For the last two years in the crypto market, it has paid off to be in Bitcoin versus altcoins. However, a new BTC dominance chart shows why the tides are about to turn in favor of altcoins.

Bitcoin Crypto Market Dominance Remains Above 50%

At this very moment, Bitcoin, the top cryptocurrency by market cap, represents more than 50% of the entire crypto market. On one hand, this makes sense given its regulatory acceptance, first-mover advantage, and significant brand power. On the other hand, there are tens of thousands of altcoins out there and yet BTC is still dominant.

But even Bitcoin dominance goes through cyclical boom and bust phases where it loses its dominance to the rest of the crypto market. This is typically called “altcoin season.” The last one to occur was back in late 2020 into 2021, and it lasted only several months. Before that, the rally that coined the term altcoin season took place all of 2017.

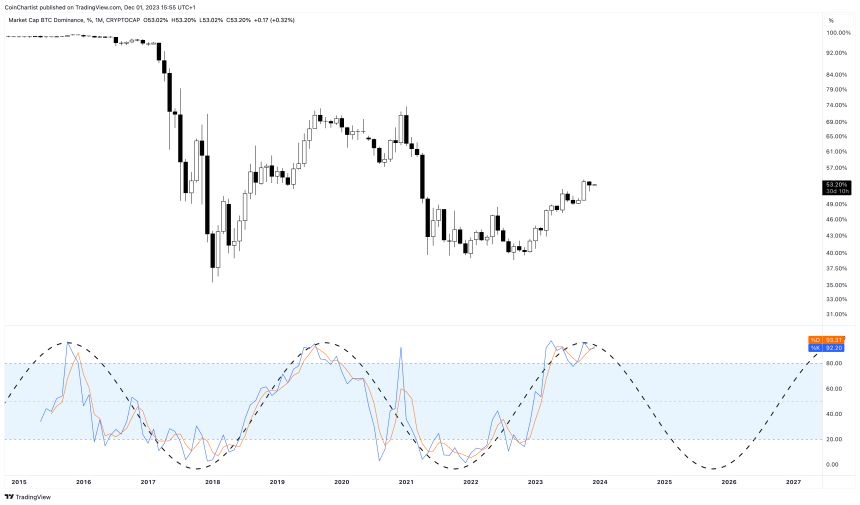

With three to four years in between the 2017 rally, the calendar turning toward 2024 puts us yet another year closer to the next altcoin season. This is evident by price action and technical oscillators following sine waves.

Sine waves could point to the next alt season | BTC.D on TradingView.com

Riding The Wave To The Next Altcoin Season

According to Investopedia, a sine wave is an S-shaped geometric waveform that oscillates periodically above and below zero. Sine waves can be used in technical analysis to help identify cyclical patterns in technical indicators and oscillators.

In the chart above, the sine wave suggests that indicators are ready to begin rolling over, with the wave overlaid matching the 1M Stochastic almost perfectly. Aside from some chop, the sine waves have followed the ebb and flow back and forth between Bitcoin and altcoin dominance for going on a decade.

If the tool accurately demonstrates the path ahead for Bitcoin dominance, the next altcoin season could be on the way soon enough. Bitcoin is approaching $40,000 and is becoming increasingly expensive for retail investors, who aren’t even paying attention yet to the crypto market.

When they do realize how expensive Bitcoin is again, right under their noses, retail investors will search for the “next Bitcoin” frantically, sparking the next altcoin season. The last time these phases occurred, Bitcoin was passing $10,000 in 2017, and $20,000 in 2020. Now in 2023, will $40,000 be the trigger for alts to finally outperform?

It's time for the ebb and flow to favor altcoins again pic.twitter.com/y5cONFhJyo

— Tony "The Bull" (@tonythebullBTC) December 1, 2023