Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

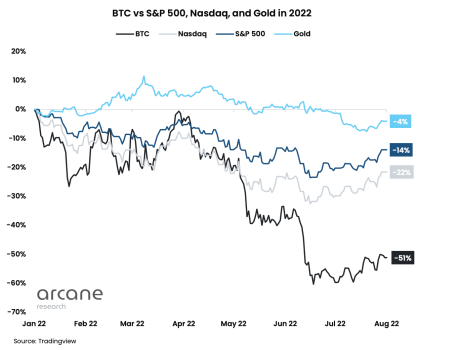

It can no longer be denied that the price of bitcoin is being heavily influenced by the macro environment. The stock market correlation had hit a new all-time high earlier in the year, and the crypto market is yet to decouple from it. Given this, bitcoin investors would do well to react accordingly and pay attention to the stock market for a possible forecast of where the bitcoin price may be headed, and here are some reasons why.

Institutional Investors Are Here

The call for institutional adoption had been loud throughout the last few years, and these big players had actually begun to move into the market. While this had come with a lot of positives for bitcoin, such as increased demand, it had also inadvertently tied bitcoin’s price to the stock market, which these big players are very visible.

The result of this had been a stronger correlation of bitcoin to the trends happening in the stock market. This means that whatever affected the institutional investors in the stock market due to the financial situations had also flowed over into bitcoin. Hence, if the stock market was going down, bitcoin is now more likely to follow it. And what’s more is that bitcoin actually does this with more volatility, causing a larger swing in price compared to the stocks.

Correlation with stock market remains high | Source: Arcane Research

So if institutional investors are forced to sell their stocks, as was recently seen, it also flows into bitcoin. Hence, when there is forced selling in the stock market, there is also forced selling in crypto. So a decline in the stock market means a decline in bitcoin price.

Rising Interest Rates Affect Bitcoin

2022 has put the financial markets through a lot of hurt, and it has gotten worse with the level of inflation being recorded. The Fed has had to come up with new ways to combat this, which has led to a dramatic rise in interest rates.

BTC trading at $23,516 | Source: BTCUSD on TradingView.com

These rising interest rates have been one of the major reasons behind bitcoin’s decline. Recall that the decline in the crypto market had actually started when some big players in the space had failed, but it was further pushed forward when the Fed announced the March interest rate hike that moved the fund’s rate from 0% to 2.25%-2.5%.

This is why paying attention to the macro environment is important to try to predict the future of bitcoin. Given its present correlation with the stock market and how the price had reacted to the hike in interest rates, staying abreast of the movements in the stock market as well as how the Fed is handling interest rates puts an investor in a position to make the best-informed decision.

Featured image from GOBankingRates, charts from Arcane Reseach and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…