Ethereum has been able to maintain its position above $200 despite facing some intense selling pressure earlier this week.

The cryptocurrency is now attempting to generate some upwards momentum as it fast approaches a key resistance level.

Traders do anticipate this level to be surmounted in the days ahead, as its technical outlook has been bolstered by its strong recovery from its recent lows of $190.

This comes as traders on Bitfinex continue piling into long positions, pushing the notional value of ETH longs on the platform to reach fresh all-time highs.

Ethereum Stabilizes Above $200 as Analysts Eye Further Upside

At the time of writing, Ethereum is trading up marginally at its current price of $206.

This marks a notable climb from recent lows of $200 that were set yesterday when sellers attempted to push the crypto back below this key support.

Buyers were able to absorb this selling pressure and propelled it to highs of $210 before losing momentum.

The crypto’s latest upswing marks an extension of the momentum which was first incurred following the crypto’s drop to lows of $190 earlier this week.

This decline put ETH in jeopardy of seeing a significant decline and it came about in tandem with Bitcoin’s plunge to lows of $8,800.

Analysts are now noting that they anticipate Ethereum to see some further upside in the days and weeks ahead as a result of its strong recovery from its recent lows.

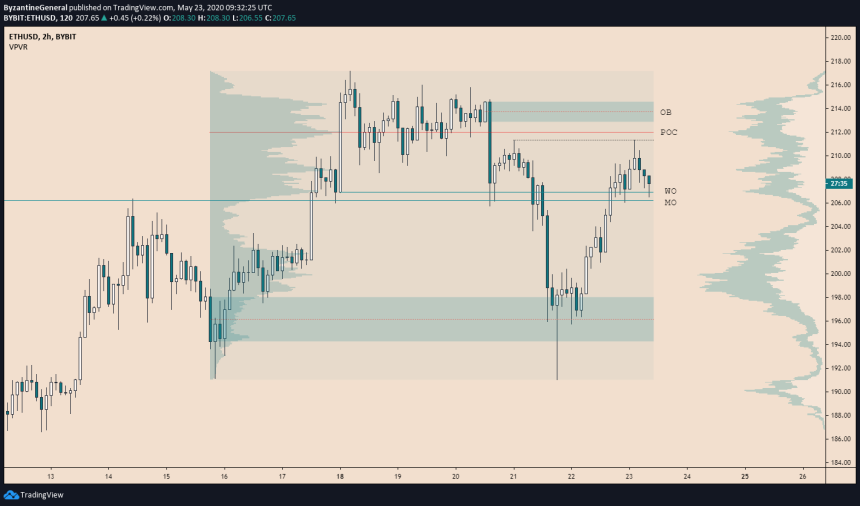

One popular pseudonymous trader spoke about this in a recent tweet, explaining that it has turned its weekly open (WO) into support and made an equal high.

He notes that this opens the gates for a movement up towards $215 – a resistance level that could soon be shattered if the trader’s analysis plays out.

“It turned the WO into support and made an equal high. I bet it takes that out. Up we go,” he explained while pointing to the chart seen below.

ETH Traders are Overwhelmingly Long

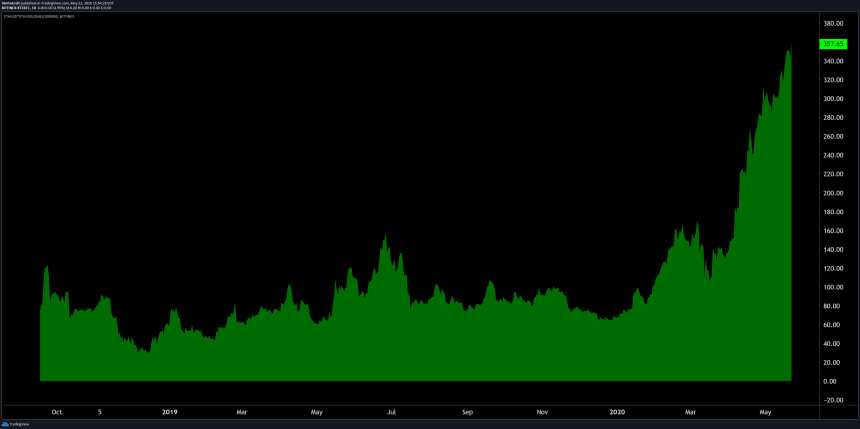

Investors were surprised to learn last week that the notional value of Ethereum long positions on Bitfinex had hit a fresh all-time high.

This trend has not changed in the time since, as margin traders have continued piling into fresh long positions as they eye further upside.

“Notional value of ETH longs on BFX continues to increase,” one popular trader noted while pointing to the striking trend seen on the chart below.

Another analyst also observed another unpredicted trend, explaining that the popular trading platform now has a higher balance of ETH than Bitcoin.

“It keeps going. Bitfinex now has a higher USD balance of ETH ($807m) than BTC ($691m) – per Glassnode,” he stated.

The buying pressure resulting from this could propel Ethereum higher in the near-term, but it could also provide fuel for the cryptocurrency to see a sharp decline fueled by a cascade of liquidations.

Featured image from Shutterstock.