Bitcoin was trading higher ahead of the New York opening bell Monday but risked shedding its intraday gains on Moderna’s latest announcement.

The tech-savvy pharmaceutical firm updated earlier Monday that its experimental coronavirus vaccine is 94.5 percent effective in protecting people from catching the infection. That marked the second successful trial seven days after Pfizer and its partner BioNTech also showed 90 percent efficacy in their COVID-19 trial.

Bitcoin initially reacted negatively to the Pfizer vaccine news on Monday last week as its price fell by more than $1,000 within a few hours into the announcement. Nevertheless, on the same day, billionaire investor Stan Druckenmiller claimed that he owns Bitcoin. His statements counterbalanced the said downside risks.

Bitcoin recovered later into the day.

Uncertainty Remains

A vaccine that effectively cures coronavirus expects to remove the necessity of social distancing.

Therefore, it allows the sectors that rely on close physical interactions — airlines, travel, manufacturing, entertainment, etc. — to return to normal. The global economy has a better probability of rebounding faster as long as there is a shot available to curb COVID-19.

A working vaccine also allows investors to reduce their appetite for riskier assets. It is the same reason why Gold, a safe-haven rival to Bitcoin, recorded its worst single-day decline on the day Pfizer claimed a successful trial. There was not a Stan Druckenmiller to save the precious metal.

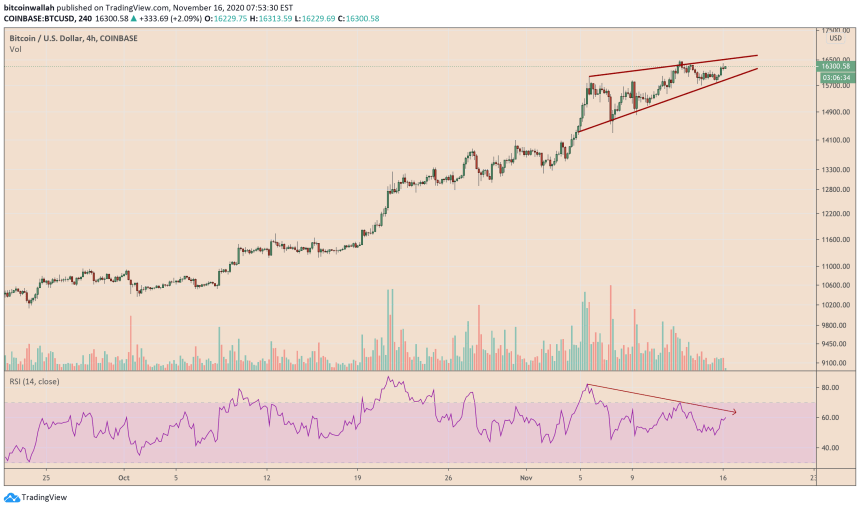

Bitcoin is attempting to hold a price floor above $16,000. Source: BTCUSD on TradingView.com

Meanwhile, questions remain about the vaccine’s efficacy, cost, and distribution. The slower it reaches the people, the higher is the probability of investors to keep their one leg in safe-havens like gold and Bitcoin. The prospect of more stimulus from governments also makes them want to hold speculative assets over non-yielding cash or cash-based alternatives.

The Bitcoin market could expect to correct lower in the short-term as traders prepare their interim bearish positions against the vaccine outlook. Nevertheless, those with a long-term risk appetite could find the next dips as their opportunity to expand their cryptocurrency stocks.

Bitcoin Technical Outlook

The BTC/USD exchange rate is inside an overbought territory on its daily chart, thus bringing up another reason why the pair should correct lower — or at least, consolidate sideways above $16,000. Meanwhile, on a four-hour chart, BTC/USD is showing a bearish divergence.

Bitcoin shows bearish divergence on short-term charts. Source: BTCUSD on TradingView.com

That further amounts to a downside correction in addition to the said fundamentals and technicals above. But, according to Konstantin Anissimov, Executive Director at CEX.IO, the next big bearish move may take another two-three weeks to arrive. Excerpts from his statement to NewsBTC:

“It seems like BTC is poised for higher highs from a technical perspective. The Tom Demark (TD) Sequential indicator suggests that the cryptocurrency may continue to rise for another two to three weeks before a sell signal emerges. If this is the case, Bitcoin could rise to $19,000.”

Bitcoin was trading at $16,320 at press time, up more than 2 percent into the Monday session.