Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has broken out of the range it traded for months and seems well on its way to reclaiming previous highs. Indicators have been turning decisively bullish, as short positions get liquidated with every new level taken by the bulls.

At the time of writing, BTC trades at $45,858 with a 2.6% and 14.8% profit in the daily chart. The market capitalization sits at around $860 billion, closer to its previous high north of $1 trillion.

After making an upwards move from the lows at $30,000, BTC’s price faced some resistance at $40,000 and $42,000 but was able to turn them into support. The next key resistances were located at $45,000 and $47,000, as trader Justin Bennett said.

The former was reclaimed in the past 24 hours, if the bulls can sustain the bullish momentum, $47,000 should be the final obstacle before a potential move to $65,000, Bitcoin’s previous all-time high. Bennett added:

Flip $47,000 to support on the daily and weekly time frames, and the bull run likely continues to $100,000+. Looking for $40,000 to hold as support.

One of the most bullish and historically accurate Bitcoin indicators, the Hash Ribbons, showed a buy signal during the weekend. The signal was confirmed by its creator, Capriole Investments founder Charles Edwards.

The expert created this indicator by taking BTC’s hash rate and the mining difficulty as moving averages. It’s estimated that Hash Ribbons has helped investors to achieve over 5,000% in returns with an average maximum 20% drawdown once triggered.

The indicator usually signals a buy once a miner’s capitulation event has been completed. This was most likely caused by China’s ban on BTC mining for large operations. With only “strong miners” live on the network, and less selling pressure on the market, Bitcoin has more room for appreciation.

One Final Bitcoin (BTC) Dip Before $100,000?

As our Editorial Director Tony Spilotro pointed out on Sunday, August 8th, the Hash Ribbon made its comeback as a long period of capitulation during June and July. As the chart below shows, this indicator’s buy signal precedes a strong move to the upside.

https://twitter.com/tonyspilotrobtc/status/1424350348144218114?s=21

Tony expects the Hash Ribbon to play out in the next two to one week with a possible retracement to $40,000. In 2017, this indicator preceded the move to $20,000, that year’s all-time high, and in December 2020, it signaled the move to its current ATH. The next could be around $130,000 or more.

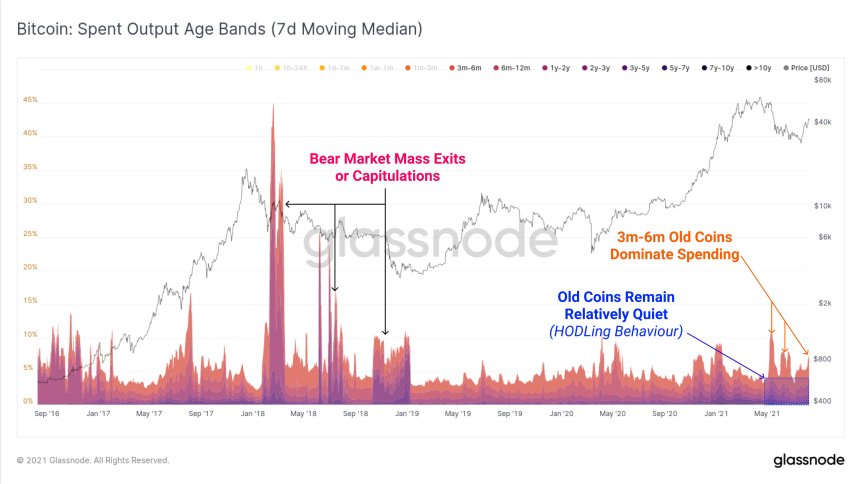

Further data shared by Glassnode point out a strong bullish sentiment amongst long-term investors. Unlike previous “bear markets”, these investors’ coins haven’t been spent on the recent rally. Most of the Bitcoin sold on the market is coming from short-term investors, as the chart below suggests.

This data indicates a “holding behavior” and could support further appreciation if the bulls display similar strength to break above $47,000.