- As the decentralized finance sector explodes in value, a recent Messari report indicates that the so-called DeFi boom is likely to continue.

- Researcher Ryan Watkins wrote that a capital shift from “useless” cryptocurrency projects might help the DeFi tokens boom.

- Most of these dead projects are listed among the top-30 cryptocurrencies, stated Mr. Watkins.

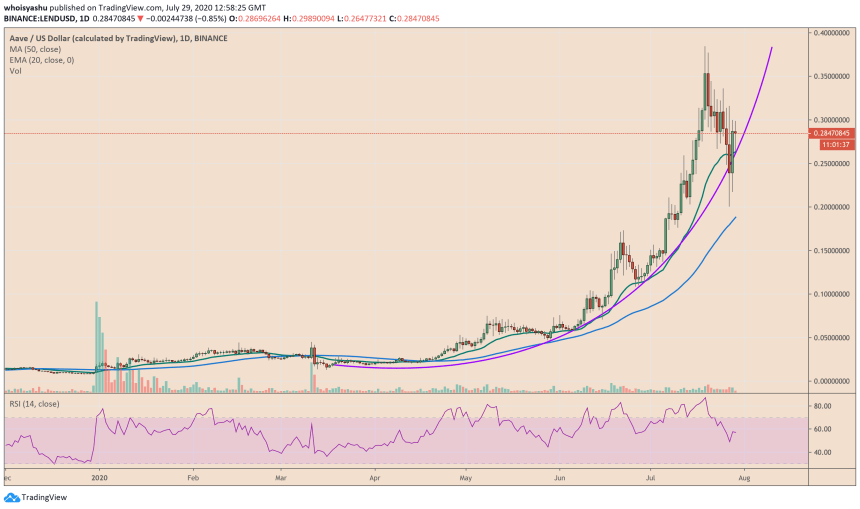

Some of the DeFi tokens that rallied by thousands of percent in 2020 may just extend their bull run further, according to Messari’s latest report on the decentralized finance sector.

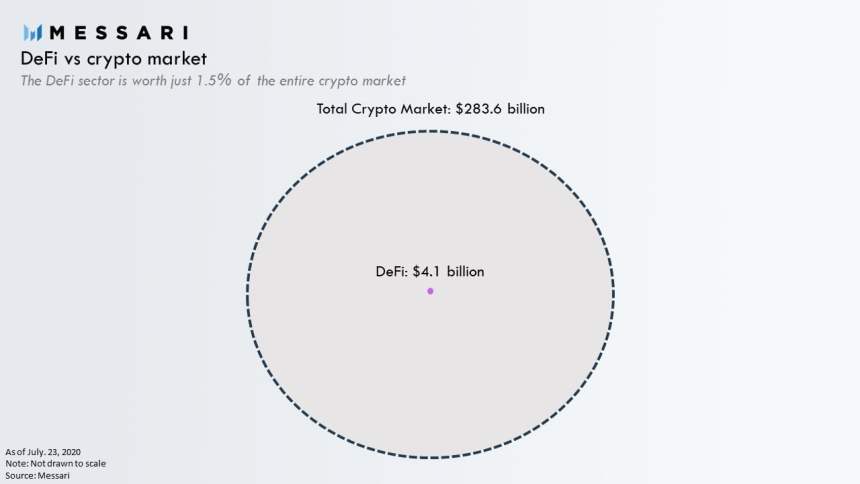

Researcher Ryan Watkins noted that the DeFi tokens, on the whole, make up just 1.5 percent of the entire cryptocurrency market. That is despite the existence of credible startups that promise excellent returns to their investors in the long-run.

DeFi market size compared to other crypto projects. Source: Messari

Mr. Watkins also noted that the projects that hold a more significant portion of the crypto market–especially those listed in the top-30– are “useless first-generation cryptocurrencies.”

They include the so-called “Ethereum Killers” that have done very little in displacing the second-largest blockchain platform. They also include vaporwave that raised a large sum of money during the 2017 ICO boom but never delivered a working product to this date.

“Even Dogecoin, a literal meme coin, is worth more than nearly every asset in DeFi,” wrote Mr. Watkins.

Capital Reallocation

Mr. Watkins noted that the crypto investors would eventually want to reallocate their capital from “worthless” crypto projects into yield-driven DeFi products. The researcher further stated the DeFi itself does not need new money flowing to continue its rise, which also increases the sector’s ability to rise without a doubt.

“It may seem like DeFi has already arrived with its recent run, but at just 1.5% of the entire crypto market, it could just be getting started,” he wrote.

DeFi token LEND rallied by more than 1,650% in 2020. Source: TradingView.com

Mr. Watkins also noted why investors would want to move outside the top-30 crypto tokens, other than Bitcoin and Ethereum. He said that most of the mentioned cryptocurrencies operate as “non-sovereign stores of value.”

“In theory most layer 1s are priced according to their probability of winning this market,” the analyst explained.

Not an ICO Bubble

Mr. Watkins also went against comparing the 2020’s DeFi boom with the 2017’s ICO craze.

He noted that the ICO market attracted billions of dollars worth of investments without even delivering a working product. On the other hand, a majority of DeFi projects already have live products. Moreover, they are already cash flows for their investors.

“However, despite all the attention and activity, DeFi still remains an incredibly small part of the total crypto market,” he added. “In fact, the entirety of what we call DeFi is worth less than both XRP and Bitcoin Cash alone.”