Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows Bitcoin whale transactions have exploded recently, suggesting that these investors may be looking to buy the dip in the price.

Bitcoin Whale Transaction Count Has Shot Up In Recent Days

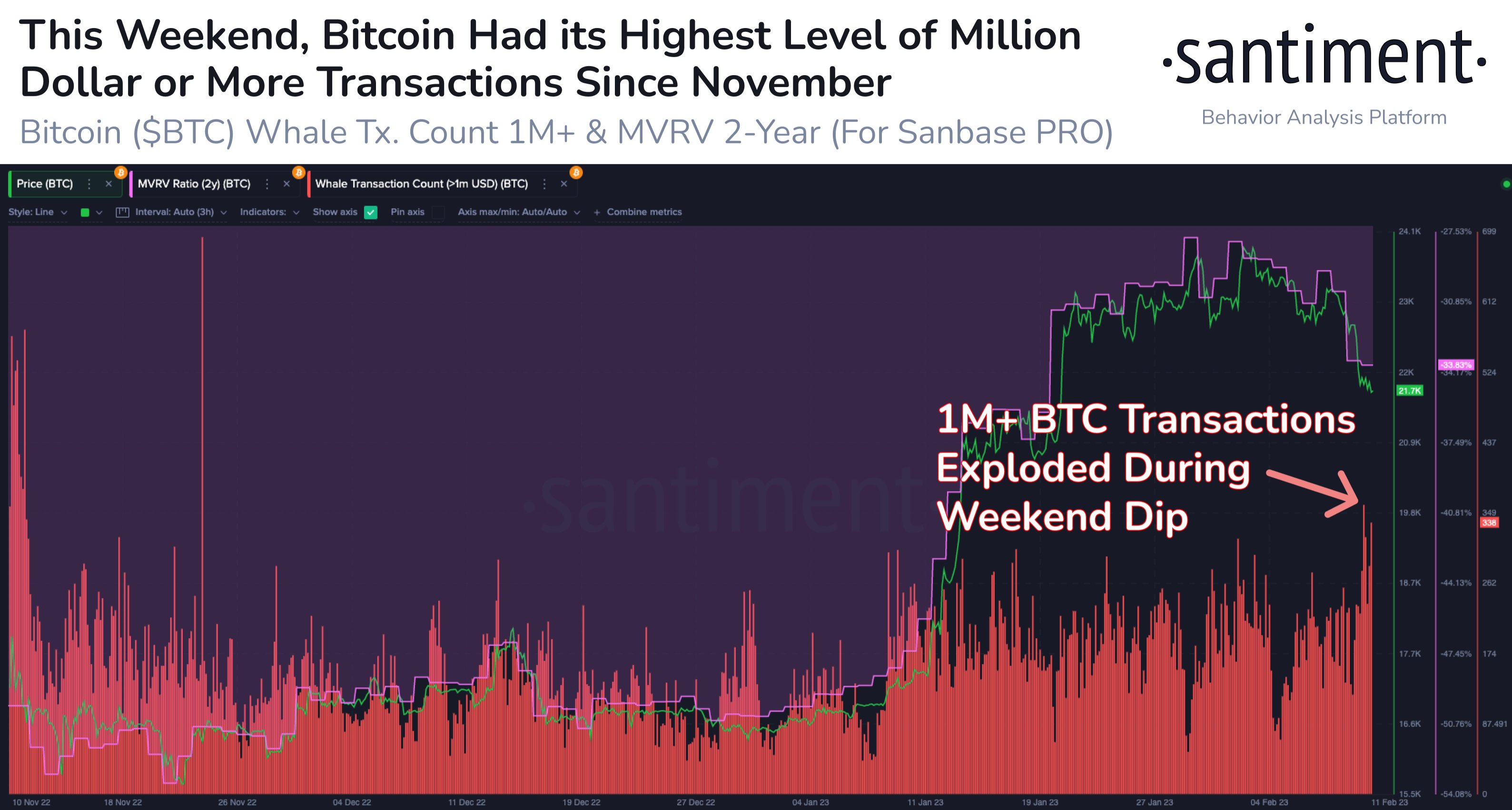

According to data from the on-chain analytics firm Santiment, whale activity is now at its highest level in around three months. The relevant indicator here is the “whale transaction count,” which measures the total number of Bitcoin transfers taking place on the network that is at least $1 million in value.

When the value of this metric is high, it means whales are making a large number of transactions right now. Such a trend shows that these humongous holders have an active interest in trading the asset currently.

Because these transactions involve the movement of a significant amount of capital ($1 million or more), they can sometimes create noticeable ripples in the market.

As such, whenever the whale transaction count has elevated values, the chances of the price of the asset displaying more volatility go up. This is why activity from this cohort is usually something to watch for.

Now, here is a chart that shows how these whales are behaving in the current Bitcoin environment:

Looks like the value of the metric has been raised in recent days | Source: Santiment on Twitter

As shown in the above graph, the Bitcoin whale transaction count has surged recently and has hit some pretty high values. The current levels of the indicator are in fact the highest observed since November 2022, around three months ago.

This latest elevation in the activity of the whales has come following a plunge in the value of the coin below the $22,000 level. The timing of the transfers may imply that these holders are looking to buy the coin while the price is seeing this dip.

However, something to keep in mind is that both buying and selling transactions contribute to the metric’s value, which means that the current spike may very well be a sign of further distribution from this cohort instead.

Naturally, if the whales made these transactions in preparation for selling, then Bitcoin would feel a bearish impact from this and the decline could extend further.

But, on the other hand, if these large investors are indeed accumulating here, then BTC might observe a bullish impulse instead and recover the losses piled up in the past few days or so.

Either way, the Bitcoin whale transaction count being at such high values likely means that volatility may be imminent for the cryptocurrency. It only remains to be seen in which direction the transfers might eventually end up taking the price of the asset.

BTC Price

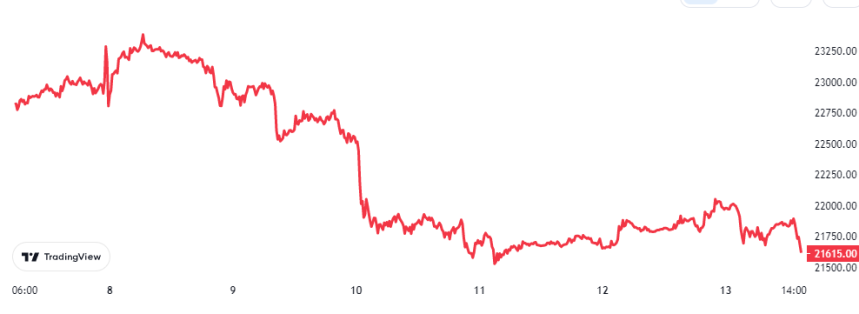

At the time of writing, Bitcoin is trading around $21,600, down 5% in the last week.

The value of the asset seems to have been moving sideways since the dip | Source: BTCUSD on TradingView