Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Grayscale Bitcoin Trust (GBTC), the largest Bitcoin trust in the world, saw a rocky end to the year 2022 after its sister company Genesis Trading filed for bankruptcy. However, it has seen a better start to the year 2023 as it continues to close the gap on its unusually deep discount in December 2022. As the GBTC makes its way back toward parity with BTC spot market prices, could this be good news or bad news for Bitcoin?

Grayscale Discount To NAV Shrinks

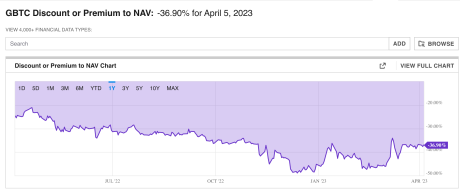

In December 2022, the Grayscale discount to NAV had climbed to almost 50%, recording a new all-time high in the process. This meant that the trust was trading at about a 50% lower price compared to the price of BTC on the spot market. It would then carry this high discount into January 2023 but the tides began to turn as the crypto market saw a recovery.

Slowly but steadily, the GBTC discount has been shrinking over the first quarter of 2023. It has since recovered by over 15% during the three-month period, dragging the discount back down into the 30% territory, a new five-month low.

On April 5, 2023, the GBTC discount was sitting at 36.9%, although this is not its lowest point so far for 2023. The lowest discount so far for 2023 was reached on March 8 when it dropped to 34.11%. Nevertheless, it is still a long way from its 2022 highs.

GBTC discount falls to 36.9% | Source: YCharts

Likewise, the discount to NAV on the Grayscale Ethereum Trust (ETHE) has been recovering in 2023. ETHE closed out 2022 with an all-time high discount of 59.62%, but by April 5, it has dropped to 50.92%, with the lowest discount for the year so far being 46.88% recorded on March 9, 2023.

GBTC Recovery Good For Bitcoin?

The Bitcoin price suffered from the uncertainty surrounding Grayscale Bitcoin Trust last year because the trust currently holds over 600,000 BTC which it holds with the Coinbase Custody service. Most of the uncertainty was surrounding whether the contagion from Genesis Trading filing for bankruptcy would spread to the trust.

GBTC’s team had, however, pacified investors when it revealed that the trust was operated independently and so far, the trust has been able to continue operations. The closing of the discount gap also shows that investor confidence is returning and the GBTC is recovering.

BTC falls below $28,000 | Source: BTCUSD on TradingView.com

One thing that continues to hold the trust back though is its lawsuit with the Securities and Exchanges Commission (SEC) after the regulator denied its filing to turn the trust into a Bitcoin Spot ETF for the second time. The lawsuit is still ongoing but if Grayscale were to emerge victorious, it would be a momentous win for the space and BTC’s price would more likely than not react positively to such news as it would be the first BTC spot ETF in the United States.

For now, BTC is still struggling to hold $28,000 and the bears have beaten the price back down to $27,900 once more. However, interest remains high as the Bitcoin Fear & Greed Index shows investors are still very greedy, pointing to buying pressure for the digital asset.