Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

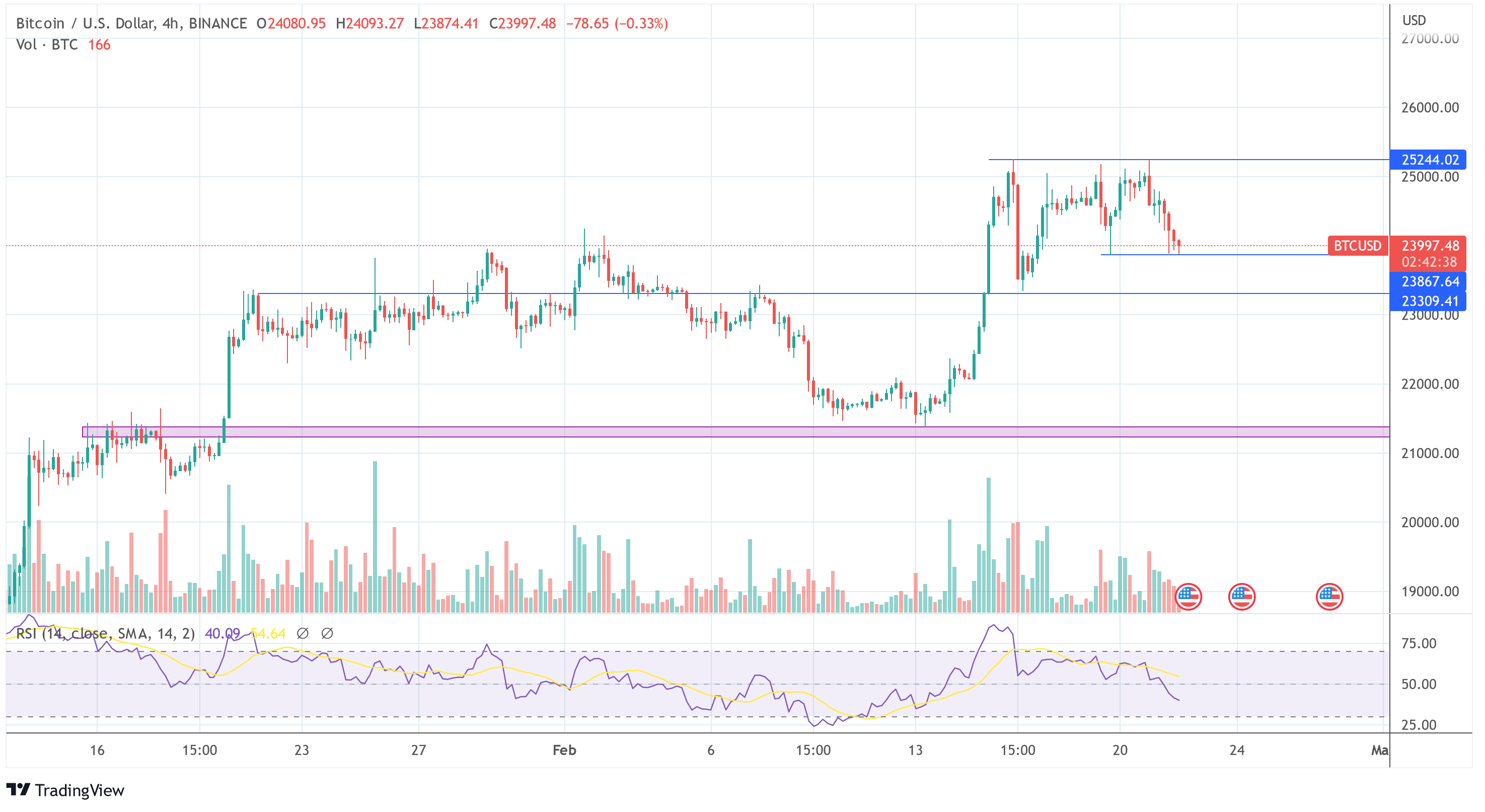

After Bitcoin failed to break through the key resistance at $25,200 over the past week, the price is currently on a downward slide. At press time, BTC broke through the $24,000 level to the downside and initially found support at $23,867.

After a strong start to the year, Bitcoin is thus trying to defy the weakening stock market and macro outlook. The S&P 500 lost 2% yesterday, closing at 3,997 points. The technology-heavy Nasdaq fell 2.5% to 11,492 points.

In particular, concerns about the future interest rate policy of the Fed depressed the mood of investors. Several central bankers have signaled in recent weeks that interest rates could rise even more this year than initially assumed.

Also, the Fed could again consider larger interest rate steps, as among others James Bullard, head of the regional Fed in St. Louis, had signaled last week. In addition, fears about a recession are currently rising massively again, as the CPI for January was a disappointment.

Today’s retracement therefore comes in line with the much-anticipated release of the FOMC minutes at 2:00 pm EST. If the minutes mention that the Fed has considered larger rate hikes in the future (50 basis points) and/or a higher policy rate as a target, the crypto and Bitcoin market may be in for larger losses.

These Price Levels Are Crucial For Bitcoin

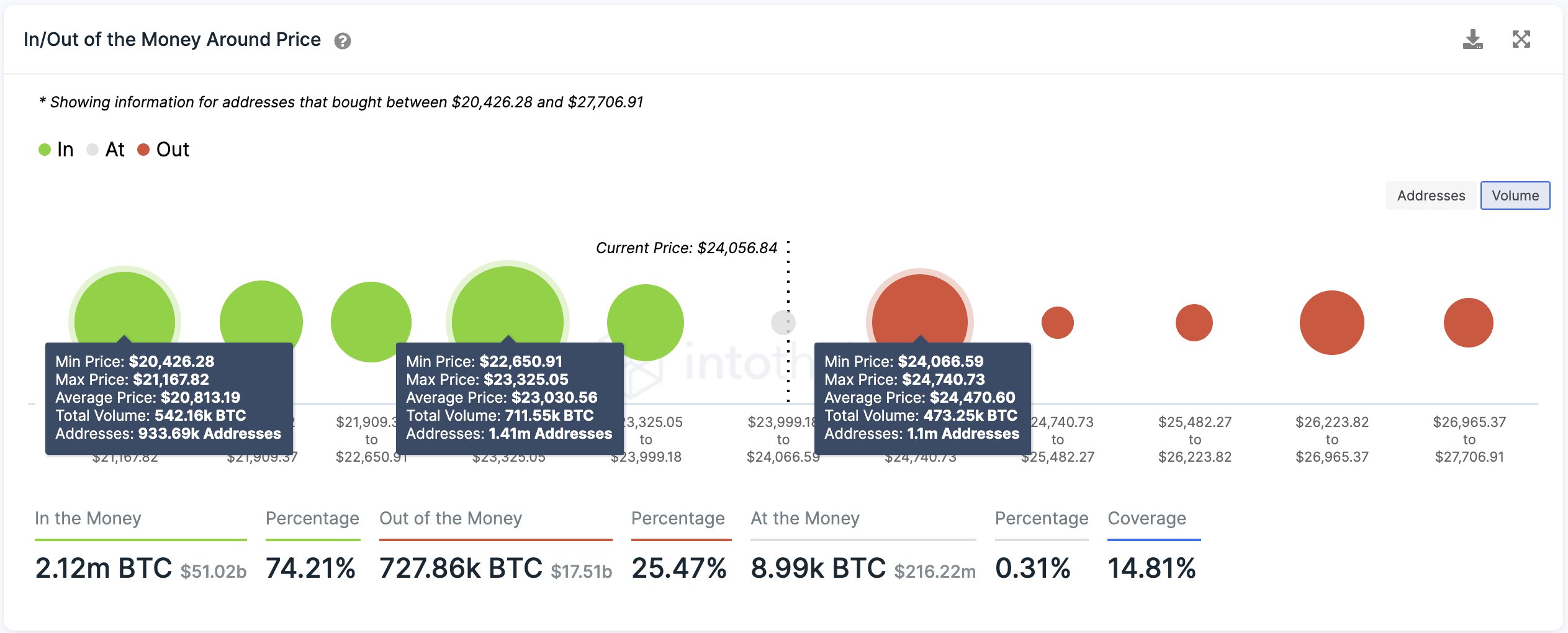

As popular analyst Ali Martinez discusses, there are two extremely important support areas for Bitcoin right now. Citing IntoTheBlock’s In/out of the money price indicator, Martinez writes that the first key support is between $22,659 and $23,325, where 1.41 million addresses have purchased 711,550 BTC.

The second support area is between $20,426 and $21,167, where 933,690 addresses bought 542,160 BTC.

This analysis also coincides with the technical chart analysis of Bitcoin. A look at the 4-hour chart of Bitcoin indicates that the $23,300 level is of huge importance. If BTC loses the current support of $23,867, it looks like the price is heading for a sweep of the low after sweeping the range high.

Thus, the price of $23,300 would be the line that Bitcoin bulls need to defend in order to have the upper hand.

One argument that the bulls could win the battle are the Binance Futures. Due to the correction, 58.59% of all accounts are long on Binance futures in the last four hours, up from 48.53% yesterday.

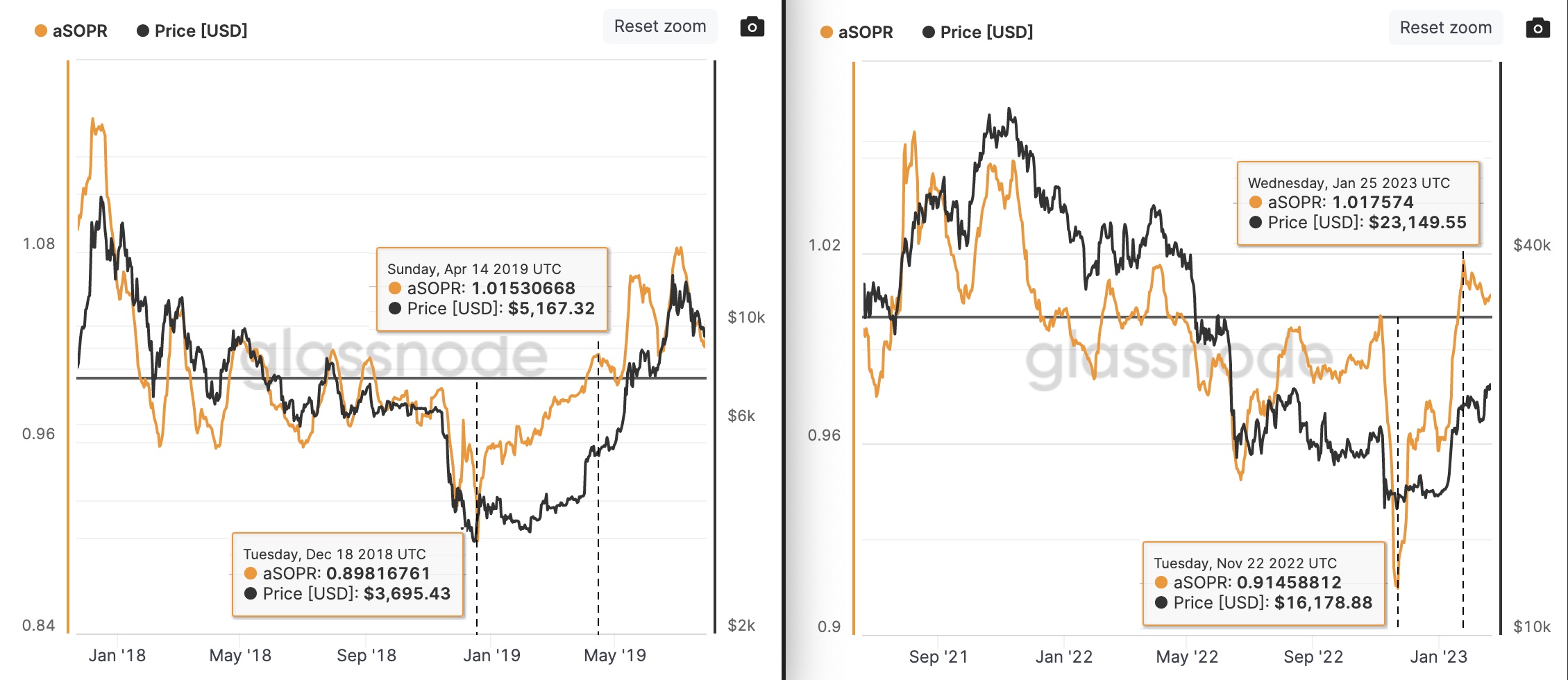

Martinez also stated that he will not short Bitcoin to $10,000 as some ” renowned” analysts suggest. The reason is the aSORP:

The aSORP behaves today as it did in 2018. After it marked the bottom at 0.914, it jumped to 1.017, and now it’s retesting the crucial 1.0 support. If this level holds, it will confirm the bull run.

Further volatility is expected for the release of the FOMC minutes. Bitcoin bulls and bears will closely study and evaluate the document.