The global economy is currently under tremendous pressure, thanks to the fast-spreading COVID-19 pandemic, the OPEC fueled oil price war, global stock markets shock and more. The widespread issues have driven global stock markets, futures, and crude oil prices to the ground and spread into the cryptocurrency market as well.

Considered the best alternative and one of the safe havens during tumultuous economic times, the cryptocurrency market wasn’t immune to the onslaught either. After coming under heavy selling pressure, the price of BTC, which was at a new high of recent times at $10,502 over a month ago on Feb 13, 2020, plunged on Mar 13, wiping off 44% of its value in just a few hours. On that fateful day, the benchmark crypto fell to a low of $3,791.9.

While the price rebounded to around $5,000-mark, Bitcoin is still struggling to recover the lost ground. It is not just the Bitcoin that bore the burnt, the world’s top 10 cryptocurrencies witnessed a fall in their market cap by over 30% with USDT- only stablecoin among the top 10 being an exception.

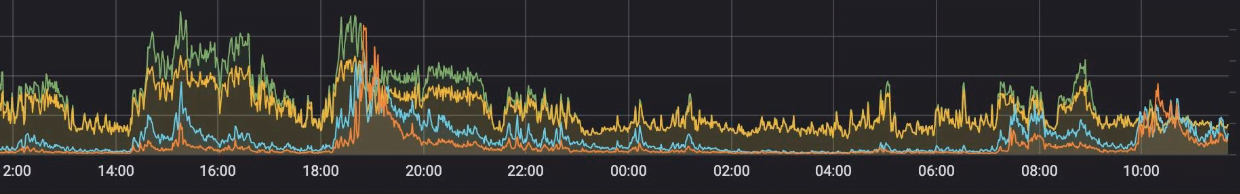

The sudden fall in cryptocurrency prices sent out shockwaves through the entire industry, as exchanges and trading platforms had to deal with a sudden influx of users trying to sell off and hedge. As orders started flooding in, the market depth and capacity of the trading systems were put to the test. The performance of these exchanges under such situations also offered an insight into their efficiency and reliability.

Some Exchanges Performed Better than the Rest

Many exchanges over the weekend witnessed their performance impacted due to sudden market movements. These problems ranged from delayed spot depth push to overloaded futures trading system. On one leading exchange, the problem was accompanied by the failure of the futures ADL system. There were also claims that the exchange raised ETH withdrawal fees to stem the outflow of funds.

Server errors, downtime in futures and OTC trading were also prevalent across almost all exchange during that time. The flaws in the market depth on a few exchanges were exposed to be way less than the claims, and some robust exchanges like OKEx experienced app lag. Even though all these issues were a result of an unexpected turn of events, the trading community was inconvenienced. It is to be seen whether the traders will make any changes in the trading patterns or platform preferences after having experienced the market shock.

Few Good Things During Bad Times

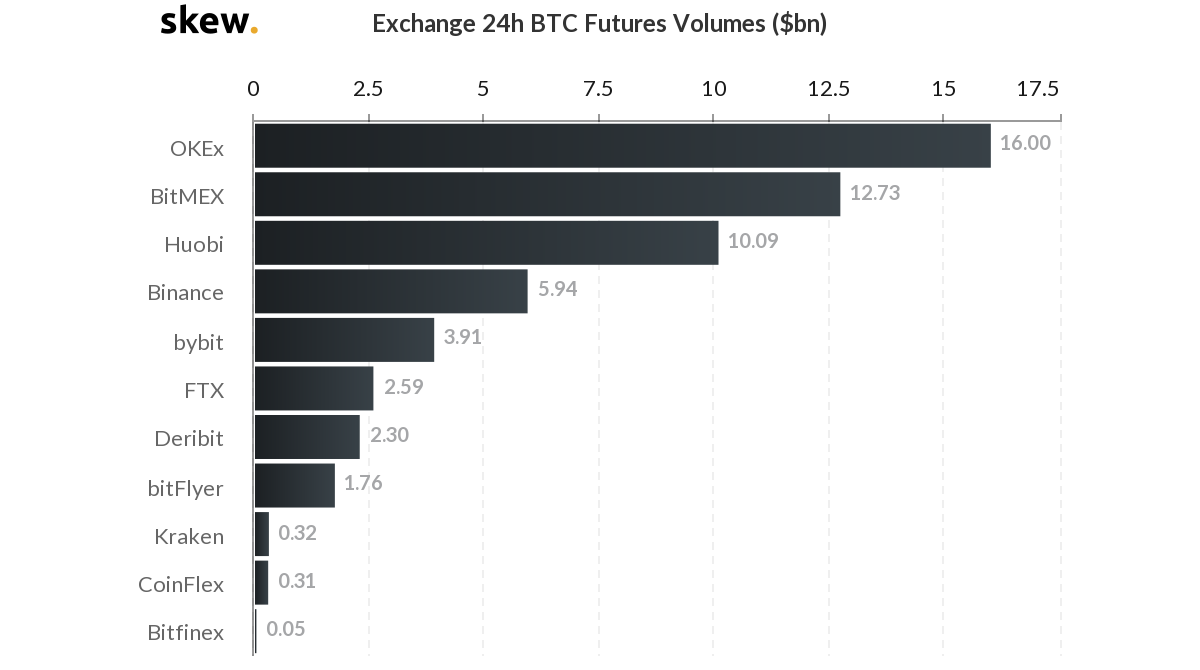

The price crash is just a temporary setback, as most people in the crypto already know or have experienced in the past. The cryptocurrencies, especially BTC, are expected to regain the lost ground and even soar above this year’s maximum price in the coming months. In the past couple of days, the BTC futures trading volumes have gained ground with $16 billion worth of trading on OKEx alone. According to Skew data, OKEx has gained the top spot in terms of BTC Futures volume followed by BitMEX, Huobi Binance, bybit and others.

According to Jay Hao CEO of OKEx, the platform and its trading services were able to process as many as 300k orders per second during the volatile period while maintaining a record of 0 clawbacks during the market crash.

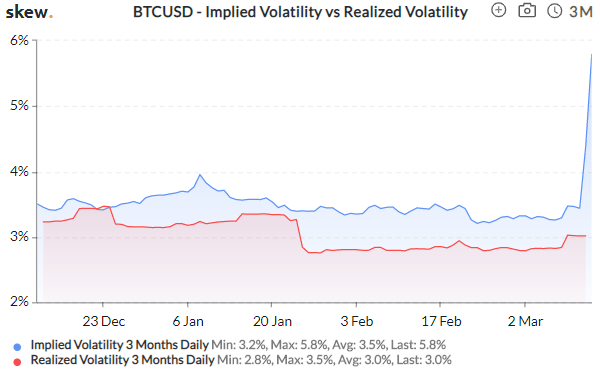

Also, just because the cryptocurrency price is falling doesn’t mean every investor is making losses. Those who opt for derivatives can still profit during the downturn by formulating different trading strategies. Multiplex derivatives trading tools can help with hedging and shorting to reduce losses and even make profits in the process. OKEx users have access to a full suite of crypto trading products, including spot with margin trading, options trading, futures, and perpetual swaps, allowing them to pick the right one to match prevailing market conditions. The best example in today’s highly volatile situation is the opportunity BTCUSD options trading offers for users to reap profits.

Irrespective of the general sentiment in today’s markets, there is still a lot of hope left for cryptocurrencies. With governments actively introducing fiscal policies to contain the economic situation, the crypto market will benefit from it. Meanwhile, various industries and governments are looking for ways to incorporate blockchain technology into the existing systems, with some economists even calling for the creation of fiat-backed central bank-issued cryptocurrencies to promote financial inclusion and wellness. Even Lennix Lai from OKEx has, on multiple occasions, expressed the idea of using some stablecoin and blockchain to eliminate unbankedness, which received a positive response from various government representatives.

The crypto market crash is neither the first nor the last time in the over-a-decade-old legacy of Bitcoin and other cryptocurrencies. But each time, the market has bounced back stronger than ever before. Until then, all one can do is wait and trade responsibly with the right strategies.