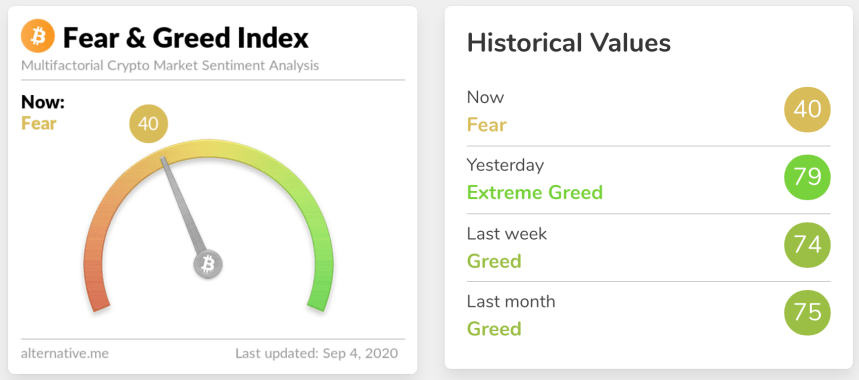

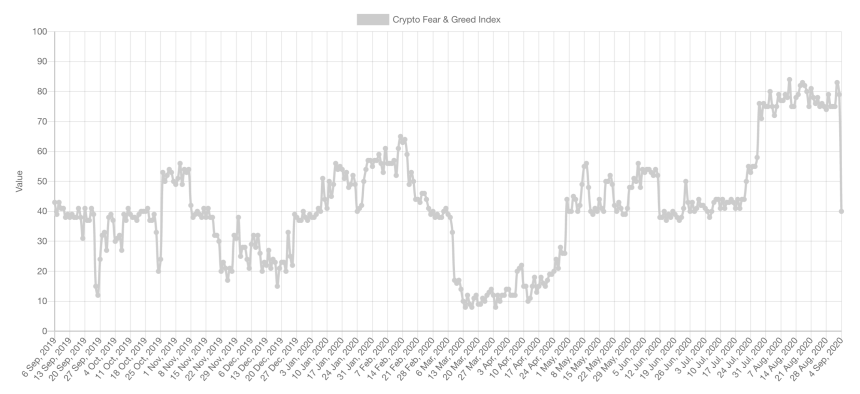

Bitcoin price yesterday tanked by 10% and this week alone fell 17% from high to low. The 24-hour collapse not only cut down valuations across crypto but it also immediately turned sentiment from extreme greed, to fear.

With three days left until the weekly close, and the market suddenly frightened, are things about to turn around over the Labor Day weekend?

24 Hour Crypto Market Collapse Sends Sentiment From Extreme Greed To Fear In A Flash

Because the crypto market is comprised of a wide range of investor types, and asset valuations are based on speculation primarily, the market is susceptible to fast and violent price movements. This volatility has made Bitcoin and other altcoins especially risky, but also exceptionally profitable.

Bitcoin price often takes off on a parabolic rally that’s almost impossible to stop once it gets going. It is only when investors begin seeing money signs everywhere they look. When money seems too easy to be true, it often is, and its a sign that it is about to come to an end.

Related Reading | Be Fearful: Crypto Market Greed Reaches Second Highest Point In History

The crypto market has been farming $1,000s of dollars worth of ETH from made up coins that don’t have any use case. These same investors are sitting in fat profits from Bitcoin, Ethereum, Chainlink, and many more, all up over 50% year-to-date.

Some crypto assets did so well, it created a new swath of crypto-made millionaires. Coins were created that are now more expensive than Bitcoin itself.

All this extreme greed could only mean one thing: Fear, and a fall, was coming. In just 24 hours, the crypto market went from extreme greed to fear. But what does this shakeup possible say about what’s to come for price action?

BTCUSD Daily Labor Day Weekend Bear Trap Example Based On Sentiment | Source: TradingView

Will Bitcoin Bears Be Targeted Over Labor Day Weekend?

Much like any extreme deviations in sentiment can be taken advantage of by smart money market participants, sharp changes in sentiment can also be telling.

While you wouldn’t know a crash was coming by reading crypto Twitter over the last few weeks, taking strategies from top investors like Warren Buffett himself advocates, would have yielded the best results.

Those who were fearful while others were greedy, were able to profit from this week’s madness. Those blinded by greed were brought back to reality. And because reality can be scary, especially after such a strong and violent drop, the market immediately became fearful again.

But could that same sudden turn to fear be used against the market? With selling reaching a potential climax and blasting below $10,000, few scenarios would be more painful than watching Bitcoin price skyrocket back toward highs.

Related Reading | How Crypto Market Fear And Greed Be Used Profitably As A Trade Trigger

Market participants may be either too fearful to buy, or FOMO back in late, just as the rug is pulled again. Unfortunately, markets are brutal and are designed to take money from the less skilled and give it to the patient and emotionless.

March made everyone cautious, August courageous.

Huge lesson in there.

— MS📈 (@singhsoro) September 4, 2020

In a market built on speculation and therefore emotion, paying attention to these key sentiment indicators can make a world of difference.