Bitcoin has been dancing on critical support over the weekend after it was rejected north of $48,000. The first crypto by market cap has experienced a persistent downwards trend and trades at $45,937 with 1.5% losses in the past day.

Related Reading | TA: Bitcoin is Struggling, But It’s Too Early to Say Bulls Have Given Up

It seems any attempt from the bulls to take back control it’s faded due to aggressive selling pressure. Bitcoin could be negatively reacting to a more hawkish U.S. Federal Reserve, and fresh uncertainty in the legacy market as COVID-19’s Omicron variant spreads.

The financial institution led by Jerome Powell has been hinting at an early start of tapering. According to pseudonym analyst Lightcrypto, this caused large investors to de-risk and dump their positions when BTC made a run for $60,000.

In consequence, these institutional operators changed their strategy to protect their end-of-the-year (EOY) profits and were cautions to re-enter the market in these current conditions. Light, similar to other analysts, believes Bitcoin has been seeing “programmatic selling behavior”.

https://twitter.com/IamNomad/status/1471795354924367872

As NewsBTC reported, the downwards trend has impacted the derivatives sector causing a 25% decrease in Open Interest (OI). In combination with reduced participation from retail investors, attracted to other cryptocurrencies rather than Bitcoin, it has strengthened the current price action. The analyst said:

Whereas bulls have been cautious, bears have taken to aggression, pushing perpetuals basis negative on some venues and building OI, while the large players who derisked in the $60k area have reversed course and begun to absorb panic- and short-selling.

How China Will Lose Its Ability To Influence The Price Of Bitcoin

On the bright side, the programmatic selling behavior described by Light could end in the short-term leading the door open for the subsequent rally. Via Twitter, analysts from Material Indicators shared data that suggested a historic end for this behavior from December 20th to 25th.

Binance shows signs of scheduled selling. Most months this year (legend), we saw accelerated selling into mid-month. It stops around the 20th – 25th of every month, also generally marking the bottoms on PA. Not following this pattern, marked tops for the given month.#BTC pic.twitter.com/lH4YMM0Ps3

— Material Scientist (@Mtrl_Scientist) December 19, 2021

Usually, this relief in selling pressure leads the market to a Santa Rally, an increase in Bitcoin and other cryptocurrencies prices post-Christmas eve. This time the phenomenon could take the market by surprise, Light claimed the following about the possibility for big players to try to get ahead in the next bullish trend:

Funds are likely done (or close to it) with structural sell flows, are cashed-up, and will now consider frontrunning the other way, namely, incoming buy flows in January.

The decrease in OI and leverage positions, the fact Bitcoin has seen a 35% dropped from its all-time high into a historically bullish season, and the fact big players now have the cash to take new positions, support Light’s bullish thesis. The analyst believes the bears will be “stoneless soon enough”.

Related Reading | Is MicroStrategy Considering Lending Their Bitcoin To Generate Yield? WHY?

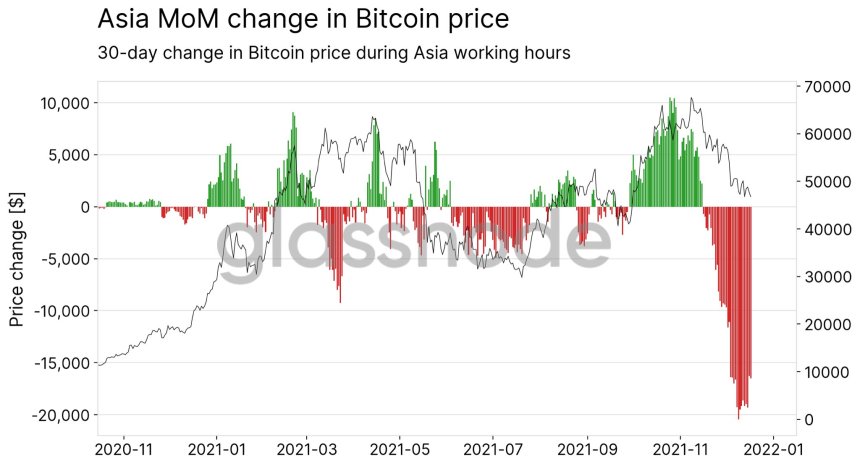

In addition, Light pointed out that two major crypto exchanges, Huobi and OKEx, will remove the “majority of mainland users”. This could have bullish implications for Bitcoin as the Asia trading sessions have resulted in negative price action in 2021.