The world’s largest cryptocurrency, Bitcoin, surged past the $75K mark on Wednesday following the U.S. presidential election, with initial results showing Donald Trump holding a lead over Kamala Harris. Trump’s potential victory has not only driven this historic Bitcoin milestone but has also ignited excitement across three key sectors: Real-World Asset (RWA) tokens, AI agents, and Decentralized Finance (DeFi). These sectors now stand poised to reshape the investment landscape.

Real-World Asset (RWA) Tokens: Bridging Physical and Digital Economies

Real-World Assets (RWA), which are expected to hit $10 trillion by 2030, are gaining momentum as big players focus on this space. By tokenizing high-value assets like real estate, art, or even financial securities, RWA is democratizing asset ownership, which was previously limited to a select group of high-net-worth individuals. RWA is opening new windows for investors to invest in digital tokens representing physical assets, bringing tangible assets to the blockchain and offering investors new avenues for secure, traceable, and liquid investments.

With Trump’s pro-business stance, regulatory frameworks may favor RWA tokens, which could speed up adoption in major markets. In fact, recent reports also hinted that Trump’s family may be debuting a real estate tokenization venture. It’s reported that Donald Trump and his son Donald Trump Jr. may be developing a project, possibly named ‘World Liberty,’ which would invest in tokenized Real-World Assets (RWA).

Having said that, a few notable projects in the RWA space include ONDO, Pendle Protocol, and Landshare. As regulatory clarity emerges, RWAs will likely attract traditional investors, facilitating cross-over investments between physical and digital realms. Projects like Landshare have gained significant traction with its unique features. The project has already sold four properties on the BNB Smart Chain, has a live RWA token, and saw a 30% price increase just last week. Unlike many other projects that remain overvalued with no property sales and lots of speculative hype, Landshares offers genuine value through diversification, passive income, and a regulated, SAFU, and volatility-free model that makes property investment more affordable, efficient, liquid, and accessible.

Decentralized Finance (DeFi): Reinventing Financial Access

Decentralized Finance (DeFi) continues to disrupt traditional finance, with reports highlighting that the DeFi user base is projected to exceed 53.56 million by 2025. With Trump’s potential win, the community anticipates crypto-friendly regulations, and a recent report from Statista underscores that the United States leads the DeFi market, bolstered by innovative blockchain projects and a strong regulatory framework.

Beyond Bitcoin’s popularity, DeFi has attracted a new wave of crypto enthusiasts by creating fresh opportunities in the crypto ecosystem. DeFi projects offer users peer-to-peer lending, yield farming, and decentralized exchanges—all without intermediaries. With a more favorable regulatory environment on the horizon, DeFi projects could experience accelerated growth, delivering advanced financial products to underserved markets.

Key DeFi trends include decentralized exchanges (DEXs) like Uniswap, which allow users to trade assets directly from their wallets, cutting fees and enhancing security. Lending protocols such as Aave and Compound leverage blockchain technology to facilitate loans, providing users with unprecedented access to liquidity. Moreover, the DeFi sector has captured the attention of major players, with projects like BASE Protocol backed by Coinbase making waves in the space. This support not only strengthens DeFi’s momentum but also accelerates mainstream adoption by bridging traditional and decentralized financial systems.

Launchpad for AI agent

AI agents on blockchains are gaining significant attention as they bridge the gap between traditional AI tasks and decentralized finance. In the Web2 world, AI agents are typically used to perform complex tasks but are confined by a financial system that does not allow them to directly engage in value exchanges. In contrast, blockchain and crypto technology provide a seamless environment where AI agents can not only complete tasks but also participate in the decentralized economy, receiving and transmitting value through tokens.

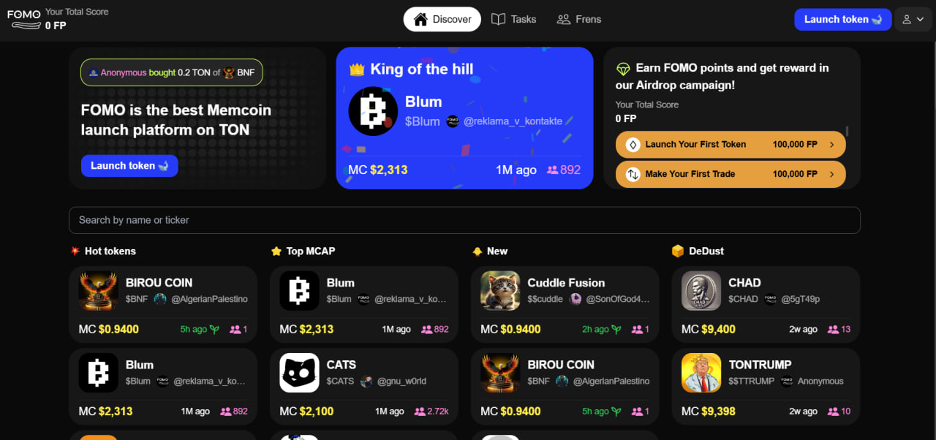

Unlike traditional Web2 AI, which functions as a resource in a centralized system, Web3 AI agents are fully autonomous entities. They can generate and exchange value directly on the blockchain, making them an integral part of the crypto ecosystem. Having said that, FOMO.fund which is a leading memecoin launchpad has recently announced the world’s first AI agent launchpad on Solana, marking a groundbreaking shift in the Web3 and AI space. FOMO has combined the trend of memecoins with the innovative potential of AI agents. But what sets this apart is the ability for users to create their own tokenized AI agents—digital entities that can learn, interact, perform tasks, and even promote tokens on platforms like Twitter, TikTok, and YouTube.

These tokenized AI agents will have unique capabilities, allowing them to engage with communities, create content, and carry out various activities autonomously. AI agents powered by blockchain, introduces a new level of autonomy and creativity within the Web3 ecosystem, expanding what’s possible with decentralized applications.

Key Takeaways

With Bitcoin surpassing the $75K milestone and Donald Trump’s victory in the U.S. presidential election, the community is buzzing with excitement over the potential for crypto-friendly regulations. This could accelerate the adoption of blockchain technologies across multiple sectors. At the same time, the Real World Assets (RWA) market, now valued at $9.39 billion with a 9.3% increase in the last 24 hours, and the DeFi crypto market, which has surged to a market cap of $65.14 billion with a remarkable 131.8% growth in just one day, highlight the significant shift in the crypto market.

Furthermore, the rise of launchpads for AI agents is reshaping the crypto landscape. With platforms like FOMO.fund leading the way, tokenized AI agents are set to transform the Web3 ecosystem. As these sectors continue to evolve, they will reshape the digital economy, creating unprecedented opportunities for investors, developers, and users alike.