Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- American banking giant JP Morgan Chase has accepted two clients involved in the emerging bitcoin sector.

- U.S. cryptocurrency exchanges Coinbase and Gemini received account approvals after a long wait, according to the Wall Street Journal.

- The news came just less than 24 hours after Bitcoin underwent a massively hyped “halving” upgrade.

JP Morgan Chase will offer its banking services to two U.S. bitcoin exchanges, Coinbase and Gemini.

The Wall Street banking powerhouse approved the exchanges’ application in April 2020. It will start processing a multitude of services in the coming days, which will include wire transfers, automated deposits, and withdrawals, as well as electronic fund transfers, people familiar with the matter told the Wall Street Journal.

Change of Heart

Founded in 2012, Coinbase is currently one of the U.S.’s leading cryptocurrency exchanges, catering to more than 30 million users. Meanwhile, Gemini is a small competitor – owned by the Facebook-famed Winklevoss Twins – but has been instrumental in attracting retail and institutional investors to the cryptocurrency space.

That partially explains why JP Morgan accepted clients from a perceivably demented Bitcoin industry. Both Coinbase and Gemini has emerged as a benchmark of a potential marriage between cryptocurrencies and mainstream finance. Unlike most of their peers, which operates shadily, the two U.S. exchanges are strictly compliant with the U.S. regulators.

Both Coinbase and Gemini has obtained a money services license from with Financial Crimes Enforcement Network, or FinCEN. They also have specialized New York work permits – the notorious BitLicense.

But the most notable takeaway remains JP Morgan’s change of heart towards Bitcoin. Back in 2017, just before the cryptocurrency would establish its all-time high near $20,000, JP Morgan’s CEO Jamie Dimon had called Bitcoin a “fraud.”

“It’s worse than tulip bulbs,” Mr. Dimon had told CNBC. “It won’t end well. Someone is going to get killed.” He also contended, “It’s just not a real thing, eventually it will be closed.”

Bitcoin, Halving, and Pandemic

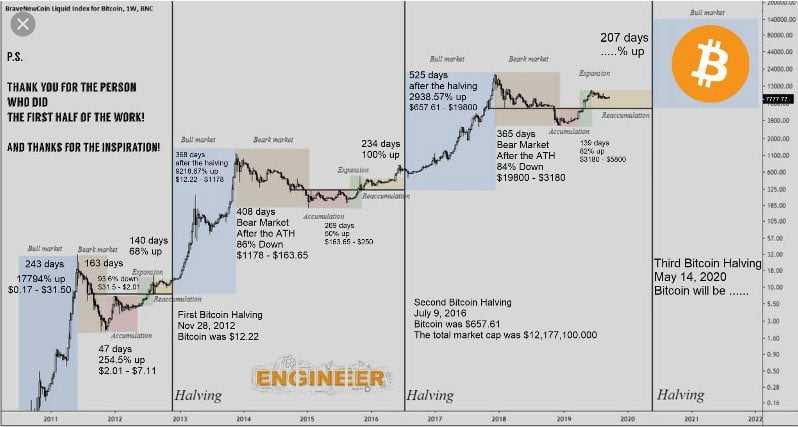

The banking approval for Coinbase and Gemini also surfaces on popular media less than 24 hours after Bitcoin underwent a massively publicized technical upgrade called halving. On May 11’s afternoon, a pre-programmed algorithm slashed Bitcoin’s daily supply rate from 1,800 BTC to 900 BTC.

That was the Bitcoin’s third halving in its 11-years existence. Analysts believe that it makes the cryptocurrency scarcer – and therefore, more expensive against the rising demand. Bitcoin’s supply limit is 21 million tokens.

The ‘deflation’ narrative has emerged as a protagonist against the global central banks’ inflationary stimulus measures. Many analysts see the fiat value depreciating soon because of open-ended printing. As the Coronavirus pandemic grows, more and more central banks are resorting to fiat printing to save their economies.

Just in late March, the U.S. Federal Reserve decided to inject a massive $2 trillion liquidity into the market.

The moves had led Wall Street investors looking for hedging opportunities elsewhere. Some of them have found Bitcoin because of its conceptual resemblance to Gold, the oldest safe-haven asset. Just recently, billionaire hedge fund manager Paul Tudor Jones decided to allocate 1-2 percent of his $22bn portfolio to bitcoin.

JP Morgan’s decision to add Bitcoin businesses signify the cryptocurrency’s growing presence on Wall Street.

Photo by Sophie Backes on Unsplash