Here’s what the current Bitcoin rally might require for a resumption based on the trend that a similar rally back in April 2019 followed.

Bitcoin Accumulation Trend Score Has Declined Recently

As per the latest weekly report from Glassnode, the accumulation trend score shows that investors have been distributing Bitcoin recently. The “accumulation trend score” is an indicator that measures whether investors have been buying or selling within the last 30 days.

For the calculation of the score, the metric accounts for both the aggregate balance changes in the wallets of the investors and the size of their wallets. The indicator puts a higher weightage on large entities like whales and institutional investors.

Thus, whenever the indicator’s value is close to 1, it means large entities like these are accumulating right now (or alternatively, a huge number of small investors are accumulating). On the other hand, values of the score near zero imply large entities are distributing currently, or more simply, they are just not accumulating.

Now, here is a chart that shows the trend in the 7-day moving average (MA) Bitcoin accumulation trend score over the past few years:

Looks like the 7-day MA value of the metric has fallen in recent days | Source: Glassnode's The Week Onchain - Week 7, 2023

As displayed in the above graph, the Bitcoin accumulation trend score has recently declined in value as the rally has gone on and has assumed distribution values (colored in shades of red/orange and marked with a ‘D’ under the curve).

The indicator’s value is now below 0.25, which means that large entities have been participating in a decent amount of selling in recent days, taking advantage of the current profit-taking opportunity.

A rally that the current one is reminiscent of is the April 2019 price surge, which was also a rally that took Bitcoin out of the bottom discovery phase of the bear market of that cycle.

Just like now, the April 2019 rally also saw the accumulation trend score show distribution values in the initial leg up out of the bottom zone. This selling, however, wasn’t enough to stop the rally back then, and it seems that before long, the distribution was exhausted as the indicator surged to accumulation values again.

This fresh accumulation (marked in shades of purple) helped the price of the cryptocurrency resume the sharp surge, as highlighted in the chart with the symbol ‘A.’

If the current Bitcoin rally really is about to go down the same route as its predecessor in April 2019, then it would appear that large entities will need to show some continued accumulation in order to outweigh the distribution and help the presently halted rally to push on.

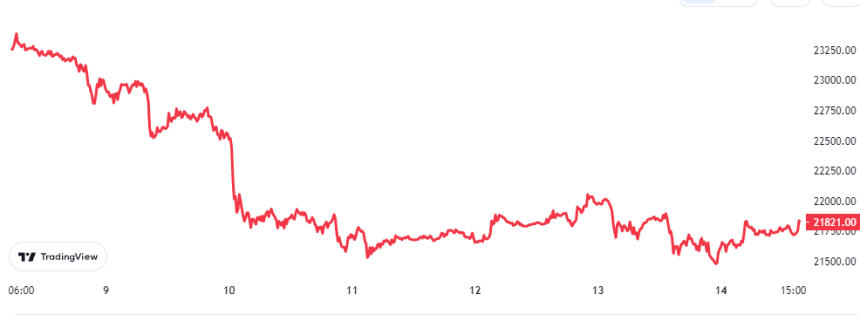

BTC Price

At the time of writing, Bitcoin is trading around $21,800, down 5% in the last week.

The value of BTC seems to have gone stale since the decline earlier in the week | Source: BTCUSD on TradingView