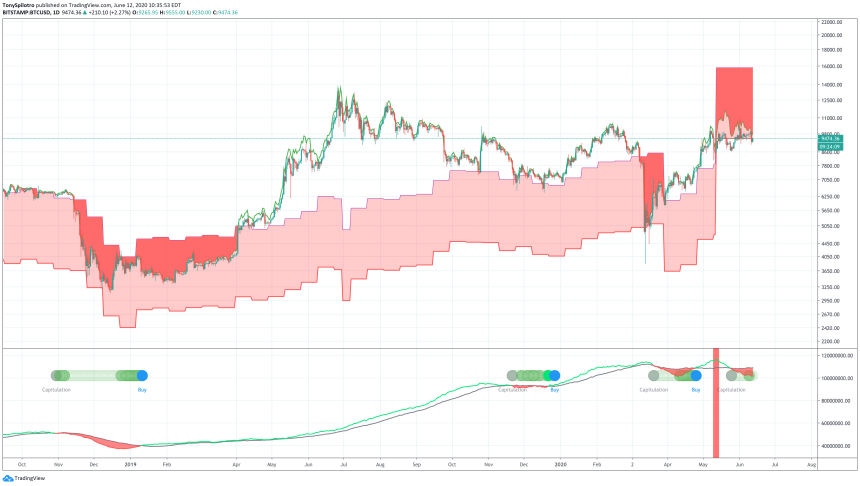

Bitcoin price has been consolidating in the mid to high $9,000 range for nearly a month and a half. Repeated attempts to break and hold above $10,000 have been rejected thus far.

The most recent rejection, data shows, was largely fueled by miners who were seen moving BTC supply to exchanges just ahead of the most recent steep selloff. Is this miners capitulating, or simply taking advantage of high prices each time the cryptocurrency reaches the key resistance level?

Are Miners Responsible For The Latest Crypto Market Selloff?

In early 2020, Bitcoin and other cryptocurrencies went on strong rallies from lows set in the year prior.

All signs had been pointing to a new uptrend forming. Indicators had been supporting the incredibly bullish sentiment and price action.

Bitcoin price began to cool off after a visit above $10,000, but then the black swan impact of the pandemic struck financial markets, and all bullish price action leading up to the high was erased in under 48 hours.

The carnage is now referred to as Black Thursday.

Related Reading | Bitcoin Slides As Greater Financial Market Is a Sea of Red, How Far Will BTC Drop?

From the extreme panic low, Bitcoin price has grown over 140% and revisited above $10,000 numerous times.

Each time it’s pushed above the powerful resistance level, it has led to a strong rejection, the last of which, data indicates may have been driven by Bitcoin miners.

But why the sudden surge in selling post-halving? According to theories related to the halving, miners should be holding any new BTC mined not selling, so why is the inverse now happening?

https://twitter.com/byzgeneral/status/1271761478518018049?s=21

Miner Capitulation And Competition May Be Purposely Pushing Bitcoin Prices Lower

Data analyzing the amount of BTC supply mining pools hold flowing into cryptocurrency exchanges shows an especially large movement preceding the most recent crash in Bitcoin price.

Speculation suggests that this Bitcoin was later market sold, causing the price of the asset to drop as a result.

Miners have been long expected to hold newly mined BTC post-halving, throwing off supply and demand, which could cause the start of a new uptrend in the digitally scarce asset.

Instead, however, miners have been selling even more BTC, even tapping into reserves.

While the halving could ultimately have the expected effect on the price per BTC, it may first require the weakest mining participants to capitulate and close up shop for good.

This also may be what is happening, according to the data, and a surge in miners moving funds to exchanges.

Miner profit margins live and die by the market value of Bitcoin versus the cost of production. When Bitcoin price heavily outweighs energy and operating costs, mining is extremely profitable.

But for miners who don’t have access to cheap energy, or aren’t large enough for the efficiency needed for profitability, the halving may have destroyed any chance of having a surviving business model.

Because the halving immediately reduced the block reward miners receive for securing the network from 12.5 BTC to just 6.25 BTC, the cost of production doubled instantly also.

This has put the weakest miners at a strong disadvantage due to Bitcoin price remaining under $10,000.

Indicators measuring the health of the Bitcoin network point to miners capitulating due to the substantial blow to profit margins. If Bitcoin price drops lower, miners may have zero choice but to sell or suffer major losses.

Another theory is that it is actually the strongest miners selling in an attempt to force the capitulation of the weakest miners by pushing prices lower.

Related Reading | Bitcoin Miner Capitulation Reaches Black Thursday Levels, Is A Severe Selloff Looming?

A temporary hit to their own, currently sustainable margins, could eliminate the competition for them for years to come.

Whatever the reason for the selling, it isn’t necessarily bearish for Bitcoin. The more weak miners are cleansed from the network, the healthier mining pools will be and the more likely they will be to hold BTC supply for later mark up during the next bull market.