Last week, crypto exchange Coinbase made its S1 filing to the U.S. Securities and Exchange Commission (SEC). The crypto community is set to gain massively as a result of the firm going public, especially in redressing the poor reputation of cryptocurrency among everyday people.

But the biggest winner is Coinbase CEO and Co-Founder Brian Armstrong, who stands to gain billions of dollars from the listing.

Armstrong Will Rake in Billions Off Coinbase Going Public

Armstrong penned a letter to the SEC accompanying the S1 filing. It outlined how the industry has evolved from speculation and trading into something more important.

“Trading and speculation were the first major use cases to take off in cryptocurrency, just like people rushed to buy domain names in the early days of the internet. But we’re now seeing cryptocurrency evolve into something much more important.”

The developing use case for cryptocurrency is reflected in the growing fortunes of both Coinbase and Armstrong. In late 2018, at the height of crypto winter, Forbes put an $8bn valuation on the firm and estimated Armstrong’s stake to be worth $1.3bn.

Current valuations put the company at between $77bn and $100bn. Taking into account Armstrong’s 21% holding of Coinbase stock, at the upper end of the firm’s valuation, that would give him a net worth of $20bn.

That’s still some distance from Jeff Bezos’s $181bn fortune. But it’s still enough for Armstrong to make the Forbes billionaire rich list at number 93, between Chinese ophthalmology entrepreneur Chen Bang, and Michael Hartono, who made his money in banking and tobacco.

All the same, Coinbase’s S1 filing brought to light the firm’s exposure to market instability, which may limit investor appeal.

Risk Exposure to Crypto Volatility

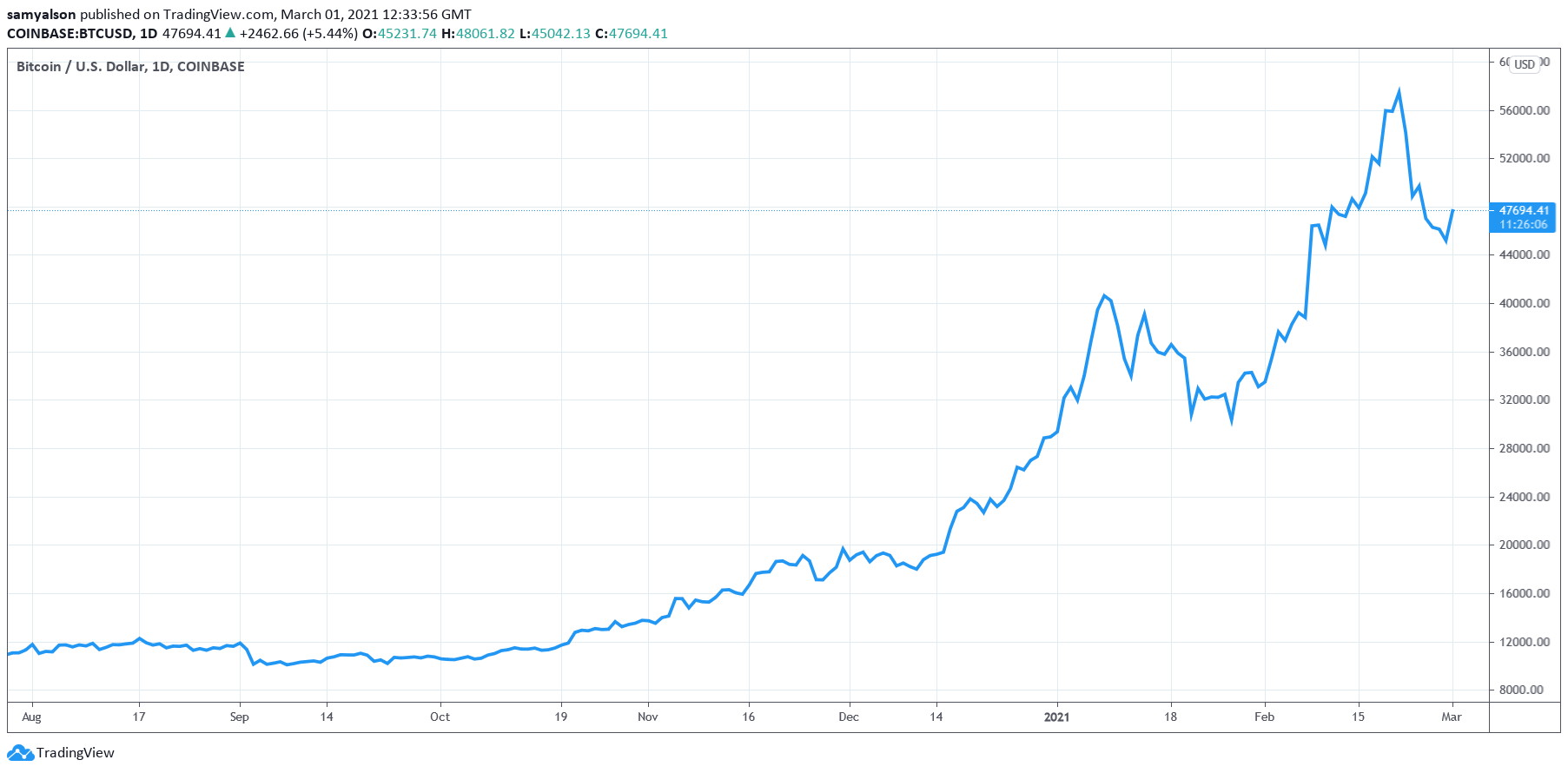

Bitcoin peaked at $58k last weekend, which was followed by a market-wide dip leading to the loss of $389bn from the total market cap. Although the bull trend remains intact, it was a stark reminder of the volatility within cryptocurrency.

That is a point felt all too keenly by Coinbase, who mentioned the issue in their recent S1 filing. The firm listed several factors that have the potential to negatively affect Bitcoin and Ethereum, their two biggest markets driving 56% of trading volume on the exchange.

Among the factors listed were disruptions, hacks, splits, developments in quantum computing, and regulation. But Armstrong responded by saying he’s optimistic about the long-term future of cryptocurrency and is unconcerned about events in the short-term cycle.

“You can expect volatility in our financials, given the price cycles of the cryptocurrency industry. This doesn’t faze us, because we’ve always taken a long-term perspective on crypto adoption.”

Bitcoin is staging a recovery today, having bottomed at $42.6k. The rest of the market followed suit, with BNB leading the top-10 at +18% gains in the last 24-hours.

Source: BTCUSD on TradingView.com

An honorable mention goes to ADA, which defied last week’s downturn, being one of the few gainers during the sell-off. It hit an all-time high of $1.55 on Saturday.