Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin has been struggling to find any strong momentum throughout the past few days, with bears rapidly gaining control over its price action

- This trend has not yet been enough to invalidate the cryptocurrency’s technical strength, but it does seem as though it may strike a blow to its macro uptrend

- Until BTC can enter a price discovery mode and break above its all-time highs, there’s a strong possibility that it will soon see some serious near-term downside

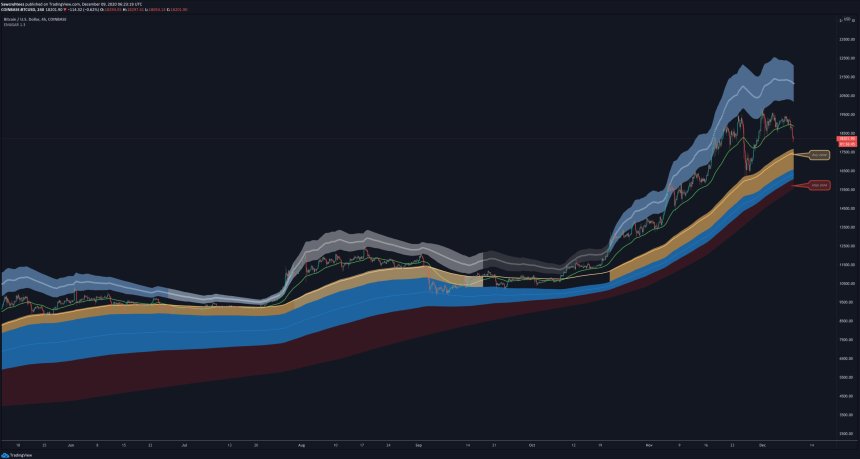

- One trader is pointing to a historically accurate indicator that seems to suggest further downside could be imminent

- He notes that a move towards the price region between $16,500 and $17,500 marks an ideal buy-zone

Bitcoin has been creating shockwaves for the entire crypto market throughout the past few days and weeks, with its inability to set fresh all-time highs causing it to see multiple selloffs and multiple consolidation bouts.

If this trend persists in the mid-term, it could mean that the cryptocurrency is bound to see a stronger decline that ultimately spurs enough buying pressure to spark a new wave of buying activities that send it racing past its highs.

One indicator is suggesting that this price region exists between $16,500 and $17,500. A break below this region could lead to significantly lower prices, including $12,500.

Bitcoin Shows Signs of Weakness as Momentum Fades

At the time of writing, Bitcoin is trading down marginally at its current price of $18,300.

Before yesterday’s decline, the cryptocurrency was attempting to gain a strong foothold above $19,000. This has marked a pivotal level for BTC in the past.

However, the break below this level led it to see some serious losses, with its decline reaching as far as $17,600.

This Indicator Suggests BTC has Yet to Visit Its Key Buy-Zone

One trader explained in a recent tweet that he is closely watching to see how Bitcoin reacts to the price region between $16,500 and $17,500.

He believes that this is a crucial region to watch, as one indicator suggests that this will be where its descent slows in the mid-term.

“EMASAR buy zone is $16,500 – $17,500 with the stop at $15,900. If that doesn’t hold I’ll be looking to reenter at $12,500 – $14,000 due to critical weekly levels. That being said I still have 50% of my spot long that I’ll hold as long as structural / trend support holds.”

Image Courtesy of Tyler D. Coates. Source: BTCUSD on TradingView.

Where the entire market trends in the mid-term will depend on Bitcoin, making it crucial that the benchmark crypto gains some near-term momentum and begins rising higher.

Featured image from Unsplash. Charts from TradingView.