Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data suggests Bitcoin has a large wall of resistance ahead of it currently. Here are the exact levels that make up this important range.

A Large Amount Of Bitcoin Supply Was Purchased Between $42,700 & $44,000

According to data from the market intelligence platform IntoTheBlock, BTC is sitting just below a significant on-chain resistance zone. In on-chain analysis, the strength of any resistance or support level is defined based on the number of coins acquired by the investors there.

To any holder, their cost basis is naturally an important level; thus, they may be more prone to make some moves whenever the cryptocurrency’s spot price retests their profit-loss boundary.

How the investors might react to such a retest can change depending on the direction of the retest. Holders at a loss can sometimes be desperate to exit the market, so if the price retests their cost basis (that is, the retest is happening from below), they might sell to at least be able to get back their investment.

Such selling can provide resistance to the price. Only a few investors making such moves may not be relevant to the broader market. Still, if a significant number of traders acquired a large amount of BTC inside a narrow range, the reaction produced by a retest could be sizeable.

On the other hand, investors who were in profit before the retest may look at dips in their cost basis as an opportunity to accumulate more, thinking that the price would go up again. This buying, when large enough, can support the asset.

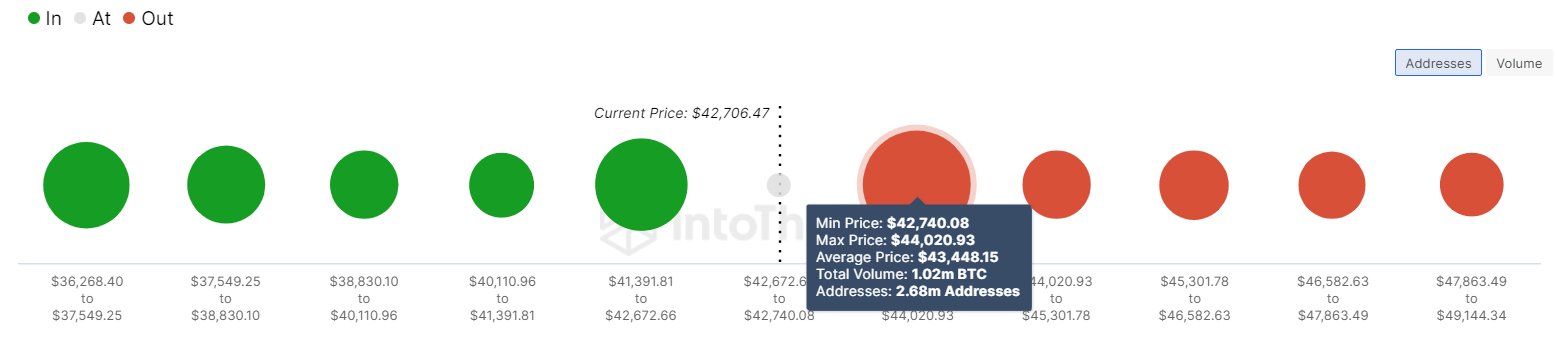

Now, here is a chart that shows how the various Bitcoin price ranges look like right now in terms of the amount of BTC that was acquired at them:

The density of cost basis at the different price ranges above and below the current value of the asset | Source: IntoTheBlock on X

As is apparent from the graph, the $42,700 to $44,000 range hosts the cost basis of 2.68 million addresses, which acquired a total of 1.02 million BTC inside it. The average price of this range is around $43,400, which is above the current spot price of the cryptocurrency.

“Uncertainty can cause these holders to sell into their break-even point, increasing resistance in a move up,” explains the analytics firm. If Bitcoin can break through this resistance, though, it may have an easier time exploring higher levels, as it offers less resistance.

The chart shows that below the current spot price is the substantial $41,400 to $42,700 support range, which has helped cushion Bitcoin’s fall during the recent correction. Thus, even if the resistance zone rejects BTC, this support area may at least help it return for another go.

BTC Price

At the time of writing, Bitcoin is trading around the $43,200 level, down 8% in the past week.

BTC has displayed boring price action in the last few days | Source: BTCUSD on TradingView