Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In their December report, Marathon Digital Holdings announced their total BTC holdings. And assured their investors that they were not selling any of it any time soon. This is particularly interesting considering the company bought “a record number” of S19s in December. Reportedly, they got a giant loan using Bitcoin as collateral. An operation we’ll see a lot more in the near future throughout the industry.

The report quotes Fred Thiel, Marathon’s CEO, in a celebratory mode. “2021 was a transformative year for Marathon as we increased our hash rate 1,790% and increased our bitcoin production 846% year-over-year to 3,197 self-mined BTC.” Staggering numbers that show the size of the Bitcoin mining business.

Marathon announced an record investment of nearly $1B in new equipment just before Xmas…

BUT THEIR STILL HODLING ALL THEIR #BTC!https://t.co/PRlaHMNR7j

— What Bitcoin Did (@WhatBitcoinDid) January 4, 2022

As for their holding plans, the report says:

“The Company last sold bitcoin on October 21, 2020, and since then, has been accumulating or “hodling” all bitcoin generated. As a result, Marathon currently holds approximately 8,133 BTC, including the 4,813 BTC the Company purchased in January 2021 for an average price of $31,168 per BTC.”

Of course, they’re not alone. NewsBTC documented the trend throughout the whole year.

Most Miners Are Holding Strong

One of the first persons to spot the trend was Lex Moskovski. In February, the analyst reported on “the first day since Dec, 27 when Miners Position change turned positive.”

https://twitter.com/mskvsk/status/1365557599358320642

Approximately four months ago, NewsBTC used data to find a possible explanation:

“Data shows that miner profitability has dropped in comparison to the last time that bitcoin was at this price. The profitability for bitcoin back in April at $50K had been 40% higher than it is right now when bitcoin hit $50K again. This means that miner profitability is hitting the lows at all-time highs.

This drop in profitability has seen miners refusing to sell the BTC they are rewarded with for mining blocks. Instead choosing to hold these coins in wait for much higher prices.”

Miner profitability might be decreasing, but, the business is still a long way from turning red. Especially for a giant operation like Marathon. In a recent interview that NewsBTC reported on, Fred Thiel said:

“Thiel expressed that, factoring operational mining costs (energy plus hosting), Bitcoin’s breakeven rate is roughly $6,500, meaning that the digital coin would need to drop at least 80% for Marathon to face challenging difficulties.”

Less than three months ago, NewsBTC reported on another set of data that showed the same phenomenon:

“BTC miner reserves continue to trend sideways amid the coin’s strong move up. The “miner reserve” is a indicator that shows the total amount of Bitcoin that miners are currently holding in their wallets. An increase in the metric’s value suggests miners think the coin’s value will go up in the near future, hence they are stocking up on it.”

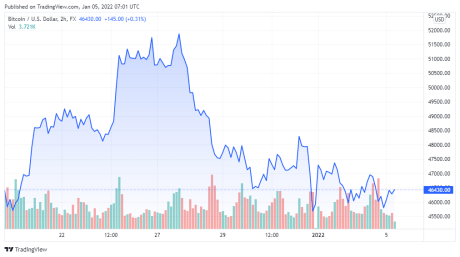

BTC price chart for 01/05/2021 on FX | Source: BTC/USD on TradingView.com

The Marathon Mining Company’s Future

The company’s recent billion-dollar investment is a play for the future. Especially considering just when those machines will arrive.

“On December 23, 2021, Marathon announced that it had entered into a contract with BITMAIN to purchase a record number of ANTMINER S19 XP (140 TH/s) bitcoin miners, all of which are currently expected to ship from BITMAIN between July 2022 and December 2022.”

The chip shortage is real, people. If an order this size can only be fulfilled in six to twelve months, something’s up. Also, by the looks of it, the ASIC manufacturing business might be even more profitable than Bitcoin mining. That’s a topic for another day, however.

Featured Image by Mārtiņš Zemlickis on Unsplash - Charts by TradingView