Derivatives trading is a common activity in conventional financial markets and the same is true in the cryptocurrency industry. In the recent days, Bitcoin and crypto derivatives are becoming a welcome new volatile asset-class that presents an alternative to traditional trading.

As we witness a rising interest in cryptocurrency, we’re also witnessing an urgent demand from institutional and retail investors for solutions that help in risk management and reduction of volatility in trading cryptocurrencies and blockchain assets on exchanges.

Thus, there exists a myriad of platforms or exchanges that provide derivatives trading instruments. Chicago Mercantile Exchange (CME) and Bakkt, for example, are emerging as leading players in the institutional cryptocurrency market. However, sophisticated traders have a plethora of services in leveraged cryptocurrency trading from a variety of exchanges to suit their individual needs. Based on this philosophy, exchanges that are focused on security and risk management today are the real champions. By leveraging blockchain technology, exchanges that deliver fair and efficient markets for emerging assets are the real winners.

However, the crypto derivatives ecosystem is still in development and this, combined with volatility may lead to strong gains and exposures to loss. Preparing to take part in the action, one must first choose which exchange offers the features and pairs that will create the optimal, secure, and potentially profitable experience. The infrastructure needed to offer these products is considered as such there are specialized exchanges that may be new to traditional traders but are already well ahead of the curve in the crypto derivatives ecosystem.

According to CoinGecko 2019 Year-End Report, the crypto market analysis platform indicates that there were 17 crypto derivatives platforms in October as compared to just 6 in the month of July, and the overall 24h derivatives trading volume also increased rapidly to 7.5 billion, which means the average volume per exchange (around 0.44 billion/exchange) has been around 3 times as that (around 0.15 billion/exchange) of the spot trading exchanges.

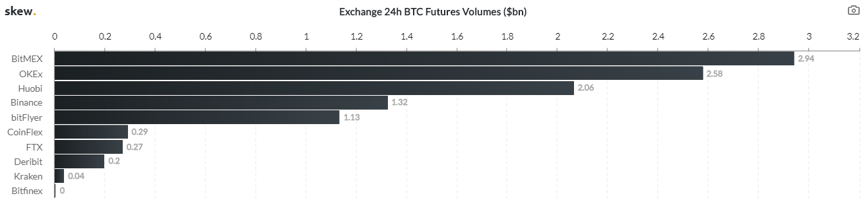

What’s more, skewAnalytics has published the comparison of real-time data for crypto derivatives market, in which it has mentioned that BitMEX has dominated the market with 24h BTC Futures Volume at 2.94 billion USD, followed by OKEx with 2.58 Billion USD. The other top exchanges in spot trading like Binance and Huobi are also leading in the crypto derivatives landscape.

Source: https://skew.com/dashboard/bitcoin-futures

Further, if looking into more specific details among the main crypto derivatives exchanges, we can find out the key differences among them in terms of products they can provide, so that the users may get some instructions to select the proper exchanges.

|

|

Futures | Perpetual Swap | Options | Margin Trading | Spot Trading |

OTC |

| OKEx |

√ |

√ | √ | √ | √ |

√ |

| Bitmex |

√ |

√ | √ |

|

||

| Bitfinex | √ |

√ |

√ |

√ |

||

| Deribit |

√ |

√ |

√ |

|||

| LedgerX |

√ |

√ |

√ |

As mentioned in the table above, OKEx now offers a full set of crypto trading instruments, while the others have their own advantages. For example, BitMEX has been offering crypto derivatives since 2015, has a brand name and good liquidity, and it tops both in trading volume and open interest. Deribit exchange is specific in doing what it does and has a decent share of crypto derivatives traders specifically in terms of options trading. Bitfinex on the other hand, offers margin, spot, OTC trading along with derivative products like perpetual contracts.

However, futures could be the most common product on all the exchanges. More specifically, there are two kinds of futures in the cryptocurrency market depending on whether the margin is token or USDT. Jay Hao, CEO of OKEx, has given an explanation on why we need USDT future contracts, “Comparing to our existing futures (token-margined futures) product, it’s more stable, as you’ve already avoided the volatility of the collateral. It’s more convenient, as you don’t have to switch between currencies to trade different contracts. And it’s more suitable to beginners, as the threshold of entering the market has lowered to ~ $1 with leverage 0.01-100x.”

Also, the USDT futures contract allows traders to earn USDT profits when opening short positions, meaning you will never need to worry about the influence of token price decrease during the bearish market. In order to let more users understand the key benefits of USDT futures, OKEx also initiated the trading contest with great rewards.

Cryptocurrency futures trading is considered as an advanced feature for sophisticated users, who at least are familiar with the basics of risk management and high-risk trading. In this respect, it is of utmost importance to provide relevant educational content, and instructions for the users, as well as to inform them of the risks of leveraged trading. The rule of thumb is to never invest more money that one cannot afford to lose.

Image by Gerd Altmann from Pixabay