consumed, indicating significant movement of tokens in the last few days.

UNI Age Consumed: Understanding On-Chain Data

With the UNI token price soaring to a remarkable 4-month peak, investors are now contemplating the opportune moment to secure profits. The rapid surge in value has led some market participants to consider early profit-taking strategies.

Investors and analysts closely examine on-chain data to understand better the market sentiment and the possibility of imminent sell-offs, focusing on a critical metric known as “Age Consumed.”

Age Consumed represents the total number of days since each token unit was last moved. It provides valuable insights into the activity of long-term holders and short-term traders.

UNI back into the $6.4 territory. Chart: TradingView.com

A significant increase in Age Consumed indicates that tokens previously held for an extended period are now being moved, potentially suggesting profit-taking or a shift in investor sentiment.

In the case of UNI, the Age Consumed skyrocketed from 11.66 million on July 22 to 292.71 million by the end of July 30. Such a surge in Age Consumed suggests a notable movement of previously dormant UNI tokens, raising questions about the intentions of long-term holders and the potential impact on the token’s price.

Source: Santiment

Uniswap Gains Preference After Curve Exploit

The bullish sentiment around Uniswap has been further fueled by a significant exploit that impacted another cryptocurrency token, the Curve Stablecoin Pools (CRV) token. The exploit led to a steep 20% plunge in the price of CRV, causing traders to pivot towards Uniswap’s UNI token.

Uniswap’s UNI perpetual futures are now trading at a 20% premium, indicating that traders strongly believe in Uniswap’s potential to gain more market share in the aftermath of the CRV exploit. Moreover, the funding rates for UNI perpetual futures have surged to 19%, showcasing the optimistic sentiment among traders regarding the future performance of the UNI token.

The aftermath of the Curve Finance exploit has had varying impacts on different DeFi platforms. While Curve Finance’s total value locked (TVL) dropped significantly from $3.2 billion to $1.8 billion, Uniswap’s TVL remained steady at around $3.8 billion. This stability in TVL demonstrates Uniswap’s resilience and strong fundamentals even during market turbulence.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Bitcoin-Bude