Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On Monday, Ethereum (ETH) recovered the $2,000 support, fueled by the market’s recovery. After hitting a two-week high of $2,104, an analyst noted that the cryptocurrency could end March positively.

Ethereum Nears Green Monthly Close

In the past 24 hours, Ethereum surged 6.2% from the $1,980 mark to $2,104. The start-of-week recovery made ETH retest the $2,100 resistance for the first time in a week and near its crucial price range.

Amid the recent performance, Rekt Capital noted that the cryptocurrency’s price action is “not that far away” from turning the downside deviation into a downside wick in the monthly timeframe.

ETH dropped below the $2,196-$3,900 range on March 9, plunging to $1,750 in the following days, its lowest level since November 2023. After retesting a historical demand arena, “Ethereum is now only +5% away from positioning itself for a reclaim of its Macro Range,” the analyst explained.

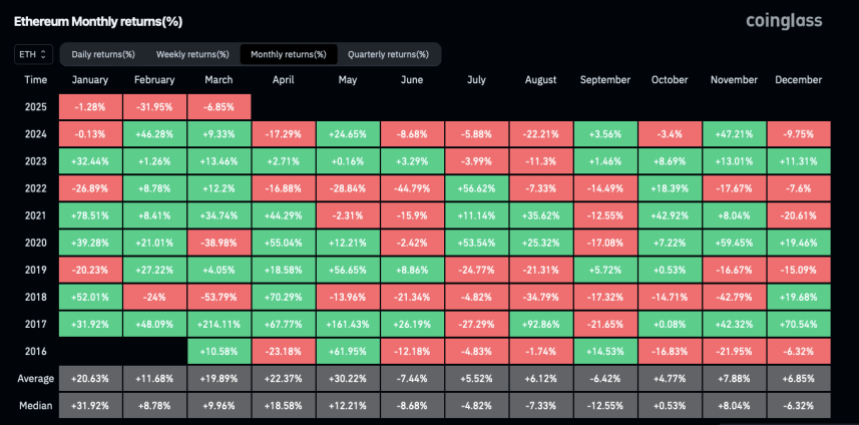

Reclaiming this level before March closes would see “this entire sub-$2,200 downside end up as a downside wick.” Moreover, CoinGlass data shows Ethereum’s current price action is 6.8% away from turning March green.

The cryptocurrency opened the month at $2,237, and a close above this level could end its three-month bleeding streak. However, if it fails to close March with positive returns, ETH could experience four months of red for the first time since 2018.

The “King of Altcoins” has seen its worst Q1 in seven years, currently down 37.46% from its 2025 opening. Nonetheless, Ethereum has historically seen a bullish Q2, only closing the second quarter in red on two occasions.

A recovery of ETH’s Macro Range lows could see the cryptocurrency climb back to the range’s highs in the coming three months.

Can ETH Recover 2,200?

Analyst Ali Martinez pointed out the key levels to watch, suggesting that Ethereum’s most crucial support zone is between $1,886 and $1.944, where more than 3 million investors bought around 6.12 million ETH.

Meanwhile, its most significant resistance is between $2,250 and $2,610, where 12.28 million addresses accumulated 65 million ETH.

He added that “a decisive break above this area would negate the bearish outlook.” Similarly, Crypto Jelle highlighted that ETH is attempting to reclaim the key $2,200 resistance, which could fuel a “monster deviation” if recovered.

Analyst Ted Pillows suggested that Ethereum’s manipulation phase “is almost over.” Previously, the analyst asserted that ETH’s chart displayed a Power of Three (Po3) pattern in the making, signaling that the cryptocurrency is in the manipulation phase.

According to the analyst, “A breakout above $2,200 and an expansion phase will start.” He noted that the breakout could be possible as ETH retested its multi-year trendline support, which has only been retested three times since 2021.

The last two times, “they marked the cycle bottom,” which could suggest that Ethereum’s bleeding is poised for a recovery if it repeats its historical performance.

As of this writing, Ethereum trades at $2,090, a 4.3% surge in the daily timeframe.