Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has been moving sideways during the day as it was rejected north of $63,000. As of press time, BTC’s price trades at $62,698 with a 1% profit in the weekly chart.

However, Bitcoin could see some action in the short term. The benchmark crypto has been rallying on the back of an increase in institutional demand and the launch of the first BTC-linked ETFs in the U.S.

Related Reading | Why Bitcoin Needs To Clear $64K For Hopes of a Fresh Rally

As a consequence, Bitcoin went from the lows at $40,000 to a new all-time high in less than a week. This caused a FOMO effect most notoriously visible in the derivatives sector.

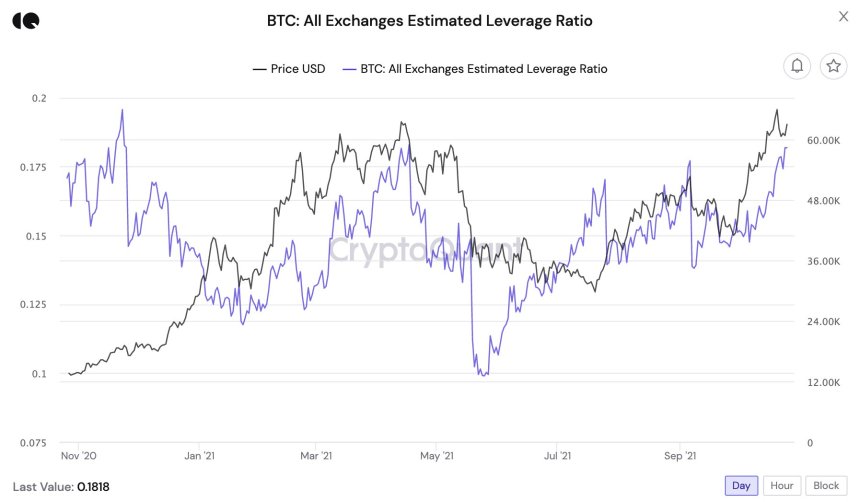

As CryptoQuant showed, the amount of leverage positions in this sector has been on the rise since the end of September. Moving to a year high with BTC’s price, the leverage ratio points to an excess which could be reflected on the price action.

The CEO of CryptoQuant Ki Young Ju believes this excess in leverage is caused by new players, as it is has happened historically when Bitcoin enters price discovery. Usually, the market reacts with a sudden move to the opposite direction of the majority of the overleverage position.

Related Reading | Brace For Impact: Wall Street Is Headed Straight For Bitcoin, Says Analyst

Whales and other major players try to shake out these new traders and take advantage of the liquidity in the market to make their own moves. In response to the possibility of the current high leverage in Bitcoin futures been driven by Chicago Mercantile Exchange (CME) futures Open Interest, Young Ju clarified:

This data doesn’t take into account CME futures. I think CME users are new players joining this industry, which indicates the market is over-leveraged by *existing* investors who are using crypto exchanges. Folks who use CME might not have over-leveraged positions.

New BTC ETFs, Same Bitcoin Price Action

The recently launched Bitcoin ETF are backed by CME futures. Therefore, some expects believe the platform could gain more relevance in the future and have a bigger impact in BTC’s price.

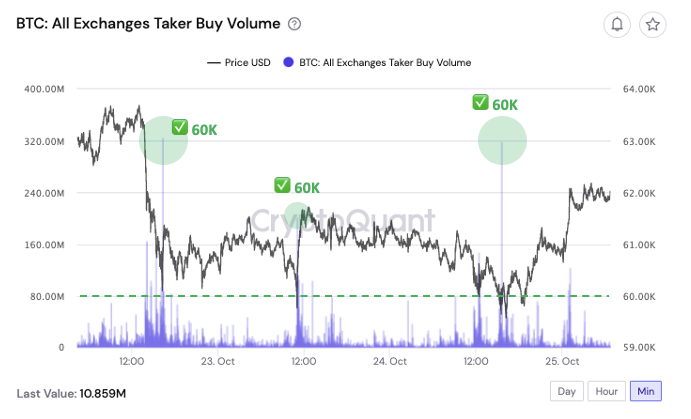

In case of volatility, Bitcoin could find critical support at $60,000, as $840 million in futures contracts were purchased when BTC’s price was hitting this mark, Young Ju said.

As noted by research firm Glassnode, the OI for the CME futures has increased by over 265% in just a month. This points towards a moment of euphoria which has favored the bears over the past months.

Related Reading | Bitcoin Funding Rates Touch Same Level As Early September, More Correction To Come?

However, the general sentiment around Bitcoin remains positive as Glassnode reported. This demonstrated by the amount of long-term investors that have stopped taking profits during BTC’s most recent price rally.