With Bitcoin ripping higher and closing in on breaking all-time highs, one analyst on X thinks $150,000 post-halving is “programmed.” The analyst remains upbeat in a post, highlighting several fundamental developments that could drive the world’s most valuable coin to new valuation and more than 2X from spot rates.

Currently, the path of least resistance remains northward. Buyers have shaken off the bears of the past trading month, finding anchor from the March 20 bull bar.

On April 8, the coin soared above the key liquidation level at around $71,800. Bitcoin has since cooled off, but the leg up remains, and it may form the basis of another breakout above $74,000.

For bulls to be firmly in control and align with the analyst’s outlook, there should be a follow-through of the April 8 surge, ideally with rising trading volumes. This could catalyze demand, even placing Bitcoin above $74,000 and fresh 2024 highs before the highly anticipated Halving event.

Eyes On Bitcoin Halving: A Supply Squeeze In The Making?

As the analyst explains, the “Halving” event is a crucial catalyst for this potential surge. Less than ten days away, this event is a protocol-driven occurrence that will see the network reduce block rewards to 3.125 BTC, down from the current 6.25 BTC.

This reduction, combined with sustained demand, will likely create a scarcity of Bitcoin, potentially driving up its price.

Ahead of Bitcoin’s Halving, the analyst said the amount of BTC held by exchanges is dwindling. To illustrate, Coinbase’s holdings stand at a six-year low. However, this is not an isolated event; data shows that major exchanges like Binance are seeing decreasing supply.

At the same time, over-the-counter (OTC) desks, which handle large, private cryptocurrency transactions, are reportedly running low on Bitcoin, indicating strong institutional demand. This suggests a potential supply squeeze set to only worsen in the coming months.

Impact Of Spot BTC ETFs: London, Hong Kong In The Picture

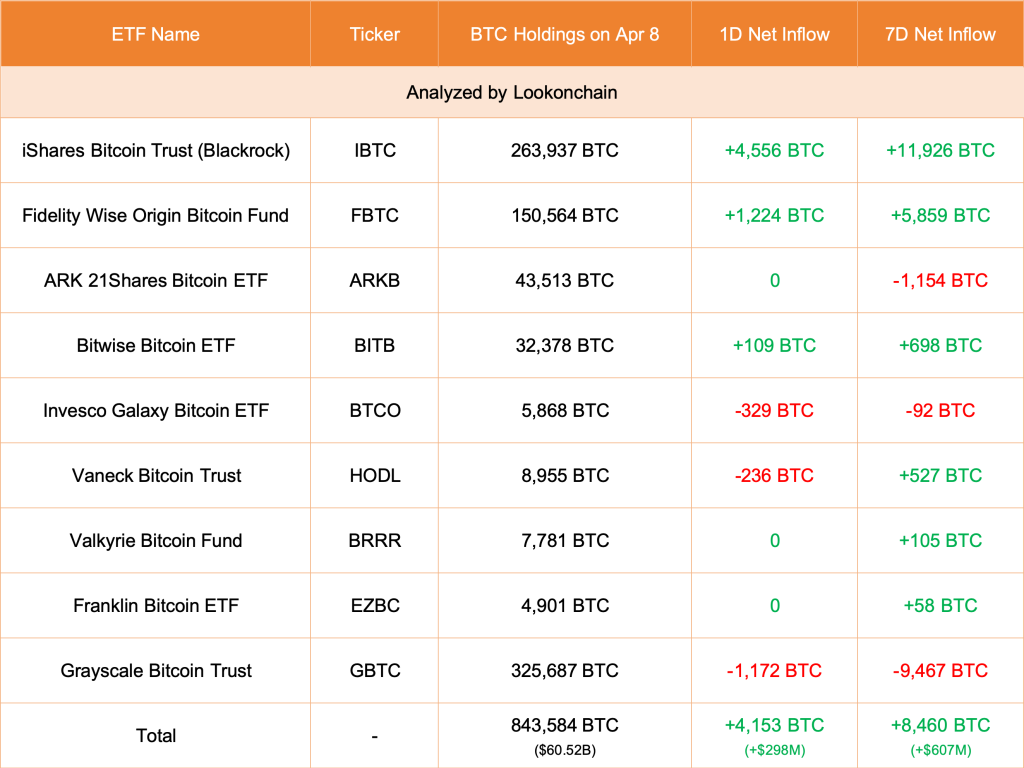

Already, spot Bitcoin exchange-traded funds (ETF) issuers, the analyst added, are on a buying spree, gobbling up over $300 million of BTC every day. Since these issuers are acting on behalf of investors, both retail and institutions, they are actively infusing capital into the market, a huge boost for prices.

It should be noted that the surge from Q4 2023 to early January was primarily because of the anticipated spot Bitcoin ETFs. The spillover effect and the billions flowing into the asset make BTC more liquid and resilient against aggressive sellers.

Additionally, the London Stock Exchange plans to list exchange-traded notes (ETNs) backed by Bitcoin in Q2 2024. Like the spot ETFs in the United States, this product will inject liquidity into the market and legitimize the coin as a worthy asset class, similar to gold.

In Asia, the Securities and Futures Commission (SFC) of Hong Kong will likely approve multiple spot Bitcoin ETFs. Some of the noteworthy applicants include leading Chinese asset managers.