The Bitcoin price has risen by more than 20% amid the crisis in the US banking system, which saw three banks shut down by the US government and a massive crash in the prices of numerous banks. After the furious price surge, BTC has stabilized between 24,000 and 24,8000 as of press time – but the calm might not last long.

With today’s release of the Consumer Price Index (CPI), the Bitcoin price is traditionally in for a volatile day. And it’s not just the CPI that points towards massive volatility in the market.

Bitcoin Faces A Volatile Day

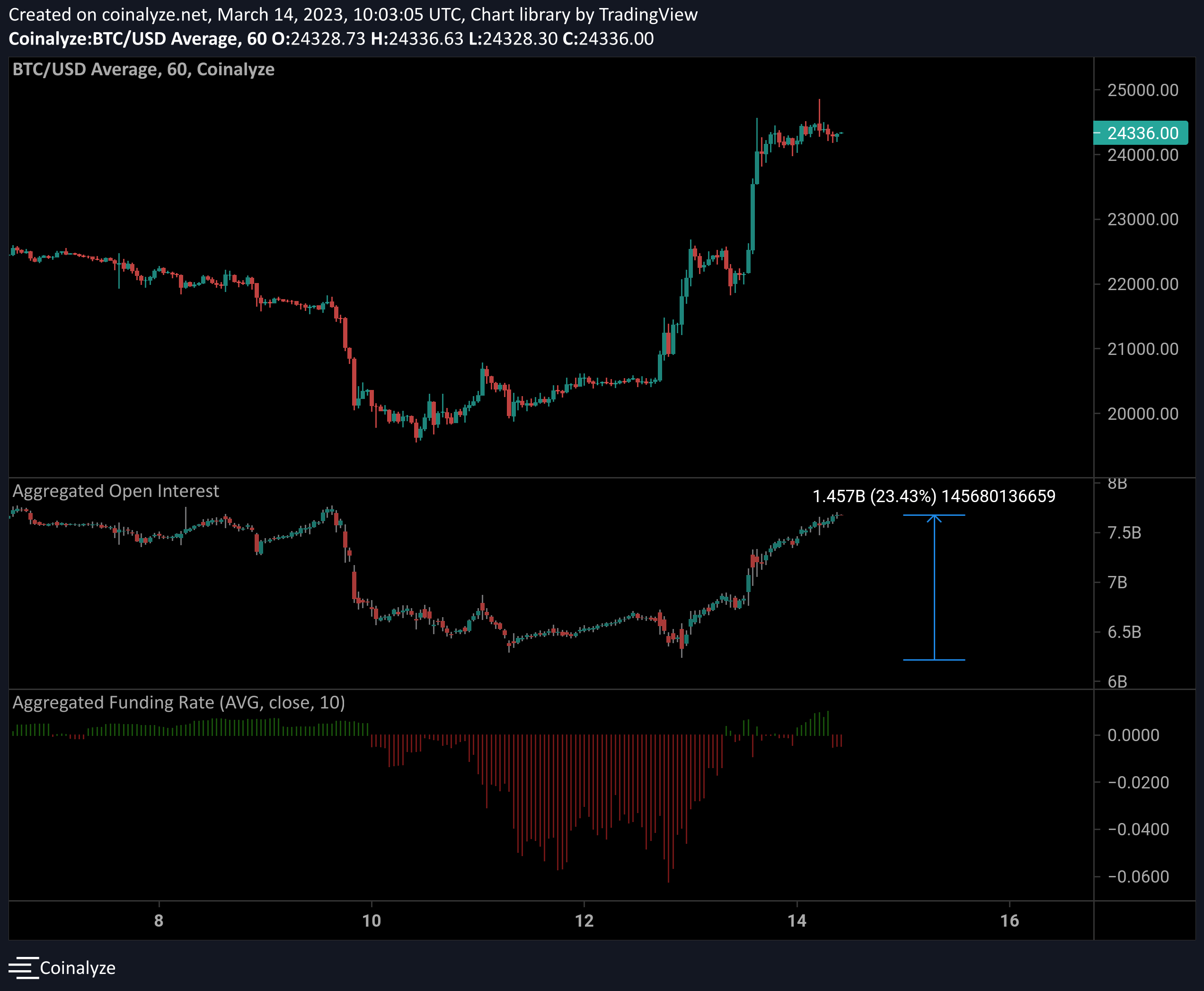

Maarten Regterschot, founder of diveonchain, outlined in a tweet that the “perfect mix for strong volatility” is currently evident with regards to BTC futures data. Open interest is up $1.45 billion (23%). Funding rates are neutral / slightly negative.

Analyst James V. Straten adds that Bitcoin perp funding rates have turned negative ahead of CPI, while options 25 delta skew suggest a bearish sentiment with puts slightly at a premium.

#Bitcoin perp funding rate turns negative ahead of #CPI.

While options 25 Delta Skew suggests bearish sentiment with puts slightly at a premium pic.twitter.com/4CzalHzgb3— James Van Straten (@jvs_btc) March 14, 2023

Chinese journalist Collin Wu also observed that in the last 24 hours, the notional value of Bitcoin options trading volume was about $2.5 billion , the second highest in history. It is also worth noting that call options with expiration dates on March 31 and June 30 are the largest.

The current Deribit Bitcoin option position has reached 336,000, with a notional value of about $8.2 billion, which is also a record high.

Remarkably, yesterday’s rally was driven by the spot market. Analyst “Skew” writes that there was a large spot volume from Asian exchanges during the US trading hours, which was somewhat unusual. As always, however, it was Coinbase and Binance that paved the way for the current market trend.

Will Bitcoin Continue Its Rally?

It is also worth noting that Changpeng Zhao has yet to complete the announced conversion of the Binance Recovery Fund from BUSD to Bitcoin, Ethereum, and BNB. Both “Skew” and renowned analyst on Twitter @tedtalksmacro have yet to observe any movement of Binance funds.

“As far as I’m aware that $1B BUSD hasn’t been used yet by CZ. This is more capital rotation into BTC; flight to safety,” Skew noted, while Ted added, “Yep, BNB yet to move. Post CPI perhaps??”

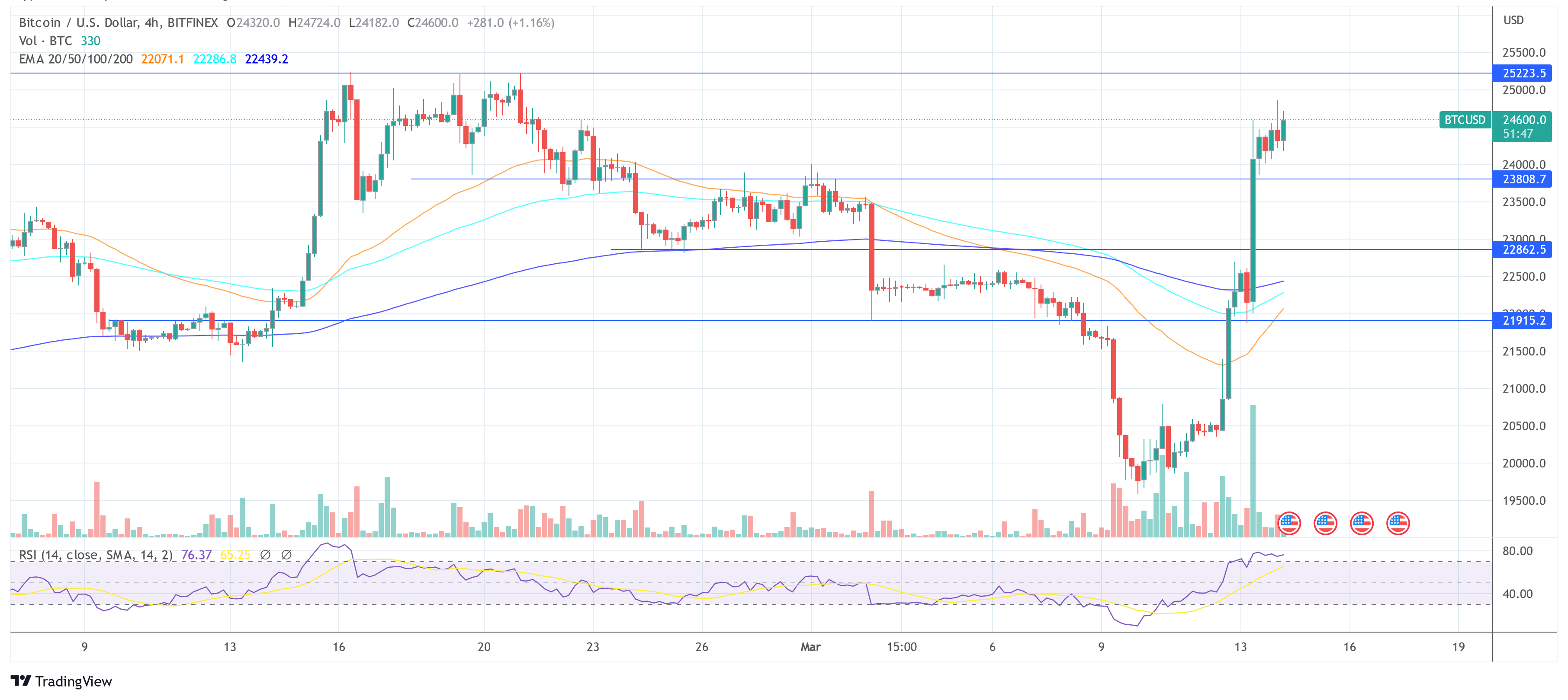

A look at the 4-hour chart of BTC reveals that the market must next the previous high of $25,200. If the price moves smoothly to this area and breaks through, this could be the start of a bigger rally.

Everything will likely be determined by today’s CPI release at 8:30am EST. US inflation year-over-year (YoY) is forecasted at 6.0%, last was 6.4%. The forecast for core inflation YoY is 5.5%, last was 5.6%. Everything below these numbers is likely to refuel the rally, making a breakout above $25,200 a possibility.

At press time, the BTC price looked strong, trading at $25,600.