Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Negotiations over a new round of stimulus relief have dragged on for many months now. To make matters worse, both Democrats and Republicans have used the delay as a political ping pong to score points.

But last week, House Speaker Nancy Pelosi indicated that she and Treasury Secretary Steven Mnuchin are close to agreeing on a deal.

“We continue to be engaged in negotiations and I am hopeful we will be able to reach agreement.”

Then again, with no deal signed into law, the outlook remains uncertain. Jack Gillis, Executive Director of the Consumer Federation of America, expressed his worries over the deadlock. Moreso, how time is running out for many Americans concerning financial assistance programs.

“It is daunting to think about what the consequences will be for families, individuals, businesses, our economy when the COVID-19 protections and financial assistance are no longer available.”

$1,200 Direct Payout Now Worth

Markets are closely following developments in the stimulus negotiations, and for good reason too.

March’s historic $2.2 trillion package was the biggest in U.S. history. It included direct $1,200 cash payments to struggling Americans, as well as a raft of measures to help local government and private industries.

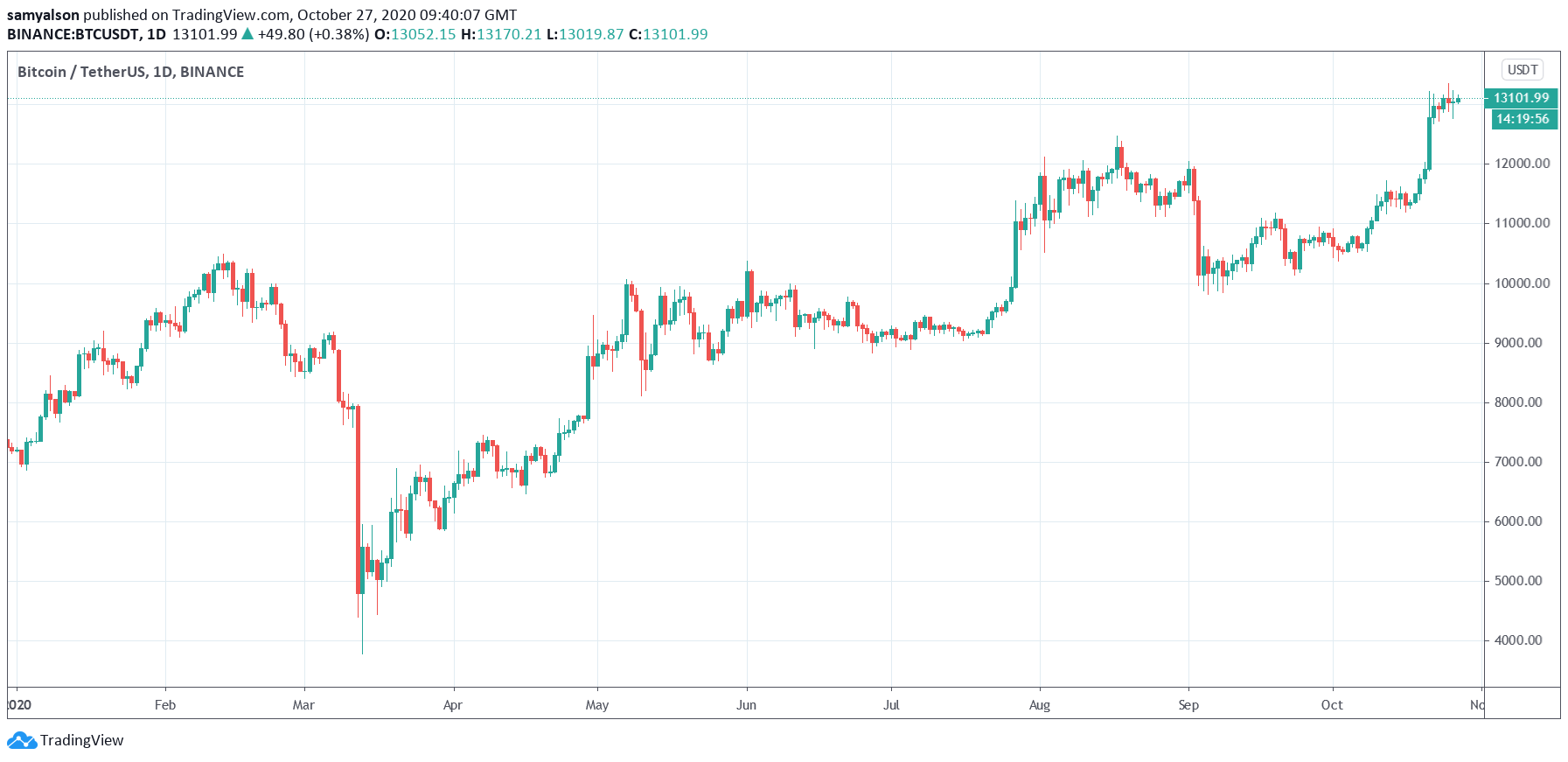

What’s more, Bitcoin rallied hard following the announcement. Investing the $1,200 payout in Bitcoin became something of a meme mocking the dollar’s decline.

Source: BTCUSDT on TradingView.com

As it stands, $1,200 invested in Bitcoin back then would have doubled your money today.

However, figures from Ran Neuner, the Co-founder, and CEO of Onchain Capital, show the same amount into Tesla would have quadrupled your money.

If you invested your last stimulus check ($1200 per couple) into ____________ ,What is it worth today?

BTC = $ 2400 .

TSLA = $ 4800

GOLD = $1440

AMZN = $1997

DOW =$1527

NASDAQ = $1811This is how much the stimulus devalued the USD so far!

— Ran Neuner (@cryptomanran) October 27, 2020

Bitcoin Shows Signs of Decoupling From Stocks

This year has shown a high degree of positive correlation between Bitcoin and stocks.

The flashpoint came during March’s stock market crash, which triggered a 50% drop in the Bitcoin price. As a supposed safe-haven asset, Bitcoin failed to act as one when the stuff hit the fan, much to the dismay of crypto diehards.

Both Bitcoin and stocks, off the back of stimulus money, have since recovered.

However, recently, Bitcoin is showing signs of breaking its correlation with stocks. Last week saw two days straight of uncorrelated intraday performance, with Bitcoin rising as stocks fell.

Despite the apparent strength of stocks, analyst Willy Woo thinks they look vulnerable and predicts a stock market crash in the coming months. When that happens, Bitcoin’s decoupling will accelerate as its anti-inflation fundamentals come into play.

“The current stock market looks very vulnerable. If the plunge continues, Bitcoin will decouple from the stock market in the next few months. People will be surprised if that happens.After the Bitcoin halving and the amount of derivatives trading The reduction has fundamentally alleviated the selling pressure of Bitcoin against the bullish fundamentals of anti-inflation hedges”

Tesla’s performance this year is impressive, but how sustainable is it?

If Woo’s prediction comes true, those who bought Bitcoin using stimulus money would appear to be investment geniuses.