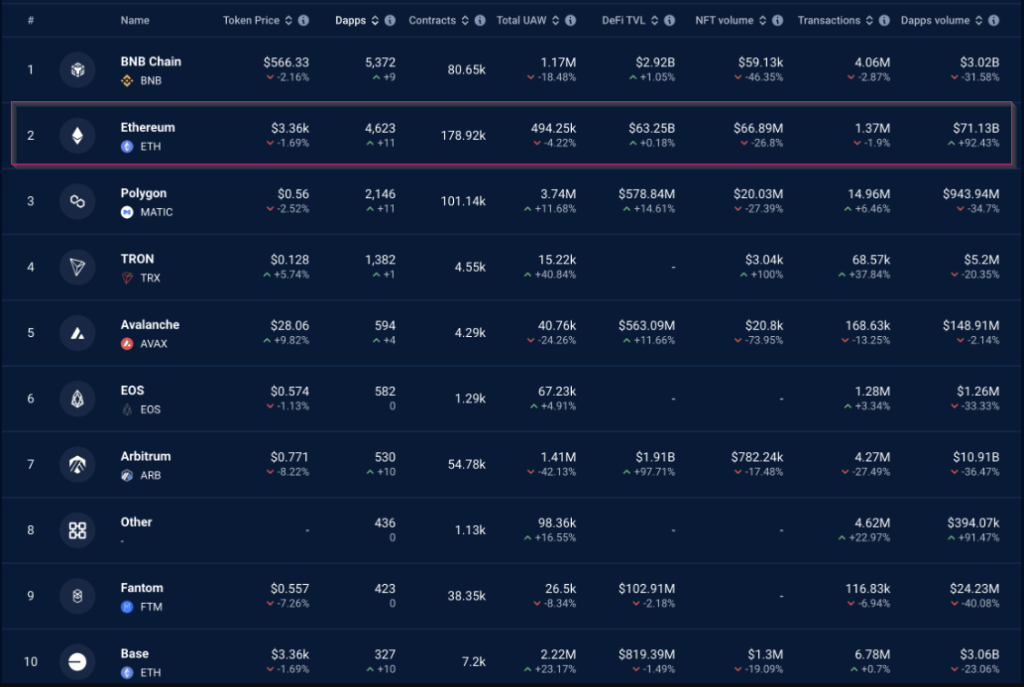

With a startling 92% increase in dApp (decentralised application) volume over the previous week, Ethereum (ETH) has become a lighthouse among blockchains. But this news is complicated and shows a terrain of possibilities as well as possible obstacles for the top blockchain.

Affordable Gas Fuels The Flame

Analysts credit the Dencun upgrade in March for the dApp traffic spike, which drastically lowered gas fees—the cost connected with Ethereum network transaction processing.

Historically, lower costs have attracted consumers; this seems to be the case also in this latest development. The increase in activity points to a revived Ethereum, maybe drawing fresh ideas and supporting a more active dApps ecosystem.

NFT Mania Drives The Figures

Although the general dApp volume (seen below) presents a nice picture, a closer view exposes a more complex tale. NFT (Non-Fungible Token) trading and staking activity seems to be driving the spike mainly.

Significant increases in applications including Blur and Uniswap’s NFT aggregator demonstrate Ethereum’s explosive NFT sector. This trend raises concerns about the Ethereum dApp landscape’s diversification outside NFTs even while it points to a vibrant niche within.

A Look At User Engagement

Looking at user engagement numbers, one finds a peculiar wrinkle. The Ethereum network’s unique active wallets (UAW) have actually dropped even with the astounding volume increase.

This discrepancy implies that a smaller, more active user base could be driving the present activity. Although high volume is undoubtedly a good sign, larger user involvement is absolutely vital to guarantee the dApp ecosystem’s longevity.

A Glimmer Of Hope?

According to Glassnode, declining exchange holdings is one encouraging long-term sign for Ethereum. This implies ETH holders are shifting their assets off exchanges, so possibly lowering sell pressure and helping to stabilise prices.

Should this trend continue, ETH might aim for $4,000 this quarter or possibly surpassing its all-time peak. Still, this price estimate is only hypothetical and relies on several market dynamics.

Ethereum At A Crossroads

Ethereum finds it at a crossroads. Particularly in the NFT arena, the Dencun update clearly has energised dApp activity. But the unequal dApp success and falling UAW call questions about the long-term sustainability of this expansion. According to Santiment, network expansion—which is gauged by the count of new addresses joining the system—is also slowing down, therefore possibly impeding more general acceptance.

ETH’s short-term price future is yet unknown. Although the long-term signals, such as declining exchange values, point to a price increase, the slowing down of the network’s development might cause a temporary price drop.

Looking Forward

Ethereum will depend much on the next months. Attracting a larger user base and supporting a more varied dApps ecosystem outside of NFTs will help the platform profit on the revived interest in dApps. Maintaining development also depends critically on addressing scalability problems and guarantees user-friendly interfaces.

Should Ethereum overcome these obstacles, it will help to confirm its leadership as the main platform for distributed applications. If it doesn’t change, rival blockchains just waiting in the wings could profit from its flaws.

Featured image from Pexels, chart from TradingView