Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows the Bitcoin exchange inflow has registered its largest value in six months, a sign that profit-taking may be going on after the price surge.

Bitcoin Exchange Inflow Has Spiked To Highest In Six Months

According to data from the on-chain analytics firm Santiment, a large number of coins have entered into exchanges recently. The relevant indicator here is the “exchange flow balance,” which measures the net amount of Bitcoin that’s moving into or out of the wallets of all centralized exchanges.

When the value of this metric is positive, it means the inflows taking place in the market are currently overwhelming the outflows and a net number of coins are entering exchange wallets.

As one of the main reasons why a holder may deposit to an exchange is for selling-related purposes, such a value can impart a bearish effect on the price.

On the other hand, the indicator having a value less than zero suggests supply is being pulled out of the exchanges right now. This kind of trend, when prolonged, can be a sign that investors are accumulating the asset at the moment, and hence, can be bullish for the BTC price.

Now, here is a chart that shows the trend in the Bitcoin exchange flow balance over the past month:

Looks like the value of the metric has been quite positive in recent days | Source: Santiment on Twitter

As displayed in the above graph, the Bitcoin exchange flow balance has shot up above the zero mark during the last couple of days. During this spike, a total of about 21,524 BTC ($524.9 million at the current exchange rate) has been deposited to these platforms.

This value of the net inflow is the highest observed since the September of last year, around six months ago. These huge deposits have come after the price of the cryptocurrency has observed some strong uptrend and has crossed above the $24,000 level.

The chart also shows data for another indicator, the “supply on exchanges,” which tells us about the percentage of the total circulating Bitcoin supply that’s currently being stored in exchange wallets.

Naturally, this metric has also shot up as the inflows have taken place. According to this indicator, around 0.11% of the entire BTC supply moved to exchanges with these deposits within just a single day.

As investors have made these transfers to exchanges with the price shooting up, it would seem reasonable to assume that at least some of these deposits are being done for taking advantage of the current profit-taking opportunity.

So far, the price has continued to rise to higher levels despite these inflows, suggesting that the market might have been more than comfortable absorbing this selling pressure. However, if the profit-taking continues, then the price may face some downside in the near term.

BTC Price

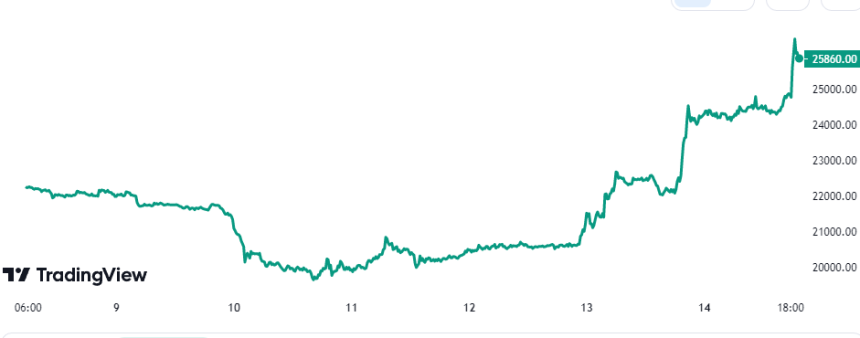

At the time of writing, Bitcoin is trading around $25,900, up 16% in the last week.

BTC has surged over the last two days | Source: BTCUSD on TradingView