Dogecoin rallied on Thursday after Elon Musk committed that he would send the meme cryptocurrency to the moon — literally.

The billionaire entrepreneur tweeted that SpaceX, a space technology company he owns, would take a “literal Dogecoin to the literal moon.” The cryptic message ignored to dwell into the hows and whys, but it was strong enough to send a bullish signal across the Dogecoin market. As a result, the DOGE/USD price exploded.

As of 0800 UTC, the pair was trading at $0.071, up 33.94 percent from its intraday opening rate. It looked obvious that traders played a prank of themselves by blowing Mr. Musk’s tweet out of proportion, given it arrived on April Fools’ day.

Dogecoin is notorious for undergoing massive upside rallies over good-for-nothing factors. Last year, in July, a viral TikTok video urged daytraders to pump DOGE/USD bids to $1. The shenanigans were able to take the pair as far as 0.005 after pumping it by up to 155 percent in just three days of trading. It crashed by more than 50 percent after the social media-led buying frenzy.

A similar viral campaign surfaced in late January 2021. Dogecoin bulls pushed the prices by a whopping 1,299 percent in just two days of trading in a copycat rally, inspired by Redditors-led GameStop stock-buying mania.

The intraday upside rally originated from the same prankster bulls — on the day that celebrates pranks.

SpaceX is going to put a literal Dogecoin on the literal moon

— Elon Musk (@elonmusk) April 1, 2021

Dogecoin Pump or Dump Ahead?

The April Fool’s Dogecoin rally carries massive risks for traders who want to enter the cryptocurrency market at its sessional highs. A clear lack of concrete upside catalyst, coupled with a potential liquidity crisis, hints at a heavy profit-taking scenario ahead. In short, only traders with braver risk appetites could tread Dogecoin’s waters.

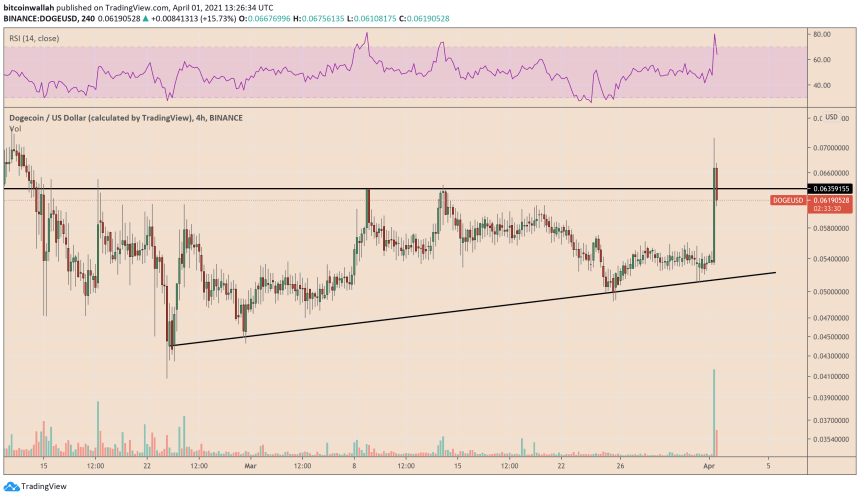

As of this press time, DOGE/USD was crashing down from its intraday high. It slipped by up to 15.52 percent ahead of the US session, breaking below a flipped support level of $0.06 to turn it back into support. The next downside target appeared at the mid-March resistance level near $0.05.

Photo by Maciej Ruminkiewicz on Unsplash