Circle Society, Corp., and its owner, David Gilbert Saffron, have been charged with fraud relating to an Bitcoin and crypto asset investment scheme. The Nevada-based firm is suspected of operating an $11 million binary options scheme.

The charges have been brought by the CFTC. Curiously, the chair of the US financial regulator said such scams were a threat to an emerging market that holds “great promise” the United States economy.

CFTC Protecting the Bitcoin and Crypto Industry?

According to a civil enforcement action filed yesterday by the United States Commodities Futures Trading Commission, David Gilbert Saffron has been charged with running a fraudulent investment scheme with through his company, Circle Society, Corp. The scam apparently duped at least 14 investors out of around $11 million in cash, Bitcoin, and other crypto assets.

ENFORCEMENT NEWS: CFTC Charges Nevada Company and its Owner in $11 Million Cryptocurrency Fraud and Misappropriation Scheme https://t.co/nwxHVM0xJ3

— CFTC (@CFTC) October 16, 2019

The complaint was filed on Monday September 30 and later, on October 3, the US District Court for the District of Nevada issued an order freezing the company’s assets. The court issued an extension of this order last Friday and a hearing on the Commission’s Motion for Preliminary Injunction is expected on October 29, 2019.

The filing itself gives some details the nature of fraudulent investment scheme operated by Saffron. It states that from at least December 2017 and until the company was recently taken down, the defendants encouraged US investors to deposit funds for management to trade various crypto asset pairs and foreign exchange markets on their behalf. The company claimed Saffron had extensive experience trading binary options and that they could expect returns of as much as 300 percent.

Funds were reportedly misappropriated by Saffron, who never actually traded them at all. Transactions in crypto assets went directly to the defendant’s wallet rather than to an exchange platform. Some early investors received payment from the deposits of those signing up later – in the CFTC’s own words “in the manner of a Ponzi scheme.”

Interestingly, the CFTC expressed an interest in not only bringing Saffron to justice for the sake of the victims he defrauded but for the wider crypto asset industry. The regulatory body’s Chairman Heath P. Tarbet reportedly commented:

“Digital assets and other 21st century commodities hold great promise for our economy… Fraudulent schemes, like that alleged in this case, not only cheat innocent people out of their hard-earned money, but they threaten to undermine the responsible development of these new and innovative markets. America must be a leader in this space, and we will only succeed if these markets have integrity.”

Related Reading: Indian Crypto Ban Sees State Funds Seized in Bitcoin Scam Frozen in Bank Account

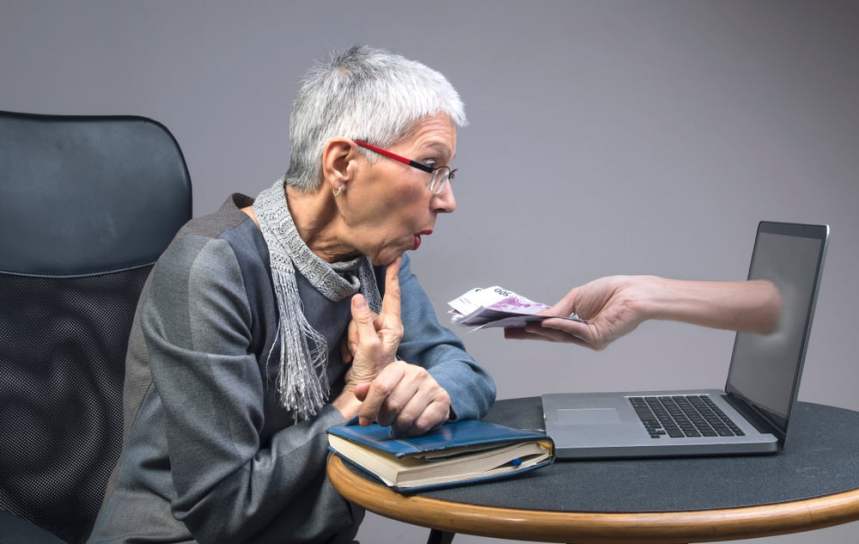

Featured Image from Shutterstock.