Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows the Bitcoin shrimp supply has continued to rise recently, which can be positive for the BTC ecosystem.

Bitcoin Shrimps Now Hold 6.7% Of The Entire Circulating Supply

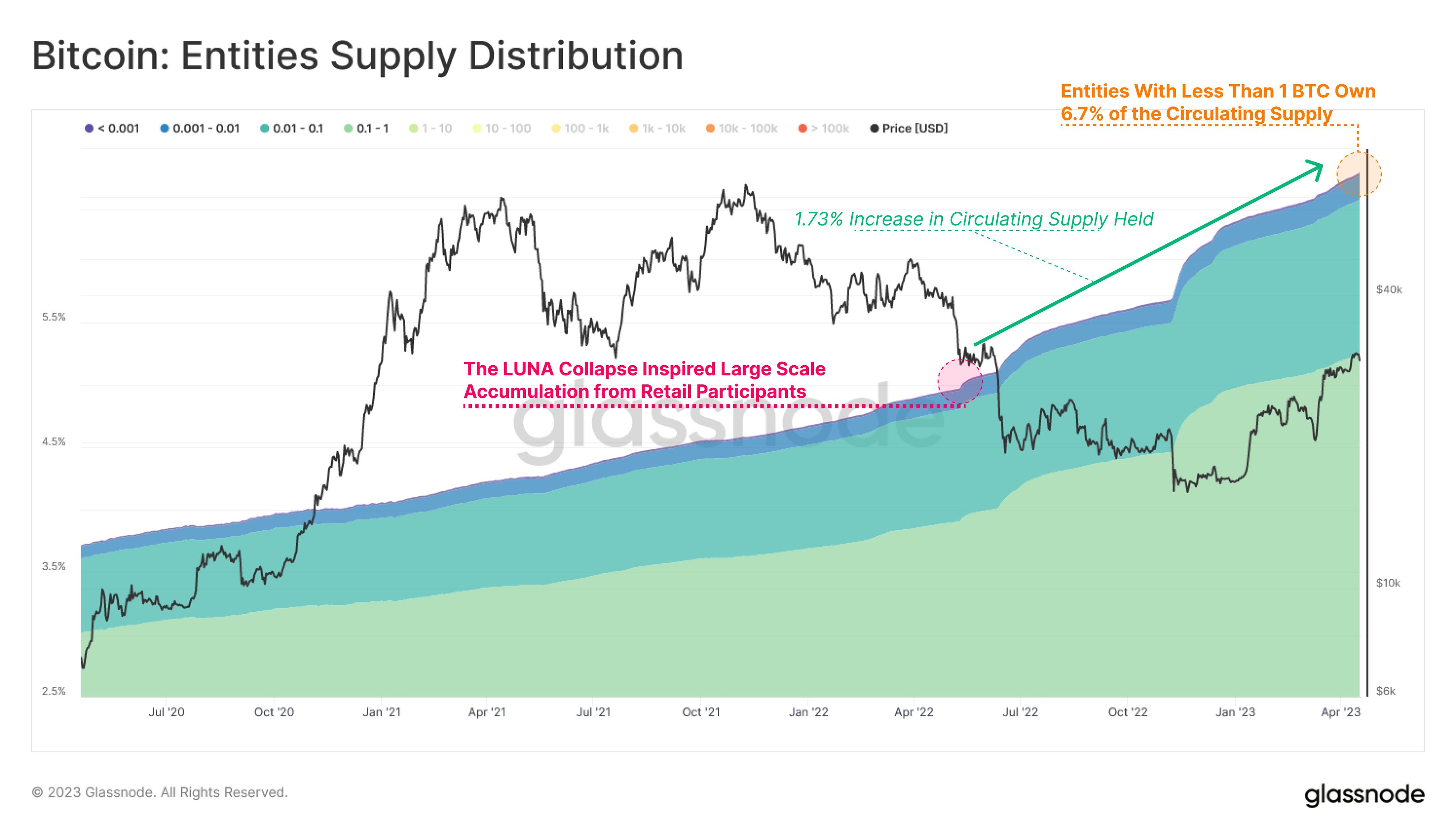

According to data from the on-chain analytics firm Glassnode, the BTC shrimps have added 1.78% of the cryptocurrency’s supply to their holdings since the LUNA crash last year.

The relevant indicator here is the “Entities Supply Distribution,” which measures the total percentage of the Bitcoin supply that each entity group in the market is currently holding.

Investors are divided into these entities based on the total number of coins they carry in their wallets. For example, the 0.001 to 0.01 group includes all addresses holding at least 0.001 and 0.01 BTC.

When the Entities Supply Distribution metric is applied to this specific group, it tells us about the percentage of the BTC supply that the amounts of wallets falling in this range add up to.

The “shrimps” are holders with less than 1 BTC in their wallet balances. This means that this cohort includes all entity groups in the 0 to 1 range (to be more precise, four groups satisfying this condition: less than 0.001, 0.001 to 0.01, 0.01 to 0.1, and 0.1 to1).

Here is a chart that shows the Entities Supply Distribution for the entities belonging specifically to the shrimps’ cohort:

The values of these metrics seem to have been rising in recent days | Source: Glassnode on Twitter

As displayed in the above graph, the percentage of the total Bitcoin circulating supply held by the shrimps has notably increased during the past year or so. As a whole, these investors now hold 6.7% of the entire BTC supply.

The shrimps represent the retail investor segment of the BTC market, so their supply rising up during this period implies that retail participation has been increasing in the sector.

The percentage of the supply held by these smallholders had already increased during the preceding couple of years, but the growth had been slower. In the past year, a few events have resulted in the growth of this cohort to accelerate.

The chart shows that the first of these was the LUNA collapse back in May 2022, while the second one was the 3AC bankruptcy, which took place only a few weeks later. The most significant effect appears to have been from the FTX crash back in November, as the supply held by these holders rapidly rose shortly after it occurred.

Accumulation from retail investors can be constructive for the Bitcoin market in the long term as it represents growth in the adoption of the cryptocurrency. Adoption generally provides a solid foundation for the sector, on which later price moves can sustainably lift off from.

BTC Price

At the time of writing, Bitcoin is trading around $29,300, up 2% in the last week.

Looks like the value of the cryptocurrency has plunged during the past day | Source: BTCUSD on TradingView