According to Lark Davis, a prominent crypto expert, the current decline in Bitcoin (BTC) may be a transient setback. Davis is predicting a substantial increase in the value of Bitcoin in the upcoming weeks, aiming for it to reach $90,000 by the end of the year. This positive perspective arises amidst a surge of confidence over institutional investment and the possible introduction of Bitcoin exchange-traded funds (ETFs).

Institutional Investors Set To Supercharge The Market

Davis anticipates a substantial influx of institutional funds into the cryptocurrency market, which will serve as a significant driving force behind the projected market upswing. He highlights Standard Chartered Bank’s forecast of Bitcoin surging to an astonishing $100,000 by August as evidence of increasing institutional trust.Although he presents a little more modest estimate of $90,000, his primary emphasis is on the long-term consequences of this institutional infusion.

Davis’s optimistic outlook is further bolstered by the introduction of Bitcoin ETFs. These investment instruments would enable conventional investors to have exposure to Bitcoin without the intricacies of directly obtaining and safeguarding the cryptocurrency. Davis asserts that the convenience of entry provided by ETFs may entice a substantial influx of fresh funds, hence driving Bitcoin’s price even higher.

Beyond Bitcoin: A Banner Year For Altcoins?

Davis’s optimistic perspective extends beyond Bitcoin, embracing a substantial percentage of the altcoin industry. He expects a significant increase in investment into Ethereum (ETH) due to the forthcoming introduction of spot ETFs. Solana (SOL) is a cryptocurrency that Davis is closely monitoring because to its prominent role in blockchain advancement and its high market momentum, which positions it as a formidable candidate for expansion.

Technical Hurdles Remain: Can The Bulls Break Through?

Although Davis’s projections are optimistic, technical signs indicate that there may be some obstacles to overcome before the desired outcome is achieved. The latest price rejection at the level of $63,956 and the bearish signals from technical indicators such as the Relative Strength Index (RSI) indicate the possibility of encountering some short-term difficulties.

Nevertheless, Davis maintains a positive outlook. Should Bitcoin successfully surpass the resistance level of $72,000, it has the ability to initiate a bullish trend in the fourth quarter, which may have significant repercussions throughout the whole cryptocurrency market.

A Climb Or A Cliffhanger?

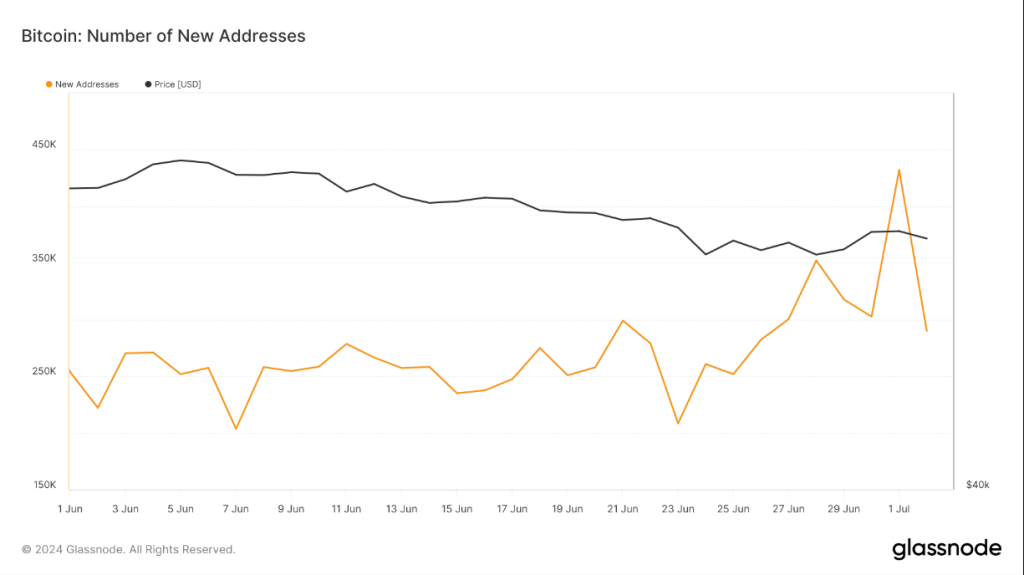

NewsBTC’s review of Glassnode’s data shows a surge in BTC’s new addresses, suggesting a possible spike in user interest. In order for the bulls to make significant progress, it is essential that the price closes above the resistance level of $63,950 on a daily basis. This has the potential to cause a 5% increase and a reevaluation of the $67,140 resistance level on a weekly basis.

If momentum indicators such as the RSI and Awesome Oscillator exhibit positive signals, there is a possibility of a further 6% increase in price, reaching $71,200, which is the weekly resistance level.

If the price falls below $58,300 and forms a lower bottom, it might indicate a continued pessimistic attitude. This could potentially result in a 3% decrease and a return to the May low of $56,520

Featured image from Getty Images, chart from TradingView