Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has continued trading above $200 despite facing a massive influx of selling pressure earlier this morning that jeopardized its position above this key support level.

It now appears that ETH is gearing up for a massive movement in the days and weeks ahead as it continues trading within a multi-week range.

Analysts are noting that there are three factors that suggest its price is about to snap this long-held bout of consolidation and spark a massive movement.

As for which direction this potentially imminent bout of volatility could lead the cryptocurrency, one trader believes that it will favor buyers.

Three Factors Suggest Ethereum is About to See Some Massive Volatility

At the time of writing, Ethereum is trading down just over 1% at its current price of $204, marking a climb from daily lows of around $200 that were set during a sharp early morning decline.

This price action has been largely driven by that seen by Bitcoin, as the benchmark cryptocurrency has been struggling to gain any momentum as it trades beneath $9,000.

Ethereum has been severely underperforming Bitcoin ever since it declined from its yearly highs of $290.

From this point, it has been unable to garner any upwards momentum and has been setting lower highs. This has resulted in a multi-week bout of consolidation within the lower-$200 region.

As Bitcoin flashes signs of weakness, it is possible that it will cause altcoins like ETH to similarly decline in the days and weeks ahead.

One analyst recently pointed to three main factors that may show a massive move is imminent in the days and weeks ahead.

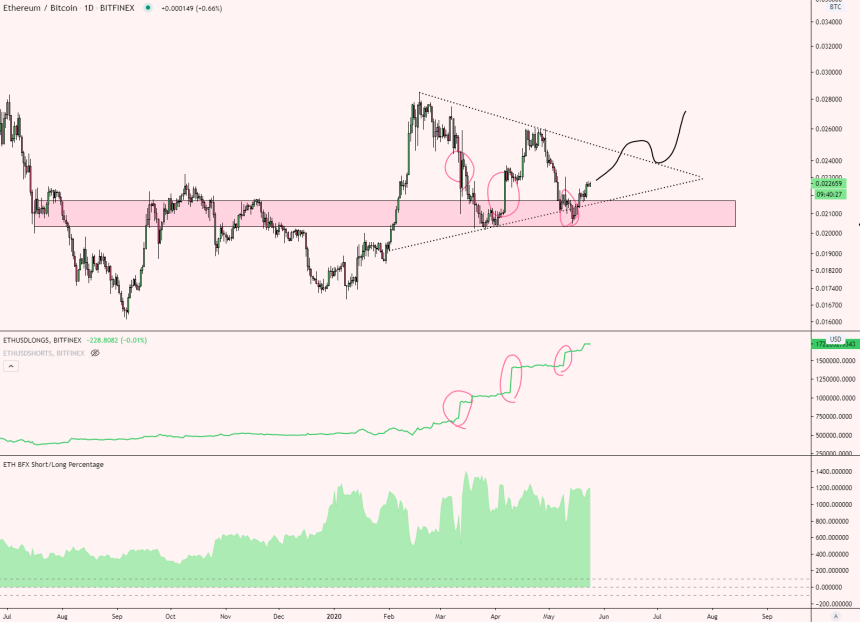

He points to the crypto’s long-to-short ratio being at an all-time high, the number of long positions being at its highest point ever, and its price closing in on two years of macro consolidation as reasons why the cryptocurrency is bound to see heightened volatility.

“ETH Long to short ratio at an ATH. ETH Longs at an ATH. ETH Near historic all time lows, closing in on a two year consolidation. Something is going to snap soon. I’m with the herd this time and long,” he explained while pointing to the chart seen below.

ETH’s Next Movement Likely to Favor Buyers

The same analyst later went on to explain that he does believe the next trend will favor buyers.

He notes that the current buy-side demand that Ethereum has seen just below its current price level suggests that large traders are anticipating upside.

“Someone with more money than me or you is adding heavily on ETH / $USD longs here when ETH / $BTC falls into this demand zone. I think a 10% ish move from 0.022 -> 0.025 is a nice catch right now but they are looking for something much larger, I am too,” he said.

Featured image from Shutterstock.