So, it’s Friday morning and it’s time to put together our first bitcoin price analysis of the day. We are doing so under pretty extreme circumstances. Action overnight brought price to trade just above the $3000 level and it is in and around this level that we find ourselves right now and from which we must set up some key levels that we can carry forward into the session.

The driver behind the decline is the suggestion that China is expected to basically exit the market in terms of buying and selling – with exchanges set to shut in the nation by September 30. How this is going to affect the mining industry in the space is unclear, but there’s a good chance that it will follow suit. Again, the impact that this whole situation is going to have on bitcoin is uncertain. There is a chance it won’t be great from a price perspective. However, longer term, things should recover and the exit of China from the market might be a good thing.

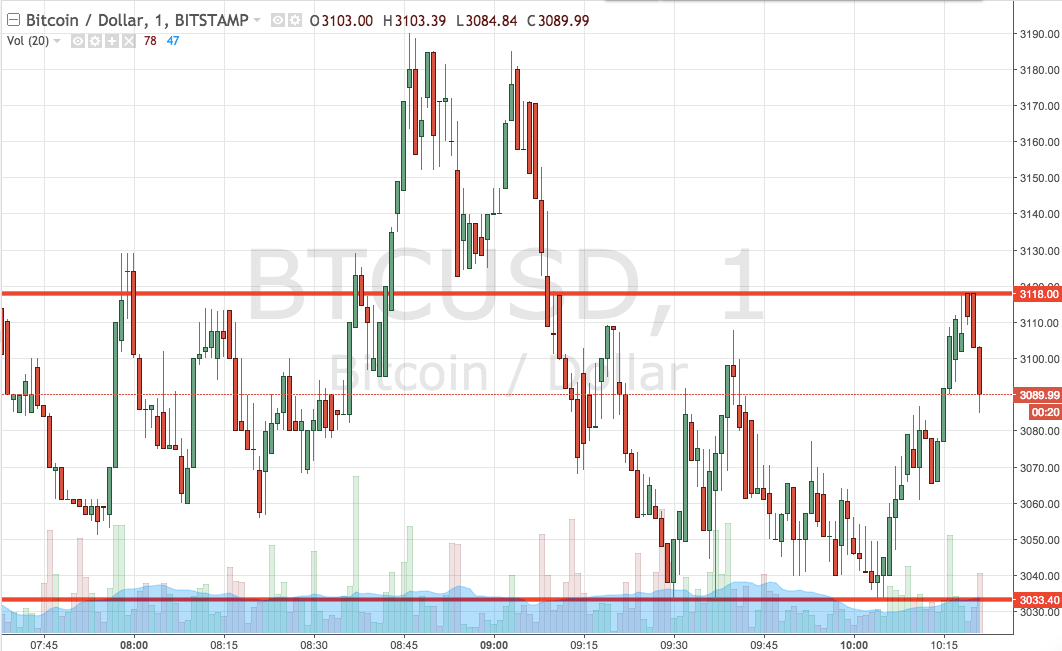

Anyway, let’s get some levels put together. Take a look at the chart below before we get started. It is a one-minute candlestick chart and it has our key range overlaid in red.

As the chart shows, the range we are using for the session today comes in as defined by support to the downside at 3033 and resistance to the upside at 3118. Standard breakout rules apply for the session.

We will look for a close above resistance to validate an immediate upside entry towards a target of 3160. A stop loss on the position at 3105 looks good.

Looking the other way, if we see a close below support, we will enter a short trade towards a downside target of 2080. A stop loss on this one at 3045 does the job.

Charts courtesy of Trading View