Ethereum (ETH) has failed to break from a key level, retracing 4% as most of the market bleeds. Some analysts believe that ETH’s next leg up won’t come in a few months, as the second-largest cryptocurrency could move sideways until May.

Ethereum To Continue Sideways Move?

On Monday, Ethereum swan against the current and registered a 6.3% surge toward the $2,850 support zone, momentarily breaking out of a symmetrical triangle pattern where it has been consolidating for the past 15 days.

The cryptocurrency attempted to reclaim the $2,700-$2,800 level but failed to hold the zone in the following hours. On Tuesday, ETH’s short-lived party ended, sending the King of Altcoins on a 4% pullback toward the $2,605 mark.

Crypto analyst Ali Martinez noted that Ethereum needed to hold the $2,600 support, a crucial level for the cryptocurrency, to continue within its multi-year ascending channel. To the analyst, failing to hold this level could hinder the long-awaited Altcoin season.

Moreover, failing to hold this level could see ETH dropping to the $2,400 mark, as the current level doesn’t have significant demand. According to Martinez, the $2,425 level remains the most critical support zone for the cryptocurrency, as 10.33 million wallets accumulated 63.43 million ETH.

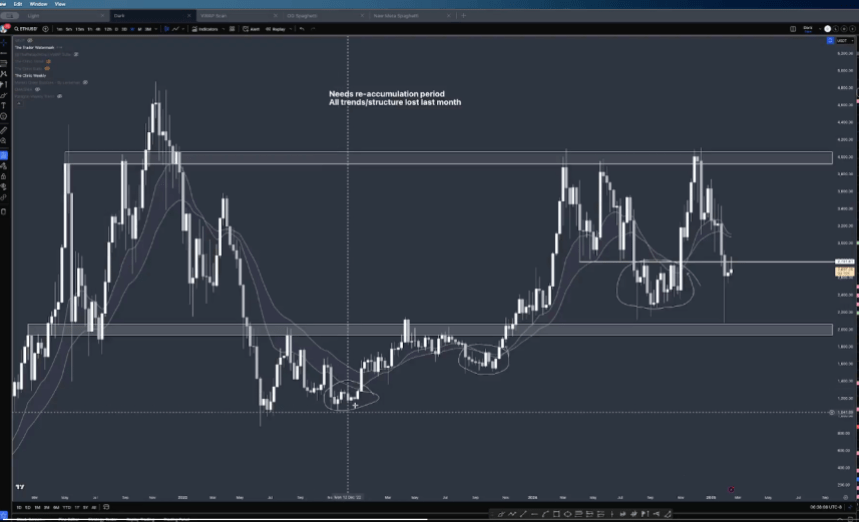

Amid its most recent performance, market watcher DocXBT considers that Ethereum needs a re-accumulation period to attempt to reclaim higher levels. The analyst stated, “It needs an extended period of re-accumulation,” as the ones seen during the FTX collapse, 2023’s capitulation, and summer 2024’s capitulation.

To DocXBT, “There’s nothing for ETH to do except go sideways for an extended period of time.” He added that it could continue hovering within its current range for two to three months “before we can bring trends down, flip them, and maybe get bullish again.”

ETH’s $4,000 Breakout Just ‘A Matter Of Time’

Crypto trader Mikybull pointed out ETH’s bullish pattern in the longer timeframes. Ethereum has been in an ascending triangle since 2022, which suggests it could have a “massive breakout” once the upper resistance, around the $4,000 mark, is broken.

The trader asserted that a “longer consolidation leads to a sustainable rally.” Similarly, analyst Ted Pillows stated that Ethereum is holding its uptrend support level, which suggests that the $4,000 breakout is just “a matter of time,” which could lead to a retest of the 2021 all-time high (ATH).

The analyst pointed out the sentiment shift toward the Solana memecoin ecosystem, suggesting that rotation to Ethereum is about to happen. “Memecoins chains are dying, and people are flocking to utility chains,” he affirmed on X.

Other analysts have recently signaled the potential rotation from SOL to ETH, arguing that the SOL/ETH trading pair has topped after the recent events in the Solana network. The most recent incident saw capital rotate toward Ethereum for the first time in a while and suggests the “ETH season” could be near.

At the time of writing, Ethereum trades at $2,631, a 1% retrace in the weekly timeframe.