In a recent development, the Bitcoin price witnessed a remarkable surge of 7% within 24 hours, reaching a high point of $45,300. This significant price increase coincides with the anticipation surrounding the potential approval of a Bitcoin spot exchange-traded fund (ETF) by the US Securities and Exchange Commission (SEC).

In addition, market experts, backed by multiple models aligning to indicate increased price action and bullish momentum, suggest that Bitcoin could soon reach the $50,000 level and potentially establish a new all-time high (ATH).

Bitcoin Price Poised To Reach New All-Time High?

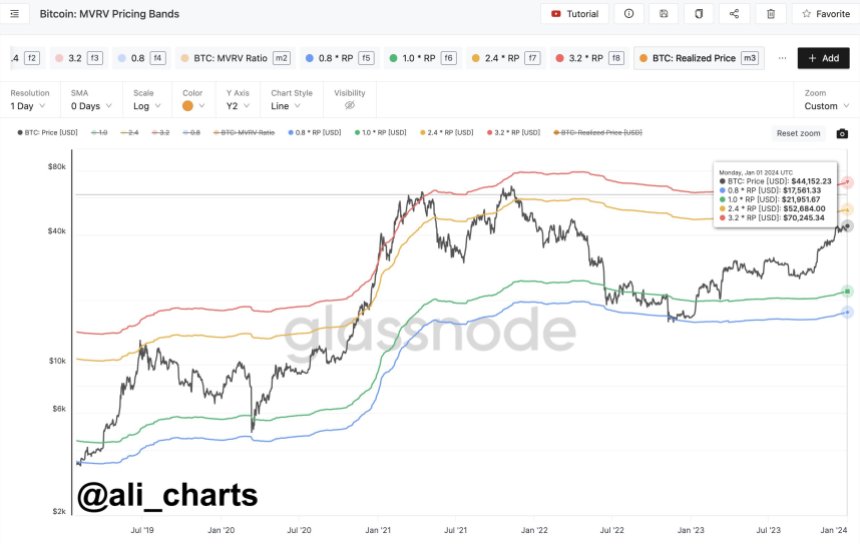

At the forefront of this analysis is Ali Martinez, a renowned crypto analyst, who emphasizes the valuable insights provided by the Bitcoin Market Value to Realized Value (MVRV) pricing bands.

These bands serve as a metric to analyze the price movement and potential levels of Bitcoin, or any other cryptocurrency, by comparing the market value to the average value at which coins were last moved on-chain. The MVRV ratio assesses whether Bitcoin is overvalued or undervalued relative to its historical on-chain activity.

A high MVRV ratio suggests that the market value of Bitcoin has surpassed the average value at which coins were last moved, indicating a potential overvaluation. Conversely, a low MVRV ratio may indicate that Bitcoin is undervalued.

Considering these factors, Martinez highlights the significance of the MVRV pricing bands, which reveal key price targets for Bitcoin at $52,680 and $70,250, surpassing its previous ATH of $69,000.

This analysis presents an optimistic outlook for Bitcoin’s future performance and reinforces the belief among investors that the cryptocurrency’s upward momentum is likely to continue.

However, despite these Bitcoin price projections that could propel the largest cryptocurrency on the market into uncharted waters, another analyst points to a more prudent prediction.

Cooling Period For BTC?

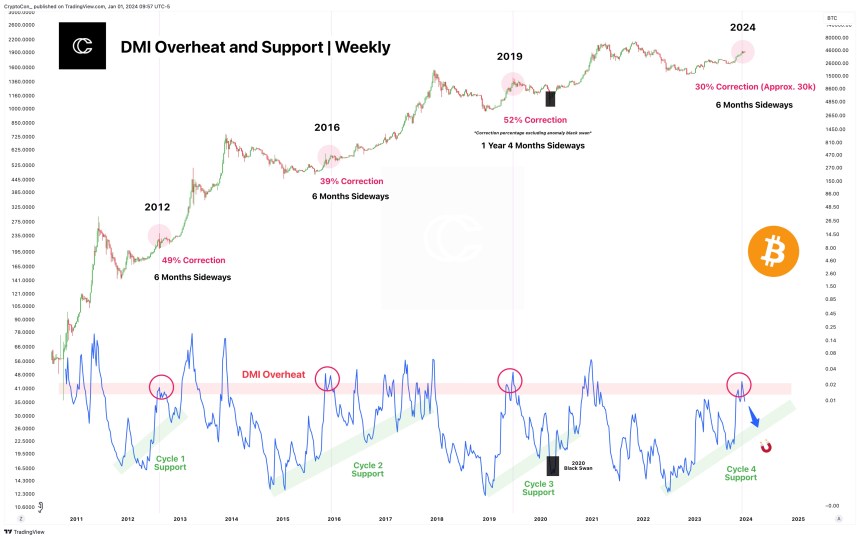

According to renowned crypto analyst Crypto Con, despite a year-long bullish stance, he believes it is time for a cooldown as the new year, 2024, begins.

Crypto Con predicts a 30% correction from the directional movement index (DMI) overheat zone, projecting prices around $30,000. The overheat zone mentioned by Crypto Con suggests that the price of Bitcoin has experienced a significant upward movement and may be due to a correction or cooling period.

As seen in the chart above, when the price enters this zone, it is seen as a signal that the trend may have become overextended and could potentially reverse or experience a pullback.

Drawing parallels to the example in 2019, characterized by a double peak in red, Crypto Con anticipates a drawdown that is both smaller in magnitude and shorter in duration.

Furthermore, the analyst points to the consistent support offered by diagonal green zones throughout each cycle, suggesting a pattern that has been held thus far.

While some analysts project a new all-time high for the Bitcoin price, reaching uncharted waters above $70,000, others, such as Crypto Con, advocate for a cooling period and anticipate a correction in the near term.

Featured image from Shutterstock, chart from TradingView.com