The Securities Exchange Commission (SEC) continues to pursue its regulatory policy toward the crypto industry. In the process, the regulator contributed to the so-called stablecoin war, which intensified.

Paxos’ decision to stop minting new BUSD tokens caused capital to flee to rival stablecoins like Tether’s USDT, which raised $1 billion just hours after the SEC crackdown on the crypto-regulated blockchain platform.

Stablecoin War See New Casualties

According to a Bloomberg report, trading firms are moving out of stablecoins USD Coin (USDCD), issued by Circle, and BUSD, issued by Paxos, and into Tether’s USDT, which is more attractive given that the token is based outside the U.S. jurisdiction.

Tether Holdings Ltd’s USDT- the most widely adopted stablecoin launched in 2014, has increased its market shares by over $1 billion in the past 24 hours as traders move their holdings to this asset.

With the allegation that BUSD is an unregistered security with the SEC, the market cap of the stablecoin leader rose from $68.5 billion to a new high of $69.5 billion, according to CoinMarketCap data.

The Hong Kong-based stablecoin giant represents an immediate solution for investors. SEC Chairman Gary Gensler is implementing new requirements for crypto exchanges to gain further regulatory approval.

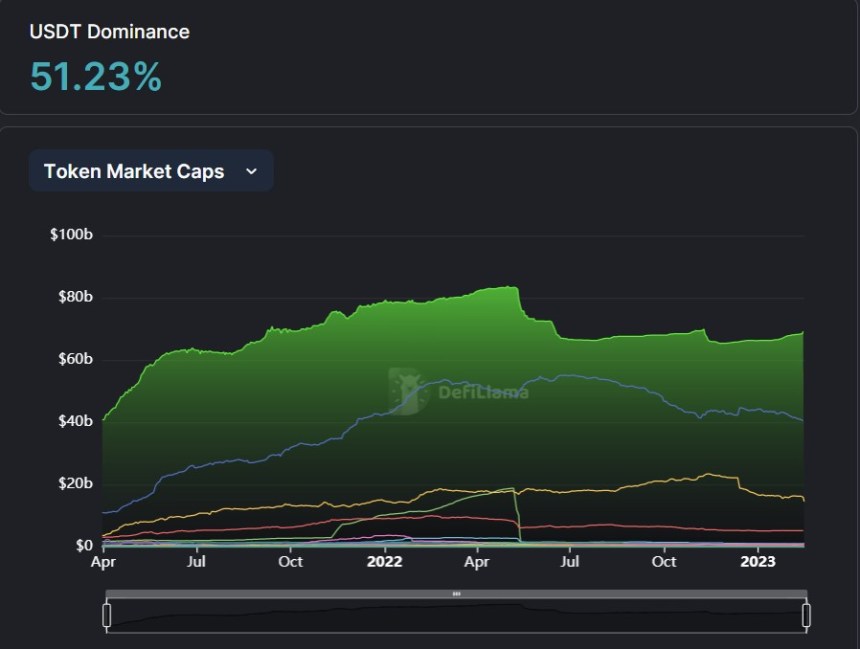

Data compiled by DeFi Llama proves that with the recent capital raised in the last 24 hours, Tether’s USDT dominance has grown again to 51.23% in the total market cap of the crypto industry, which is currently sitting at $136.9 billion.

The New Normal For Stablecoins?

According to a recent post on Twitter from research firm Delphi Digital, despite the crypto bear market that characterized the industry in 2022, the total stablecoin market cap is only down -18%, while the total crypto market cap is down -55%.

Following the news that Paxos has stopped minting BUSD, decentralized stablecoin assets such as FLX and LQTY are up 34% and 24%, respectively, according to the report. FLX and LQTY are governance tokens issued by Reflexer Finance (RAI) and Liquity Protocol (LUSD).

According to Delphi Digital, Binance has admitted that the BUSD peg was undercollateralized by more than $1 billion on three occasions in 2020 and 2021 but has since fixed it. 68% of BUSD supply is on Ethereum (ETH), while 32% has been bridged to the BNB chain after the news.

Liquidity for BUSD has been steadily inching down since the start of 2023, Delphi Digital claims. At the same time, traders sell their BUSD tokens for other stablecoins on the Ethereum-based Curve protocol’s pool to leverage its fluctuations. According to Delphi Digital, the pool has 81% of reserves in BUSD, following a spike to hit 86% following the recent SEC news.

Bitcoin continued its bullish reaction after inflation data was released on February 14th. Bitcoin is trading at $24,000, representing a gain of 8.4% in just 24 hours, and back in the green in the 7-day time frame, up 3.5%.

Featured image from Unsplash, chart from Trading View.