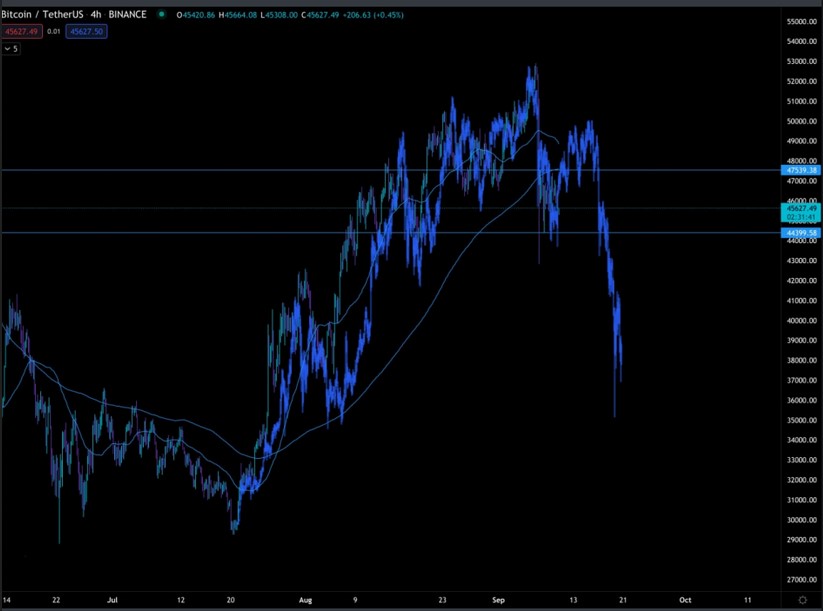

Making its way up to the higher levels of its current range, Bitcoin records a 5.6% profit in 24 hours. BTC’s price took a heavy loss, as the implementation of its legal tender status in El Salvador became a “buy the rumor, sell the news” event.

At the time of writing, the first cryptocurrency by market cap trades at $46,529 with an 11.8% loss in the 7-day chart.

Previous to this event, Bitcoin made a quick move to the $52,000 zone. This moved the Fear & Greed Index back to the green area, as the general sentiment in the market turned bullish.

Related Reading | TA: Bitcoin Topside Bias Vulnerable If It Continues To Struggle Below $46K

According to a recent Arcane Research report, the Index has flipped red, back to fear levels once again. Bitcoin has experienced a week of volatility, mostly to the upside, but the violent bearish price action has made investors fearful, as seen below.

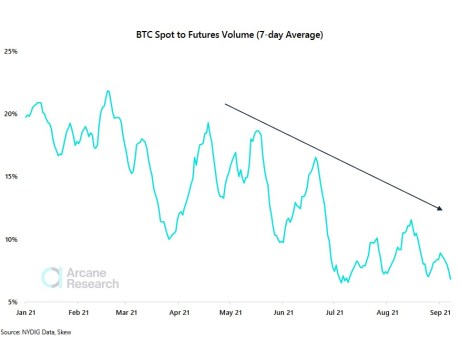

Arcane Research found that most of the action is taking place in the derivatives sector. The BTC Spot to Futures Volume indicates a decline in the trading volume for the spot market.

This doesn’t necessarily suggest a rise in the trading volume for futures, but a steady dropped in spot trading over a period of 5 months, as derivatives trading volume remains stable.

As NewsBTC reported, much of the recent price action and volatility is related to an increase in over-leverage positions for futures. This correlates with periods of bearish momentum, retail futures traders fuel the liquidation cascade that leaves the crypto market open for downside risk.

Two Possible Scenarios For Bitcoin As Fear Re-Enters The Market

On the other hand, analyst Ben Lilly from Jarvis Labs recently examined Bitcoin’s price action. The cryptocurrency has been trading in a crap-like PA indicating before yesterday’s sudden move to the upside and downside, almost immediately.

This corresponds with an increase in liquidity around those levels. Thus, Ben Lilly argued that market movers or large players attempt to push BTC’s price into a specific direction to grab the liquidity and eventually exhausted.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

The market is currently at that stage, as seen below, “bone dry” out of liquidity. In this case, the analyst recommended trading in the spot market, as derivatives could continue moving without a clear direction.

This is the best-case scenario, a sustain crab-like PA for a few weeks, as Bitcoin prepares for another retest of the $50,000 mark. Before that, the market could see another sweep at yesterday’s low:

And this scenario is currently the one we are leaning towards. Meaning we think a retest of $42kish might be in the cards.

The worst-case scenario could occur by the end of this month with a return to BTC’s previous range in the $30,000 mid-area. Ben Lilly said:

This type of price action would be vicious. It will create a lot of liquidity lower very fast. It’s often times known as exit liquidity.