Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Still in the red, Bitcoin and the crypto market have held the line in the past day. A bounce back seems feasibly, but not guaranteed. At the time of writing, BTC trades at $42,913 with sideway movement in the 1-hour chart and a 20% correction in the weekly and monthly chart.

The crypto market is uncertain, but there are signals that traders and investors have recognize over the years that suggest buying opportunities. Besides Peter Schiff and his pro-gold/anti Bitcoin tweets, CNBC has ironically provided a relatively source for indirect alpha, their “Chartmaster” Carter Worth.

In a segment for CNBC’s Fast Money, Worth claimed that BTC’s price could dropped as low as $29,000. This would place BTC at a “lower end of support”, said the analyst, after an initial 35% crash from its previous high around the $60,000 range and an subsequent 55.30% dropped.

The analyst said that there have been 11 +35% drops in BTC’s price since 2011 with an average declined around 55% with exceptions when the cryptocurrency has fallen by 80%. The analyst said:

I think we are in support, its fighting but my hunch is that it goes lower.

Could The “Chartmaster” Be Right About Bitcoin?

The “Chartmaster” predictions are usually use as counter trade by some member in the crypto community and a “bottom signal”.

Despite the above, the cryptocurrency is in critical support and BTC inflows into exchange platforms have been increasing at an alarming rate over the past few days.

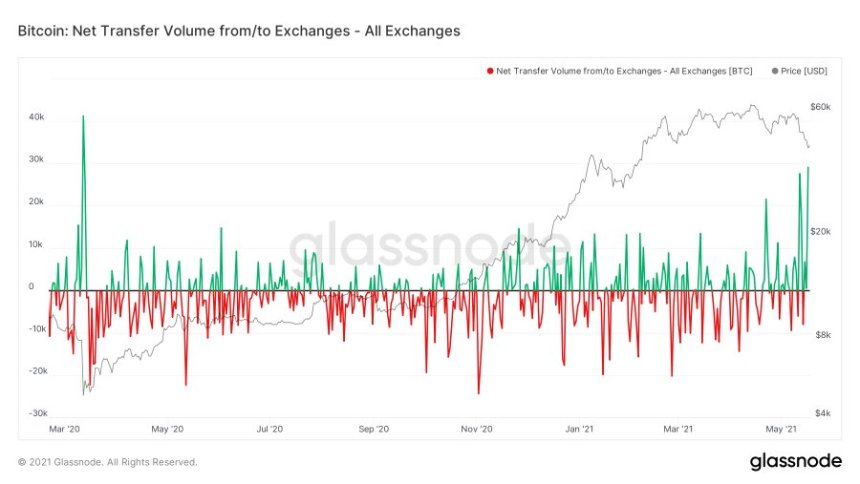

Analyst William Clemente said that yesterday May 17th, recorded the highest net inflow of BTC since March 2020 when the market crashed on the “Black Thursday”.

At the same time, the general sentiment in the market flip bullish as BTC manage to hold the line for around a day. Thus, futures traders showed “over confidence” that the price could continue to climb and turn resistance at $45,000 into support.

The funding rate across all exchange platforms changed to positive with a two day increase from May 16 to 17th. Clemente said:

Seems like BTC traders this evening are a little too confident going long. Would love to see one more flush and potentially get negative funding rates. Not counting on it though.

Additional data provided by Clemente suggest that the amount of BTC liquid supply has increased to levels last registered in 2019. As seen in the chart below, there seems to be a correlation between a downside trend in BTC’s price and the liquid supply. When it’s low, the price trends upwards and vice-versa.