Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin price is trading above the psychological $4,000 mark.

- Prices are held within a $800 range with upper limits at $4,500

- BitFinex and ETHFinex under maintenance

- DX Exchange rolls out, support Bitcoin

Still, Bitcoin prices are consolidating within an $800 but likely to break above $4,500 triggering conservative traders into action. Because of the ongoing BitFinex maintenance, volatility could increase, and from candlestick arrangement, bulls will be the main benefactors.

Bitcoin Price Analysis

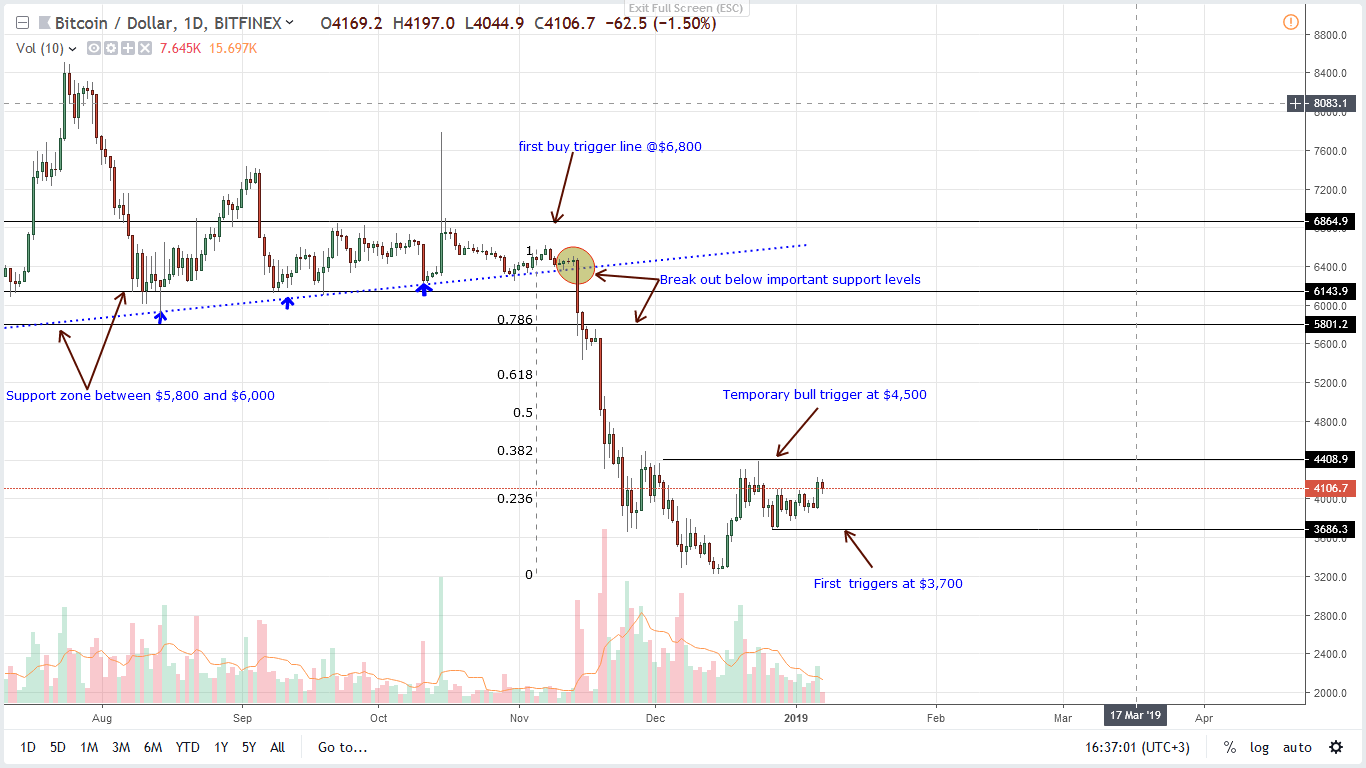

At spot prices, BTC is up 4.8 percent against the USD in the last day. Weekly gains are modest but bullish which bodes well with our previous Bitcoin price trade plans. If anything, we shall retain the same outlook but this time—thanks to yesterday’s encouraging surge above $4,000, aggressive traders can begin loading up, searching for better entries in lower time frames. There are fundamental as well as technical reasons for this outlook.

Fundamentals

First, the ongoing BitFinex server migration can be a source of volatility as three percent of the total trading volumes would be locked out for the next three to seven hours. Notice that while we expect volatility, net shorts are increasing while unexpectedly, net longs are on an uptrend hinting of demand in lower time frames. It is unusual and divergent of what logic demand.

Further boosting price is the rollout of Estonian DX Exchange. With the promise of availing digital stock derivatives of 10 NASDAQ listed companies and supporting Bitcoin and other liquid coins, the CEO of the exchange is buoyant that they won’t have a problem with the SEC and tokens are backed by real stocks held by a Cyprus based firm. Trading begins today, and already BTC has been paired with USD.

Technicals

On the technical front, BTC is bullish and firm above $4,000. It is the “volatility in the right direction” and propelling Bitcoin prices above $4,100 was decent, above average volumes—25k versus 17k. Although this heightened volatility didn’t drive prices above $4,500, it did confirm bulls of mid-Dec 2018. From candlestick arrangement, yesterday’s gains could be the basis of higher high that could finally see prices edge and close above the 38.2 percent Fibonacci retracement level in the process beckoning buyers.

Everything else constant, aggressive traders can buy at spot prices with first targets at $5,800–$6,000. On the other hand, there is an opportunity for conservative traders if there are sharp gains above $4,500. In that case, bulls of the week ending Dec 23 are true and ideal targets would be at $6,000 with tight stops at $4,100

Technical Indicators

Transaction volumes are thin but on an uptrend. Breakout volumes above $4,500 should be ideally above Nov 20—117k versus 37k if not above average—excess of 17k.

All Charts Courtesy of Trading View-Trading View

Disclaimer: Opinions are those of the author. Do your Research.