Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

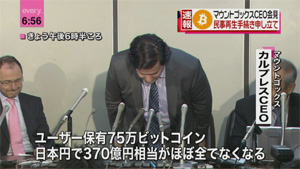

This is probably the moment that many in the bitcoin community expected. Tokyo-based exchange Mt. Gox filed for bankruptcy protection on Friday in Japan. Plagued with issues over the past several months, the company goes under with ¥6.5 billion (or $63.6 million USD) in debt (and a bank account discrepancy of $27.4 million USD).

In addition, the company — as speculated — has lost upwards of 700,000 user bitcoins and 100,000 bitcoins of their own (a figure higher than speculated previously) due to a security flaw in their software that allowed hackers to siphon out money over an unknown amount of time. The losses exceed $400 million USD.

“First of all, I’m very sorry,” said the company’s CEO, Mark Karpeles, appearing publicly. “The bitcoin industry is healthy and it is growing. It will continue, and reducing the impact is the most important point.”

In traditional fashion in the business world of Japan, Karpeles bowed before the media in his suit and tie, a huge difference from his laid-back t-shirt-wearing style.

These past few weeks have been torturous for former customers of the exchange. With the inability to withdraw funds, the company provided users will false hopes of getting them re-enabled and possible re-acquiring their money. Then on Monday, the exchange abruptly went offline, just hours after halting trading completely.

The community has seemingly prepared themselves for this news, however, with many speculating during the week that any funds they had stored on the exchange were very much gone.

The price per bitcoin has dipped 5 percent (12 hours) amidst the news, hitting $555 at exchange Bitstamp (as of this writing).

On Tuesday, Mark Karpeles made a statement on the website’s homepage noting the company would “closely monitoring the situation and will react accordingly.”

The filing essentially marks the end of the world’s once-largest and first bitcoin exchange (which incidentally started as trading platform for Magic: The Gathering playing cards).

Title is wrong: Mt.Gox Files for Bankruptcy PROTECTION, not for Bankruptcy. That’s actually the opposite 🙂 It’s to *prevent* bankruptcy.

Although in the end, the result will probably still be the same, since it’s already been clear for weeks that Mt.Gox is over.

If you do not own the private keys to your wallet, you do not own the Bitcoins!

With 3rd party wallets, like MtGox used, you only own a claim to the Bitcoins.

I will only ever use the official wallet. I don’t trust 3rd parties with my coins.