Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Stimulus money pouring into assets like stocks, gold, and cryptocurrencies are having a dramatic impact on valuations. But as well as Bitcoin and precious metals are performing, it is Ethereum that has brought the largest return on investment since stimulus checks were issued.

Exactly how much would $1,200 invested in Ethereum have earned savvy investors, and how does this stack up to the rest of the market?

Ethereum Beats Bitcoin, Gold, and the S&P 500 In Stimulus Check Investment Returns

Since 2020 first began, the Federal Reserve’s balance sheet has grown by over $3 trillion and counting. A significant portion of that money has been distributed to individual US taxpayers in the amount of $1,200 per adult over 18.

The money is meant to stimulate economic activity, consumer spending, and provide relief to those hit hard by the pandemic.

Jobless rates have skyrocketed this year nearly as fast as the money supply. Stimulus money is being used for a variety of things, from everyday necessities like paying bills and groceries, to home improvement projects, to savings and investments.

Related Reading | Are Altcoins Silver To Bitcoin As Gold? Unusual Correlation Discovered

The money flowing into the market has helped keep the stock market afloat. Meanwhile, hard assets with limited supplies are benefiting extraordinarily from inflation.

Gold recently set a new all-time high, and Bitcoin recently broke through $10,000. Silver, and its crypto counterpart altcoins, are also performing extremely well in this environment.

Out of all of the major assets seeing a boost from stimulus checks, it is Ethereum that has benefited the most.

How Much Did a $1,200 Investment Earn Since April? Top Financial And Crypto Asset ROI Compared

According to CoinMetrics data shared by crypto investors and NuggetsNewsAU CEO and founder Alex Saunders, the Fed’s stimulus is effectively monetizing crypto assets.

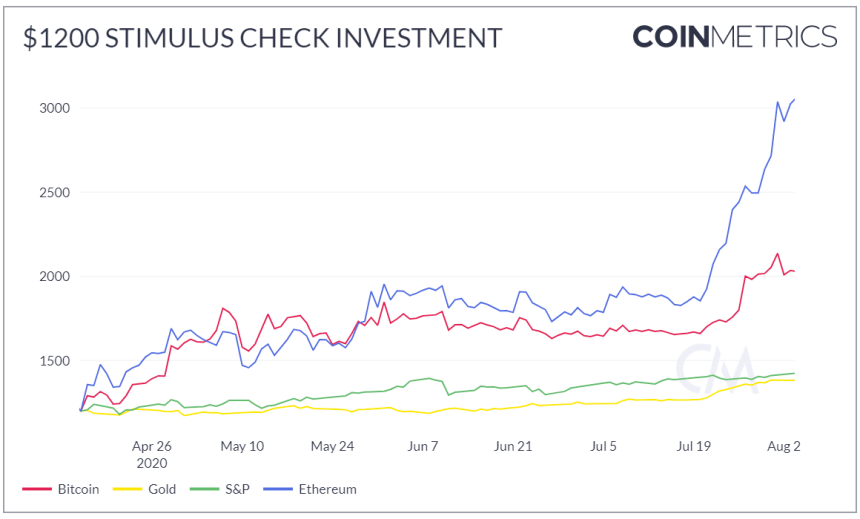

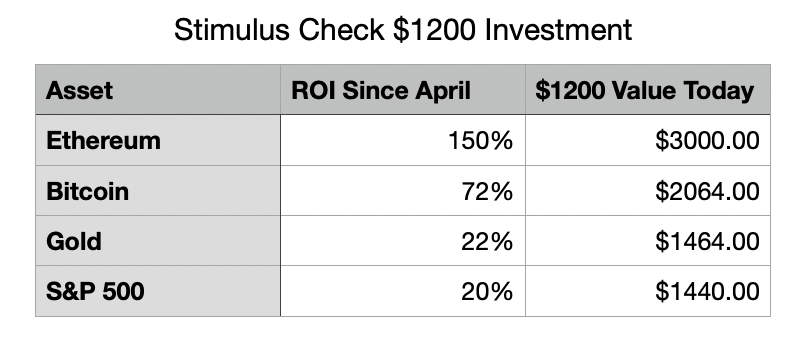

In a side-by-side comparison, the impact on the stock market and gold can be seen. But significantly above those two assets in terms of ROI, lies Bitcoin and Ethereum.

After initial checks went out in early April, those who put their money into Ethereum now have $3,000 to show for it. The same investment in Bitcoin is worth just over $2,000. An investment in the S&P 500 or gold, despite strong rallies, would have barely resulted in roughly around $250 profit.

Related Reading | Here’s Why a Bouncing U.S. Dollar Is Bad News For Bitcoin

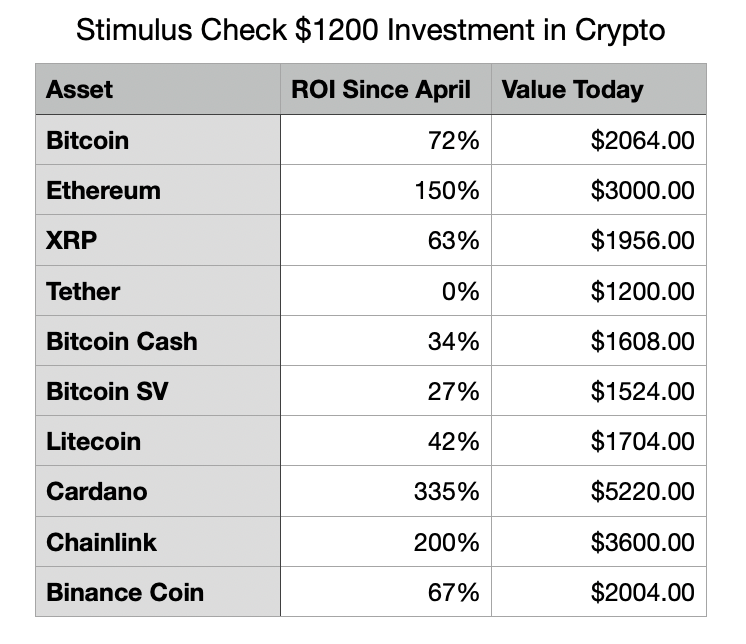

Ethereum’s performance still pales in comparison next to some other crypto assets. For example, Chainlink which recently set a new all-time high has turned that $1,200 check into $3,600, tripling the investment.

The best performer out of the entire crypto market top ten, however, wasn’t even Chainlink – it was Cardano. Cardano’s powerful rally has resulted in a 335% ROI. This would have turned any $1,200 investment made on April 11 when checks started to go out, into over $5,000.

Is this a result of inflation, hard assets performing well, or are crypto assets simply breaking out into a new bull run? Whatever the case may be, the investment world will be quick to catch on when they see that stocks, gold, and the rest of the market can’t keep pace with the crypto space.